From The Front Lines Of The Corporate Wars Business is war…and right now, things are heating up as some of our favorite brands prepare for battle.

After two years of heated conflict on social media and in drive-thru lines across the country, the infamous "Chicken Sandwich War" ended in an uneasy ceasefire…but now one restaurant chain just fired a shot that may reignite the whole thing.

With online shopping becoming the new norm and supply chain issues continuing to be a problem, delivery services are more important than ever. As Q4 reports come in, it's clear that two delivery heavyweights are preparing to go head-to-head to claim America’s shipping industry for themselves.

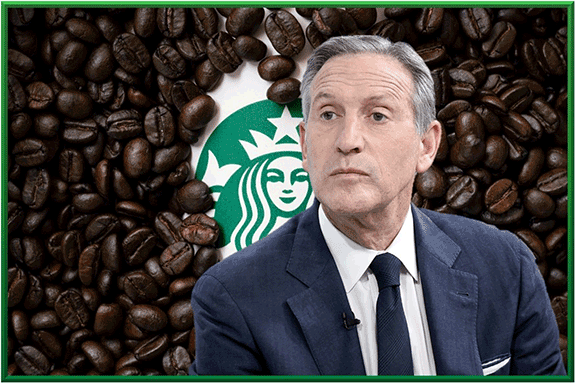

And Starbucks, America’s favorite coffee provider, is waging war not against a corporate rival but against rising prices and dropping stock value. Inflation and lingering pandemic problems have Starbucks on the defensive…which is why they’ve turned to the leader who built their coffee empire for help. Will the sudden return of former CEO Howard Schultz turn the tide…or will overpriced lattes spell doom for Starbucks?

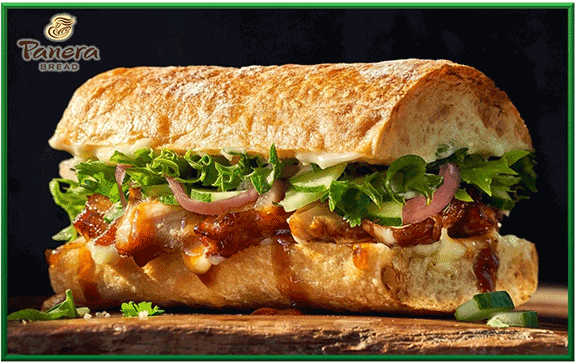

As if there weren’t enough chicken sandwiches already in the running—Chick-fil-a, Popeyes, Taco Bell, and Wendy’s, to name a few—Panera Bread has introduced its own version of the sandwich for consideration in the Chicken Sandwich Wars.

The ceasefire initiated by Popeyes in July of 2021 just came to end!

Thanks, Panera!  Panera has announced that, starting March 30, their cafes will be rolling out two chicken sandwiches that weigh in at 4.25 oz. Both will consist of white meat chicken breast and aioli on a brioche roll. The Signature Sandwich contains parmesan crisps and emerald greens, and the Spicy Sandwich contains crispy pickle chips and spicy buffalo sauce.

Yum!  Panera’s Chief Brand and Concept Officer, Eduardo Luz, upped the trash-talking game, throwing shade at the other combatants in the Chicken Sandwich Wars.

Luz said, “We respect everybody out there, but our game is about elevation–the best food you can eat for people who care about what they’re putting into their systems. We don’t see ourselves in that frame of reference of QSR. There is nothing out there of this quality. This sandwich is a work of art.”

Oh dang! This sh** just got real!

The sandwich had better be good because Panera is charging twice what its nearest chicken competitors (KFC, Popeyes, and McDonald’s) are charging.

A chicken sandwich will cost you a whopping $10.99 at Panera. I mean, come on, the rent is already too damn high, and now Panera is charging $10.99 for a chicken sandwich?!?

Let me guess, next they’re going to tell us that gas will cost over $4.00 a gallon?

Oh, that’s right, that’s already happened. My bad.

The Chicken Sandwich Wars skyrocketed to viral fame when Popeyes launched their version of the chicken sandwich in 2019, which started the chain reaction of competitors ranging from McDonalds to KFC to up their chicken sandwich game.

The introduction of the Popeyes sandwich was to the chicken wars what the assassination of Archduke Ferdinand was to World War I.

Ok, well, maybe that is a tad bit of an exaggeration…or is it? You be the judge.

Everyone has their opinion on which one is best.

On a personal note, if anyone cares, I myself don’t notice much difference between any of the competitor sandwiches, with the exception of the wimpy Taco Bell chicken sandwich. The taco chain should stick to making tacos and burritos.

And now Panera Bread is vying to be the undisputed champion of the chicken sandwich chains.

May the odds be forever in their favor!

| Mike Huckabee has made a shocking confession…

“When it comes to investing my money, I feel like I’m stumbling around in the dark.”

But recently, he found a way to fight back.

He discovered a group of 100,000 Americans who are rising up … boldly taking control of their financial future.

Using a powerful investing secret, everyday folks are going from confusion, fear and frustration with their investments … to clarity, peace and success.

No wonder Governor Huckabee calls it a “Miracle on Main Street.”

In this interview, he reveals all the details. |

Man, I love a good fight.

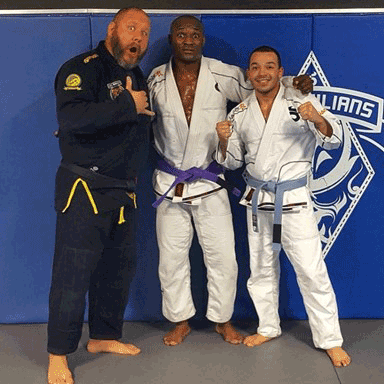

The last 15 years of my life have been dedicated to combat sports, specifically Brazilian Jiu-Jitsu, but I’ve also dabbled in the sport of Mixed Martial Arts.

Believe it or not, Kamaru Usman, the current Welterweight champion of the world in the UFC, used to take BJJ classes from yours truly. Based on that time teaching him, I’m not surprised that he’s considered the pound-for-pound best MMA fighter on the planet.

What he’s been able to do is incredible, and I also consider him a friend.

We always want our friends to do well…

But sometimes, especially in the fight game, you also want to watch something exciting and action-packed.

This past weekend, the UFC traveled to London, England, for one of their free fight cards on ESPN–and I’ve got to say it was one of the BEST fight cards I’ve seen in a while

Of the twelve fights on the card, only three went to decision. That means that nine of the twelve fights were finished either by KO, TKO, or submission–and those are always fun to see.

The most brutal KO was delivered by Liverpool’s own Molly “Meatball” McCann, who finished her opponent with a vicious spinning back elbow.

The award for most brutal overall performance goes to another Englishman, Arnold Allen, who completely overwhelmed perennial title contender Dan Hooker. A Not-So-Exciting Fight I loved the card because the fights were so exciting. That’s always what draws me into a good fight.

I wish I could say the same thing about the fight between FedEx (FDX) and United Parcel Service (UPS)–but in the matchup between the two shipping heavyweights, this fight seems like a one-sided affair.

That being said, FedEx has been doing well during the pandemic.

The shortage of shipping containers has made trade ships into hot commodities, and logistics companies were able to charge premium prices.

However, with many people forced to send their packages by air freight–which falls right within FedEx’s wheelhouse– FedEx was able to increase its prices as well.

In fact, air-based shipping makes up about HALF of this shipping giant’s sales, so the extra business–accompanied by a bump in price– helped the company grow its total revenue in Q4 by a better-than-expected 10% over the previous year.

But there’s a catch…

While air freight was up, the Omicron surge didn’t help ground shipping one bit.

In fact, FedEx’s ground delivery business was down. When coupled with the rising cost of doing business with inflation, profits, while up 25% from Q4 2020, were actually less than expected.

Believe it or not, that led investors to fly the coop.

That trend always baffles me. Profits are up, but it’s still not good enough for people.

What’s funny is that FedEx’s biggest competitor, UPS, didn’t do too much better. A One-Legged Man In An A**-Kicking Contest UPS did just 1.5% better, reporting an 11.5% jump in revenue in Q4 to $27.77 billion with the average revenue per piece increasing by 11.3%.

However, the company is optimistic for 2022 and is forecasting revenue of about $102 billion, which is coming in higher than the Refinitiv-IBES estimate of $100 billion.

A big reason for this was the direction that Chief Executive Carol Tome moved the company. Tome changed UPS’ priority from volume to lucrative deliveries and fought to win more contracts with healthcare firms and small and medium-sized businesses.

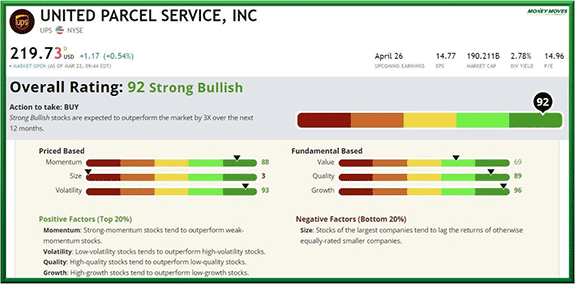

This is reflected in valuation, as UPS is worth almost $140 billion MORE than FedEx.

And while FedEx’s StockPower rating score is a “neutral,” UPS’ score is off the charts (no, not literally - just a figure of speech:  (Click here to view larger image.) So, when it comes to the fight between these two titans…it’s really a non-starter.

It’s a one-sided affair…a KO right after the first bell.

Though, I might buy on the FedEx dip, as the company is still a moneymaker. Who knows? Maybe they’ll get back to sponsoring the Orange Bowl again.

One can dream, right?

Starbucks’ off-again on-again CEO Howard Schultz is popping into Starbucks HQ in Seattle to grab a cup of coffee and pick up his old CEO job…for a short time.

That’s right, the man who built Starbucks into a global coffee empire and introduced random Italian cup size names to the masses is making a venti-sized comeback.

According to the Wall Street Journal, “He’s returning at a challenging time. Starbucks’ shares are down by 31% since peaking last summer as unionization pressure and inflation dog the company. The company says it will pay U.S. staff an average of $17 an hour by this summer.”

As of now, six Starbucks stores have voted to unionize, and 140 are seeking to vote on unionization. This will be the great problem facing Schultz’s return.

Schultz took over the company in 1987 and built it from a local Seattle wholesaler to a worldwide chain of caffes selling individual cups of crafted coffee drinks.

Starbucks is one of the most recognizable American brands on the planet, and thanks to Schultz, you can’t walk around in any major city without hitting a Starbucks on every street corner.

Thanks, Howard!

But lately, Starbucks stock has been declining and the coffee giant is raising prices…again.

It’s not as if Starbucks was that cheap to begin with. Get a Grande Latte or larger and you were already looking at $5 a pop… and that is just for a plain latte.

Add mocha or another flavor and you’d better keep that wallet out because that price is going to continue to rise.

But now, Starbucks has announced that they are raising prices for the third time just since October of 2021.

The Seattle-based coffee behemoth cited inflation, labor shortages, and rising labor costs as reasons for the price hike.

According to TheSpruceEats, “the average price of a Starbucks drink in the U.S. is currently $2.75, with New York City coming in as the most expensive location — $3.25 for a tall cappuccino. A seasonal beverage with all the bells and whistles like a pistachio coffee frappuccino with extra whip currently runs well past the $5 mark…How about a venti-sized cappuccino? According to Starbucks’ website, that’ll set you back a cool $5.25, plus taxes of course. And that latte? Right now, a basic tall-sized latte with no fancy fixings is going for $2.95. A grande-sized latte is $3.65.”

Now, I don’t know which Starbucks location these writers have been frequenting, but those prices seem a little low to me. But I am just passing the information along; don’t shoot the messenger.

But hey, at least we don’t live in Russia or somewhere in Asia. A tall latte in Russia costs $12.50, and in Indonesia, Vietnam, Thailand, Malaysia, and China, prices top $7 on that cup of frothy goodness.

Starbucks stock hasn’t had a great run of late. The stock has fallen in part because of declining visits during the pandemic coupled with issues attracting new workers.

The company’s margins are tightening thanks to rising costs and labor costs, despite having higher earnings than a year before.

They plan on raising average hourly wages from $14 to $17 which will add another $1 billion in costs to the company’s expenses.

So, these are the challenges facing Schultz as he returns to rule his coffee chain fiefdom.

He might soon wish he stayed in retirement.

| Most people don’t know this…

But sixty percent of the energy that’s generated each year in America is wasted.

That’s right — sixty percent!

Yet a tiny Silicon Valley company has just discovered how to use AI to tap this trillion-dollar treasure trove of wasted energy … and turn it into power we can use…

Meaning this company’s growth could be almost unimaginable…

To watch this video for free, click here. |

For more quality content like this, and to learn more about the Money Moves team and the Green Zone Rating System, CLICK HERE! |

Post a Comment

Post a Comment