| Russia’s invasion of Ukraine “changed everything” if you follow the headlines. It’s hard to disagree, even without a background in global politics. But when it comes to investment trends, it’s crystal clear to me that nothing has changed. In fact, the war only accelerated trends that I’ve been writing about for the better part of two years. And there’s no better place to see evidence of this than in the energy sector. P.S. My renewable energy recommendations are on fire right now! All four stocks tied to my newest “Infinite Energy” presentation are in the green since we added them to the model portfolio on March 4. Two of them are already up between 37% and 38%! And I believe we’re just getting started. Click here to watch my “Infinite Energy” presentation and see why you need to invest in these renewable stocks before they potentially rocket even higher in the coming years. Suggested Stories: Last-Minute Tax Tips: HSAs, Side Hustles and the Best Time to Prep 108% Dividend Growth in 7 Years! Inflation-Proof Your Portfolio

Marijuana Market Update Matt Clark, Research Analyst In this Marijuana Market Update, I discuss a potential problem in the cannabis sector, how it can be fixed and how you can profit from it using cannabis real estate investment trusts (REITs). Click here for my latest cannabis market insights.  Suggested Stories: Powell Follows Volcker's Lead on Inflation — Why That’s Bullish Strong Bullish at Sea: Buy Shipping Stock as Prices Soar 43%

| "The uptrend in gold is now here," says one expert. But if you're not taking advantage of this way to invest for less than $10, you're missing out. | |

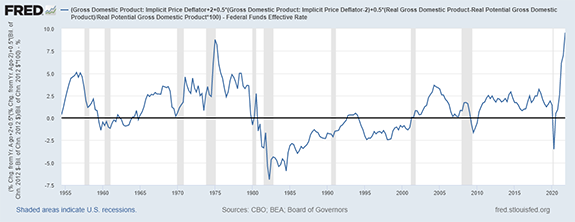

Chart of the Day In a speech earlier this week, Federal Reserve Chair Jerome Powell was firm in his commitment to fighting inflation, noting the central bank might raise rates more than 0.25% at a future meeting. He added that the Fed could even use rate hikes to restrict the economy if needed. While Powell’s words are welcome, the Fed’s stance may be too late. An important theory featured in the chart below says the Fed is further behind inflation than ever. Here’s why.  Suggested Stories: Too Little, Too Late: No. 1 Bullish Trade as the Fed Chases Inflation Stock Rally Indicator: Look at Real Interest Rates

|

1996: The U.S. issued a newly redesigned $100 bill for circulation. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment