| The conflict between Russia and Ukraine is strengthening the case for renewable energy with each passing day. Last month, just before the invasion began, I mentioned that the elephant in the room was Russian natural gas. Sure, the United States and Europe worry that military conflict with Russia (or any global superpower) could end in nuclear Armageddon. Those fears have existed since the early days of the Cold War. But the bigger and more tangible threat is that Russia pulls its natural gas and crude oil exports from the market, causing prices to skyrocket. We’ve already seen what even the threat of this happening does to oil prices. Brent Crude Oil futures spiked to more than $116 per barrel on Thursday. Prices have increased around 17% since Russia crossed Ukraine’s border a little over a week ago! And price spikes (plus other factors) are precisely why I’m so bullish on the future of renewable energy. Suggested Stories: 3 Value Stocks With Market-Crushing Momentum This Bullish Dividend Stock Has Weathered Conflicts Since 1837!

| If you own gold or gold stocks, read this warning immediately. The man who predicted the historic bull market that followed the 2020 crash sees a major move on the way. An event in 2022 could have a massive impact on gold and other sectors. "Move your money by early 2022," he says. That means right now. The last time he issued a public warning like this, the market went on to see its biggest one-day move in history. | |

Marijuana Market Update Matt Clark, Research Analyst In this Marijuana Market Update, I answer a viewer’s question on High Tide Inc. (Nasdaq: HITI). I also share the top-rated cannabis stock in the Green Zone Ratings universe. Click here for my latest cannabis stock analysis.  Suggested Stories: Maximum Energy Stock Momentum: Buy One Massive Oil Name Now Will Bonds EVER Be Interesting Again?

| Everywhere you turn, people are raving about the metaverse. Facebook's now called Meta. Microsoft's CEO says, "The metaverse is here." Apple's all in too. But there's a critical piece of the metaverse story you're NOT hearing about. | |

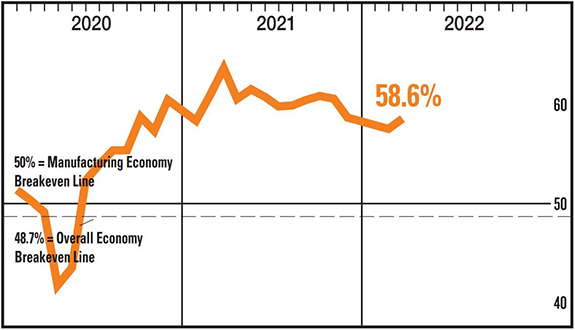

Chart of the Day On the first trading day of every month, the Institute for Supply Management releases its survey of supply managers in the manufacturing sector. It gives us insight into the rest of the economic data for the month. The chart below shows the good news from the nation’s factories. But another points to more bad news for supply-strapped manufacturers. Click here to see what it means for America’s economic recovery.  Suggested Stories: Runaway Inflation Won’t Return — Consumers Are Key How Will Russia-Ukraine Shake Out in Markets? Follow the Traders

|

1933: Franklin Delano Roosevelt was inaugurated as the 32nd president of the United States. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment