| Inflation is running hot … but $100 trillion is still a lot of money. In a recent presentation to investors NVIDIA Corp. (Nasdaq: NVDA) CEO Jensen Huang said that his company was targeting industries with combined revenues of $100 trillion. And his company is addressing 1% (a full $1 trillion) of that enormous sum with its latest efforts. A trillion dollars sounds so big as to be hyperbole. But Huang breaks it down like this: - $300 billion in sales to the auto industry.

- $300 billion in chips and systems.

- $300 billion in enterprise software.

- $100 billion in the video game industry.

And the tie that binds together this diverse set of industries? Artificial intelligence.

| "I'm not trying to scare you... But for many people — life is about to take a very strange turn." | |

Artificial Intelligence Is Ubiquitous It’s not just for games anymore. Artificial intelligence — or AI — is now ubiquitous. It’s a critical component of some of the biggest investment themes of the next 20 years. Autonomous driving requires AI. Efficiently managing modern renewable energy production and storage requires AI. Even genomics — another one of my favorite investment themes — requires AI for advanced modeling. AI can’t replace human labor in a lot of endeavors. It might be a while before we have robotic barbers or dentists. But leveraging AI solutions is a big part of resolving the global labor shortage, both by replacing some workers outright and by allowing other workers to be more efficient and handle more responsibility. Just as AI is a critical component of a host of industries, NVIDIA’s chips are a vital part of the hardware that makes AI possible. And you want to know if it’s worth buying some shares of NVDA after the chip giant’s blockbuster announcement. Let’s see what my proprietary Green Zone Ratings system reveals.

| There's a little-known way Trump could — one day — have his revenge. It involves a federal ruling he oversaw in the final year of his presidency that could change America forever … unleash an estimated $15.1 trillion in new wealth … and create countless ways for everyday Americans to benefit. What is this little understood decision? And how will it impact you? | |

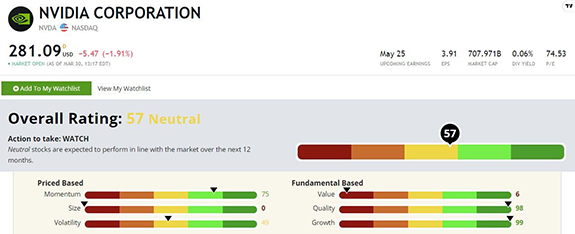

NVIDIA Is a Fine AI Investment — We Can Do Better NVIDIA rates a “Neutral” 57 out of 100 on my Green Zone Ratings system. But it’s worthwhile to dig into the numbers because there is a much bigger story here than the composite score suggests.

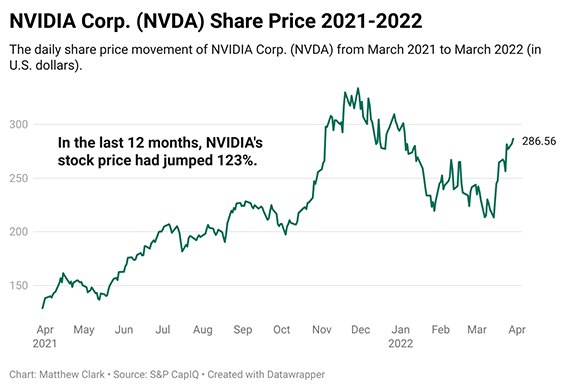

(Click here to view larger image.) Growth — NVIDIA chips go into almost everything these days. This is obvious from NVDA’s stellar growth factor rating of 99. NVIDIA is in the top 1% of all companies in our universe in terms of growth. And with revolutionary new AI tech, I don't expect that growth to slow down. Quality — My system measures quality objectively, using various measures of profitability and balance sheet strength. NVDA is near-perfect here as well, with a quality rating of 99. It has no weaknesses here and rates highly across its returns on equity, assets and investment. The company also maintains only moderate debt. Momentum — I’m always looking for opportunities within market mega trends, and I like to buy high and sell higher. NVDA rates a respectable 75 on momentum. It’s common for high-growth stocks to also be high-momentum stocks. And to see some of that momentum in action, just look at NVDA’s stock chart. Over the last year, NVDA has gained 123%, even factoring in the tech sell-off that we witnessed earlier in 2022.

(Click here to view larger image.) Volatility — Despite NVIDIA’s torrid growth, the stock isn’t that volatile. It rates a 49 on our volatility factor, which is average. Some of NVDA’s moderate volatility can be explained by its sheer size. Larger stocks often have volatility factors in line with the broader market. Value — Tech stocks and high-growth companies are expensive these days. NVIDIA rates a 6 on our value factor. It’s an exceptionally high-growth and high-quality company. Investors are willing to pay a premium to own this stock. Size — NVIDIA is one of the largest chipmakers in the world, with a market cap of $700 billion. It’s not a hidden gem at that size! It rates a zero on our size factor, which knocks several points off its composite score. Bottom line: NVIDIA is a wonderful company and a good way to play the long-term artificial intelligence mega trend. But it’s also a large, established company and already widely owned. So, while I like NVDA, I know we can do better. And that’s why AI is the focus of my latest presentation. NVIDIA and its CEO see a $1 trillion opportunity in AI, but I’m thinking bigger. I’m targeting the fastest-growing sector of the artificial intelligence industry, an industry Cathie Wood, CEO of ARK Invest, says will add $80 trillion to markets over the next 10 years. I call this sector “x.AI,” and it’s set to grow TWICE as fast as every other sector of AI over the next decade. And my No. 1 stock in this sector has the potential to create life-changing wealth for its early investors. To find out more, click here to watch my brand-new x.AI presentation. You won’t regret it. To good profits,

Adam O'Dell

Chief Investment Strategist, Money & Markets

Suggested Stories: One Rental REIT With Massive Dividend Growth Rates (80% & 100%!) Biden’s Budget Is Bearish for Stocks

|

1980: President Jimmy Carter signed the Depository Institutions Deregulation and Monetary Control Act. It enabled banks to pay higher interest on checking and savings account balances, which helped secure deposits within the banking system. It also increased the number of banks under Federal Reserve control. Paul Volcker, Fed chair at the time, said the legislation will take "place among the most important pieces of financial legislation enacted in this century." | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment