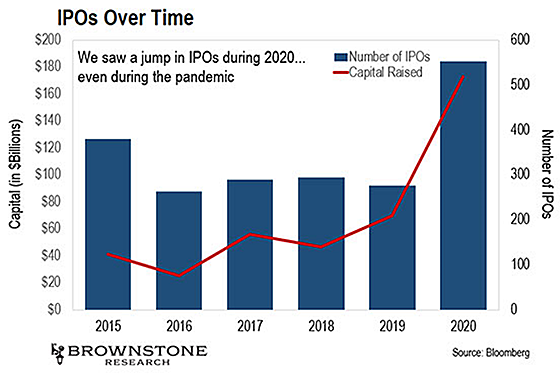

| By Jeff Brown, editor, The Bleeding Edge 2020 was a great year. Some might be surprised to hear that, given the pandemic lockdowns, tumultuous elections, and other curveballs thrown in the last 12 months. But readers following my research know exactly what I mean. In each of my investment services, we saw incredibly strong performance in our portfolios in 2020. In The Near Future Report, we earned realized returns like 87%, 277%, and 259%. In Exponential Tech Investor, we saw gains like 135%, 178%, and 308%. In Early Stage Trader, we had gains of 87%, 106%, and 116%. And I expect when we look back at 2021, we will have had another great year. But today, I want to discuss a key dynamic that we’re seeing in the markets right now… and a special opportunity for investors… | Recommended Link | | Watch Demo of Elon Musk’s Next Big Project Elon Musk made $180 million on PayPal, $18.7 billion on SpaceX, and $110 billion on Tesla. But it’s what he’s planning next that will shock everyone. It could even put up to an extra $30,000 in your pocket every year. | | | -- | A Market on Fire The IPO market has been on fire lately. In 2020, we saw 552 initial public offerings. And those IPOs raised more than $172 billion.

And I’m on record saying that the IPO market will be even bigger in 2021. In fact, we’ve already seen 276 IPOs raising over $85 billion at the time of writing. Longtime readers know this, but there is actually an IPO backlog right now. There are so many exciting technology companies that have been staying private for years and years. And this has created a backlog of companies that are now finally going public. The #1 Tech Stock of 2021 In essence, these companies are like a champagne bottle. All this pressure has been building for years. And now, finally, the cork has popped, and they are all lining up to go public. What’s interesting is that a lot of these IPOs were put on hold with COVID-19 and the economic lockdowns. Then this wave of IPOs came back with a vengeance around last September. But there’s just one problem with investing in these newly public companies… | Recommended Link | | Wall Street Veteran Slams Congress, His Rant Goes Viral… Teeka Tiwari – America’s No. 1 Investor – just made an outrageous prediction. Recorded live from his living room couch… He blasts Congress, reveals nasty truths about America… And reveals one technology set to radically change our nation. Already, 400,000+ viewers have checked it out. WARNING: This video may make you furious. | | | -- | The IPO Problem Here’s an example to illustrate the problem we’re seeing. On December 9, an artificial intelligence (AI) company called C3.ai held its IPO after being private for 11 years. The stock was officially priced at $42 a share, valuing the company at just over $4 billion. But when shares began trading, the stock opened at well over $100… more than double the listing price. Investors never had a chance to invest at a reasonable valuation. And sadly, that’s not the only time this has happened… Also in December, an exciting biotech company called AbCellera held its IPO after being private for eight years, also around a $4 billion valuation. And we saw the same thing… Millionaire’s Big Prediction From Living Room Couch AbCellera, which has worked alongside Eli Lilly on its COVID-19 antibody therapy bamlanivimab, was priced at $20, but it opened at $58. That’s nearly three times higher. Again, regular investors had no window to get in at a good price. And even larger IPOs aren’t immune to this issue. Airbnb, the popular vacation rental company, finally held its long-awaited IPO on December 10 after being private for 12 years. The stock was priced at $68 per share – putting it at a valuation of $47 billion. But once again, when it opened for trading, it was at $146. That’s more than double the listing price. Once more, regular investors had no shot at getting in at a reasonable level. I could go on and on with similar examples. Compare this to a company like Amazon. Just three years after its founding, it went public in 1997 at a split-adjusted $1.54 per share… and a mere $438 million valuation. Investors who took a chance on it at the IPO and held on could have made as much as 180,000% on their investment in the time since. But these days, it seems like this kind of opportunity has all but disappeared… | Recommended Link | Available Now: New Retirement Blueprint from America's Most Trusted Options Trader For the past 36 years, Jeff Clark has helped people retire wealthy… But he hasn't done it the usual way. He uses options. Options probably seem risky. Reckless, even. But his options strategy is different – unlike anything you've probably seen before. It helped change my life. And thousands of others have used it to make $10,000… $100,000… even $1 million or more – in some rare cases. Which is why he's offering his never-before-released blueprint… and a year of his guidance… for just $19. | | | - | Where Have the Good Investments Gone? Our opportunities to invest in promising early stage companies at reasonable valuations have almost vanished. Companies are now staying private for years – many times over a decade – so that when they do go public, the biggest gains are already gone. Regular investors aren’t able to get in anywhere close to the valuations the VCs invested at. Instead, we’re left with just the table scraps… But I have good news. I’ve made it my mission for the past five-plus years to find ways for investors to level the playing field. And I’ve discovered a space where the big, VC-like gains still exist for retail investors… There’s a small sector of the technology market where companies are still going public early in their development… and at reasonable valuations. And these tiny tech stocks have a unique feature… Thanks to the federal government, they have a pre-set “timer” attached to them. And when the timer hits zero, these stocks can see a sudden and massive spike in their share price. These stocks can rise hundreds or even thousands of percent in as little as a day. That’s why I call them “Timed Stocks.” And because of two seemingly unrelated forces converging right now… these stocks are entering a “final countdown” period. That means the profits are getting bigger… they’re happening faster… and they’re happening more often. And I want to make sure all of my readers are prepared to take advantage of this opportunity while it lasts. I’ll be hosting my Timed Stocks: Final Countdown event on Thursday, March 18, at 8 p.m. ET to show how anyone can get in on Timed Stocks right now. I’ll also be sharing details about the top Timed Stock on my list right now. Its timer could go off as soon as March 24… So if you’d like to learn more about Timed Stocks… and the best way to profit from them… make sure to go right here to reserve your spot at this event. You don’t want to miss out. And I look forward to seeing you there! Regards, Jeff Brown

Editor, The Bleeding Edge

Like what you’re reading? Send us your thoughts by clicking here. IN CASE YOU MISSED IT… Government Official Warns… “Joe Biden Devoted to the Great Reset” No American will be spared from this potential dark plan, UNLESS you take these simple steps to protect yourself and all you’ve worked for. Click here to learn how to "Escape the Great Reset".

Get Instant Access Click to read these free reports and automatically sign up for daily research. |

Post a Comment

Post a Comment