| Claim Your Supercharged Payout: One profitable American company sent out payments totaling $936 million. And regular folks claimed a 1-day payment of $3,549 or more. Go here for urgent details.

Honestly, regular dividends suck.

The S&P 500 dividend yield has plunged 62% in the past 31 years. To earn $20k in income from the S&P ETF – you'd have to invest $1.5 MILLION!

But what if you could earn $1,191 every 20 days – investing far less?

It's completely possible with these Supercharged Payouts.

The appeal of dividends is obvious.

You invest in stocks – and you get a consistent income as a shareholder.

It was a solid strategy up until the early 90s. But it's been getting worse ever since then…

The S&P500 annual dividend yield never fell below 3% between 1871 and 1960. In fact, annual dividends reached above 5% during 45 separate years over that period.

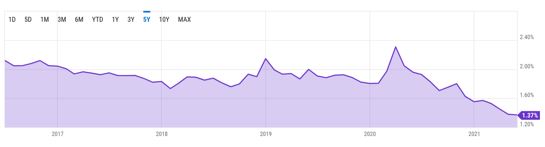

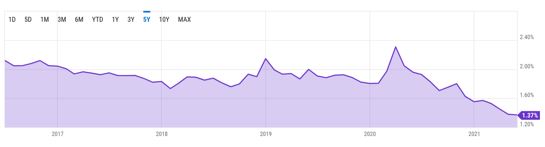

Since the early 90s, we've been in below-3% territory ever since. And we've been in a downtrend that has only gotten worse in the past 5 years.

Take a look: Dividends have plunged 35% in 5 years

Go Here to Claim Your $1,191 Payout

Today the S&P500 is yielding just 1.37%.

So, if you invest $100,000 in it, you're going to get $1,370. To earn around $20k a year, you'd have to invest $1.5 MILLION.

Let's face it...

Regular dividends suck.

That's why I'm urging folks to turn to these Supercharged Payouts.

My research just uncovered a huge payout – slated for September.

Go here for urgent details on how to receive the $1,191 payout.

Regular dividends will likely continue plunging.

Here's why…

The collapse of dividend yields since the 90s happened because of two main reasons.

First, the rise of internet-based companies in the U.S.

Tech stocks have been major growth players and have typically produced little to no dividends. Average dividends have declined as the size of the tech sector has grown.

And second, former Fed chairman Alan Greenspan and his policies.

In the market downturns of 1987, 1991 and 2000...

The former chair of the Fed responded with sharp drops in interest rates.

This drove down the equity risk premium on stocks and flooded the markets with cheap money.

That sent the stock market soaring. And share prices of blue chip stocks started to climb much faster than dividends.

These same policies are alive and well today. So, it wouldn't surprise me if dividends continued to plunge.

That's why folks are getting excited about these Supercharged Payouts.

Because they give you chance to have all the benefits of dividends... without the meagre yield.

Want to boost your income starting today? I'm hosting a LIVE briefing that reveals urgent details on this new way to earn income.

Access this for urgent details including: - How you could collect $1,191 every 20 days on average

- Why President Biden may CANCEL I.R.S Section #965 – encouraging record payouts – starting this month

- Urgent details on the next payout that could total $1,191 or even more

- The simple way you could claim the September payout

Simply click here to claim your next Supercharged Payout.

Yours in Wealth,

Ian Wyatt P.S. These huge payouts are great for folks who are retired. Yet they're open to ANYONE without restriction.

In fact, you could get started with as little as $100 or $1,000. The above income amounts are estimated based upon a $10k investment.

Simply click here now for urgent details.

|

Post a Comment

Post a Comment