| More than 27 million Americans moved last year, according to the U.S. Census Bureau. That’s 8.4% of the total population! People move for a variety of reasons, from affordability to seeking proximity to loved ones. But I’ve spotted a trend within the data that should be a boon for smart investors like you. The migration pattern in the U.S. has been consistent in the last five years. More people are moving out of the Midwest and Northeast and into the South and Southwest. And increasing the population in one area increases the need for basic services like utilities. Using Chief Investment Strategist Adam O’Dell’s proprietary six-factor Stock Power Ratings system, I found a “Strong Bullish” stock that is reaping the benefits of this population shift: - It provides water resources to an area of the U.S. that needs it the most.

- The stock has jumped 41% in the last month … hitting a new 52-week high and continuing to move up.

- This stock is in the top 1% of all stocks we rate.

Here’s why this essential service company will continue its strong performance this year and beyond.  Suggested Stories: Capitalize on NVIDIA’s Artificial Intelligence Blind Spot 2 Transportation Stocks on My Earnings Shortlist (KMX & DAL)

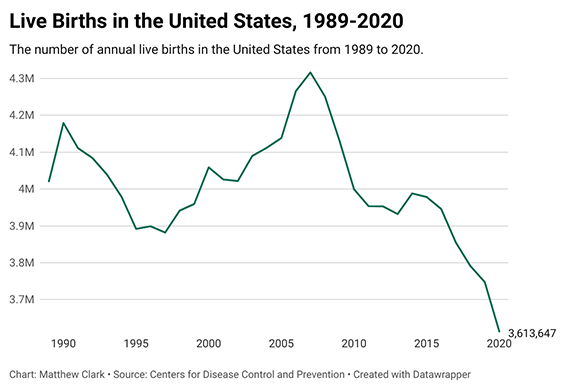

I wrote last week that colleges are toast. What does that mean for the future of the post-college job market? The number of annual American births peaked in 2007 and has been trending lower ever since. (Check out the abysmal chart below.) In about two more years, the number of kids finishing high school will start trending lower too, as the babies who weren’t born in 2008 miss walking across the graduation stage in 2025. So … what does that mean for the job market circa 2029?  Suggested Stories: Full Economic Recovery Is Bad News Faster, Cleaner Ethereum = Crypto Dominance?

| In my new video, I reveal why this is the biggest opportunity yet in electric vehicles (EVs). A former Tesla employee just released a brand-new innovation promising to make every EV out there instantly obsolete, setting up a new market 10X bigger than EVs — and you can buy in right away. | |

|

2012: Candy Crush Saga launched on Facebook. By 2013, the game was downloaded 500 million times across Facebook, Android and iOS. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment