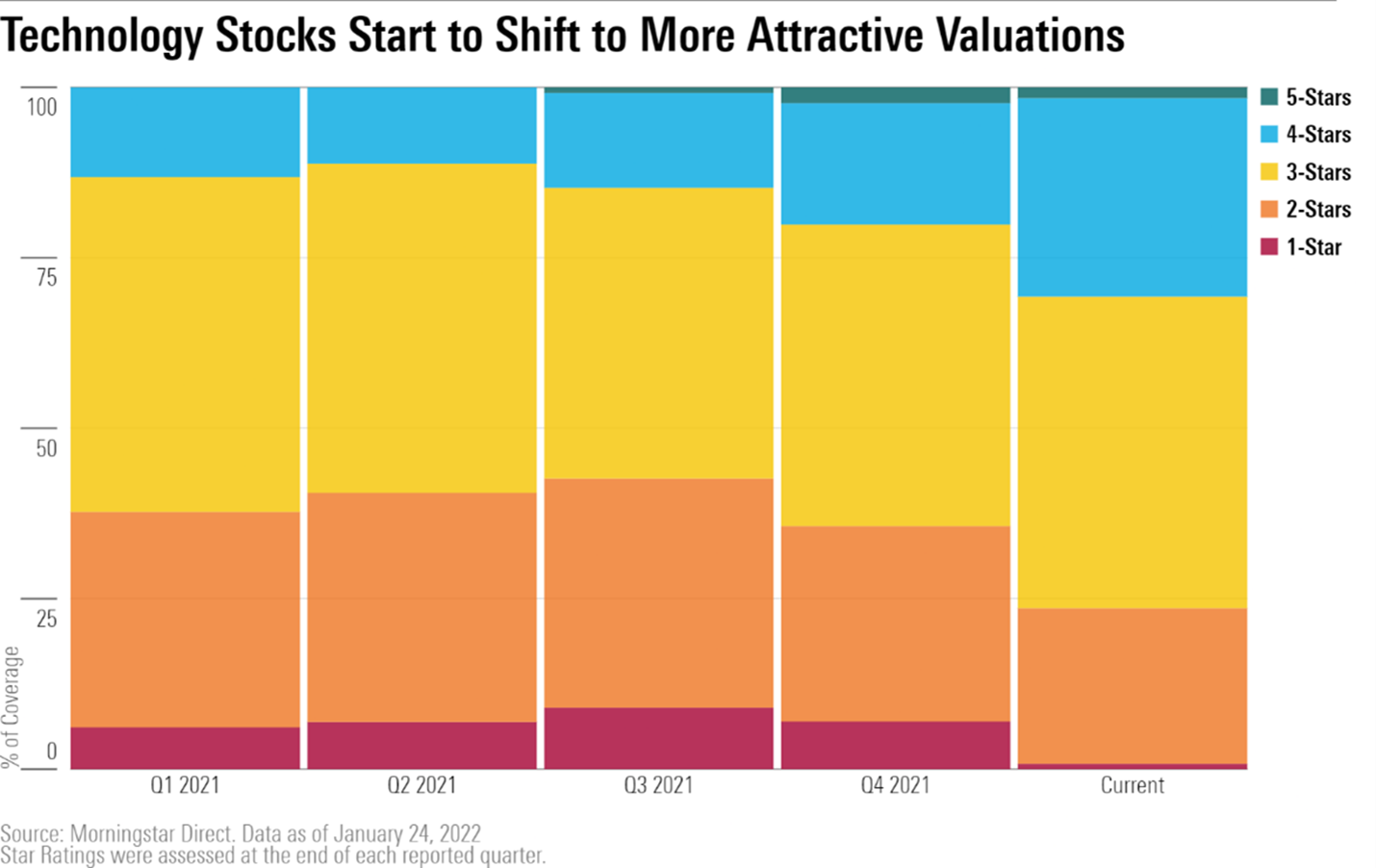

| 5 Undervalued Tech Stocks With 5-Star Ratings Morningstar -- it's one of the oldest, most widely respected financial research firms in existence. Known for its fundamentals, I find my nose buried in Morningstar data constantly, and especially when companies on solid fundamental footing have had their stock prices zig and zag all over the place. So after the tech wreck of the past few weeks, I'm once again looking to Morningstar to do its thing. From a high level, Morningstar analyzes stocks, assesses their fundamentals, and assigns a fair value estimate for stocks based on those fundamentals. It then rates stocks -- from one star to five star -- based on how the current stock price differs from the fair value estimate. When the stock is fairly valued, it gets a three-star rating. "Super" undervalued stocks get a five-star rating. Super overvalued stocks get a one-star rating. Simple enough. Well, back in the first quarter of 2021, only about 10% of tech stocks were four- or five-star stocks, according to Morningstar, meaning only about 10% of tech stocks were undervalued. Around 40% were considered overvalued at the time, with a one- or two-star rating. Those ratios speak to a tech market that's too frothy; a market that needs to correct lower. Well, it's done just that. Valuation concerns came to a head in early 2022, crushing tech stocks that previously coasted on lofty valuations. But this one investing metric shows that the sell-off may have come too far, too fast. That tech stocks, contrary to popular belief, are now cheap and primed for a huge comeback. In the wake of that correction, we're looking at a completely different valuation picture. The percent of undervalued, four- and five-star tech stocks has risen sharply to 30%, while the percent of overvalued, one- and two-star stocks has plunged to below 25%.

Essentially, most tech stocks were overvalued and almost none were undervalued a year ago. Today, however, most tech stocks are undervalued and almost none are still overvalued. The investment implication? It's time to buy the dip in tech. One of the best ways to go about buying this dip would be to (sticking with the Morningstar ratings) buy five-star rated tech stocks. Our researchers pored over Morningstar's list and found six five-star tech stocks. Of those six, we would consider five of them to be true tech stocks. Here's the kicker: We already own these five-star rated tech stocks! In other words, if you want to buy the dip in the most attractively valued tech stocks, your journey should start with us. In Innovation Investor, we currently own what we believe to be the next generation of tech giants -- the next Amazon, the next Microsoft, the next Facebook, and so on. Right now, you have an opportunity to buy those future mega-winners at prices you may never see again. The choice is yours... You can let this once-in-a-lifetime buying opportunity pass you up, or you can take your shot at making millions buying the dip in tomorrow's Big Tech giants. Sincerely, |

Post a Comment

Post a Comment