| Matt Clark, Research Analyst From 2020 to 2021, investors bought renewable energy stocks en masse. That changed last year, through no fault of the sector. Hopes were high that legislation in Congress would infuse billions of cash and tax credits into solar power and renewable energy as a way to fend off our dependence on fossil fuels. The future looked bright. Then Congress, as it often does, got in the way. Renewable energy stocks paid the price. Fast-forward to 2022… In this episode of The Bull & The Bear, I show you that, despite recent headwinds, solar and renewable energy are starting to surge ahead. And I share a solar exchange-traded fund (ETF) that you can buy to profit from this new trend. Click here to get into the renewable energy revolution now!  Suggested Stories: As Russia Stuns Oil Industry, Renewable Energy Investors Rejoice High Tide Analysis + Our Top Rated Cannabis Stock

| You should plan your next shopping trip around these 27 items. In the coming days, they could skyrocket in price … 10X … 50X … even 500X higher. Investing expert Dave Forest just went on-site to find out what the HECK is going on in America. As he explains in his shocking video exposé — it doesn't matter if stores in your neighborhood seem fine now, because: "Once this crisis hits cruising speed, these essential items could sell out quickly and never be restocked." | |

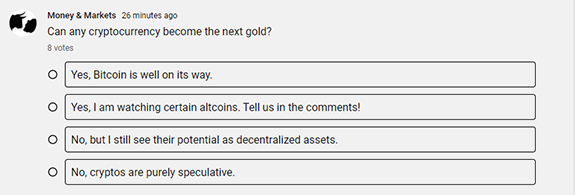

Poll of the Week In the past, investors fled to gold when market turmoil ramped up. We still see that today, but some look at cryptocurrencies like bitcoin to fill the wealth protection role. Need proof? BTC spiked 15% in the week following Russia’s invasion of Ukraine while the stock market sold off. (It’s since pared some of those gains.) Do you see the potential for cryptos to become the next gold? Vote now in our latest Money & Markets poll!  Suggested Stories: Economic Recovery? Factories Offer Good News & Bad News 3 Value Stocks With Market-Crushing Momentum

| There's a little-known way Trump could – one day – have his revenge. It involves a federal ruling he oversaw in the final year of his presidency that could change America forever… unleash an estimated $15.1 trillion in new wealth… and create countless ways for everyday Americans to benefit. What is this little-understood decision? And how will it impact you? | |

|

1953: Soviet dictator Joseph Stalin died at age 74. He was in power for 29 years. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment