EVs Are The Future…And

The Future Is NOW! The automotive industry has a history of aggressive evolution.

The horse was surpassed by the engine…then cars evolved past early models…evolved past collision concerns…evolved past non-powered steering. In the 21st Century, they’re evolving past gas-powered combustion engines…and soon they may even evolve past DRIVERS!

Like it or not, electric vehicles are fighting their way towards becoming the industry standard…and with gas prices exceeding $4 per gallon, we might need to take the industry more seriously.

But for those of us who can’t just buy the latest EV out of pocket, we’re going to need some extra profits to help out. Luckily, some of the biggest names in EV manufacturing are presenting a convenient solution.

I was born in 1973…and if you have any recollection of or affection for the 70s, you’ll know that it was the era of 8-track tapes. Some of my greatest childhood memories were based upon the music held on those square tapes.

One of those memories is running to my grandmother’s house after kindergarten and listening to Glen Campbell’s “Rhinestone Cowboy” over and over again.

Another vivid one is riding around in my grandfather’s bright orange truck (named “The Orange Bird”), listening to Vaughn Monroe’s “(Ghost) Riders In The Sky”.  [https://youtu.be/Xsfw9CEQITA] But as I got older, 8-tracks gave way to cassette tapes, and on trips with my grandparents, we would either listen to the Andrews Sisters or Harry Belafonte. The tapes were great–even better than 8-tracks!

But then CDs came out and the sound quality blew tapes out the water.

The only problem was going through the books upon books of CDs looking for that one perfect song. Man, that was frustrating.

Thank GOD for the iPod.

Digital music has been my favorite part of living in the 20th Century, hands down.

I can make playlists of my favorite songs and pull up any individual track I can think of just by searching for it. At the push of a button, I can play a song and be happy with the greatest of ease. It’s so much more convenient. The Mother Of Invention Isn’t Necessity… That’s how times change. Competition creates innovation and old inventions become obsolete. It’s just the natural order of things.

That being said…this hasn’t always been true with the car industry.

While competition has ALWAYS bred innovation, it was most often innovations in design, mechanics, or comfort. Rarely do we see a radical diversion of the path.

Electric vehicles were the first true innovation in automobiles since the invention of power steering.

While they were touted as “the future of the automotive industry,” nobody really thought that would ever be the case–especially here in the US.

Why?

Because the US is all about power, speed, and the deep rumble of a combustion engine humming and purring every time we push down on the gas pedal. EVs were a fad, a status symbol for eco-friendly people with thousands of dollars to burn on a nice car that needed to be charged every few hours.

But then we reached 2021 and rising gas prices started to change a lot of minds.

Most EV companies that didn’t have Elon Musk running them had gone largely unnoticed in the preceding years–but people really started to pay attention to them when gas prices started climbing above $3.25. The New Dotcom? Now, the EV market is hot. People are looking for all kinds of opportunities–and they’re finding them!

Even Cathie Wood exited some of her position in established Tesla (TSLA) and grabbed some Nio (NIO), even though the company LOST $340 million last quarter.

That alone should let you know that the market is heating up. Tesla isn’t the only game in town anymore.

Besides Rivian (RIVN) and Lucid (LCID), there are a BUNCH of new EV companies popping up that people are getting excited about.

One of the companies that has seen a surge in interest is Greenpower Motor Company (GP), which saw a 15% price jump simply for being mentioned in a Yahoo Finance article.

It’s like the market is voracious for EVs…and they may become the next dotcom if we’re not careful.

However, if EVs aren’t your style but you still want to look for something in the sector, you could always go with a battery company like Enovix (ENVX), which is a US battery maker for the EV market.

While they’re not experiencing a surge like GP, Enovix is looking to ADVANCE battery technology with innovations that could change their industry.

From the cars to the batteries that power them, the entire sector is HOT! Maybe the market is shifting into more asset-based stocks, maybe society has come to accept that EVs are the future of automotives. Either way, it’s a good idea to start looking for some plays in the sector. You don’t want to be the last one to the table.

Otherwise, you’re that guy that’s still listening to his 8-track in his old, beat-up Chevy Nova.

Times change…

And those that have the ability to change too are the ones who thrive.

| See the device in the box on this table here? It’s the size of a desktop computer … and functionally has the same manufacturing power as the assembly line. It’s creating 63 million new factory jobs … right here in America. MADE IN AMERICA is back! And one small little-known company is at the forefront of this $100 TRILLION shift. Click here for full details. |

Here’s a question you might be asking yourself soon as you are driving down the interstate: “Wait a second, I swear there was nobody driving that Fed Ex semi-truck! Am I going crazy?”

Fear not, Money Movers. You are indeed not going crazy. If this happens to you in the coming years, you likely did see a Fed Ex driverless semi-trailer truck cruise by you on the way to their next drop off spot.

But that’s apparently no reason to be afraid…at least not according to FedEx CEO Fred Smith. If Smith gets his way, this may soon become a very common sight.

Smith told CNBC’s “Mad Money” with Jim Cramer this week that FedEx will make an “enormous effort” to begin using autonomous trucks by the end of 2022.

Cars have come a long way since the days they were foot-controlled in the town of Bedrock. Fred Flintstone would be amazed if he were around to see that not only do you not need feet anymore to peddle a car, but soon the road will be littered with driverless cars.

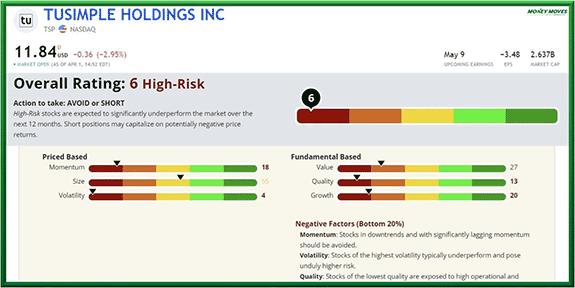

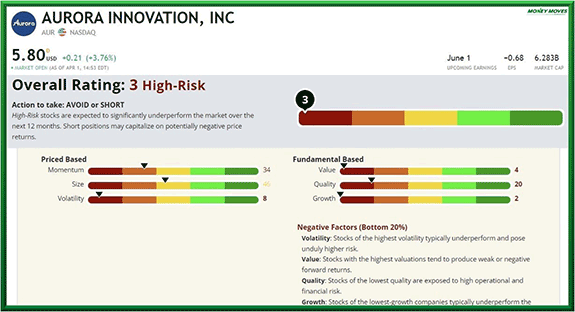

Autonomous semi-trailer truck solutions companies TuSimple and Aurora —which has a contract with FedEx—are working to improve autonomous trucks. However, so far Wall Street and our own Money and Markets Green Zone Fortunes ratings are not enamored with these two companies.

As you can see below, both stocks are high risk and it is recommended that you avoid or short these two stocks.  (Click here to view larger image.)  (Click here to view larger image.) But that’s not to say that it is all doom and gloom for the autonomous vehicle market.

There are now several companies vying for autonomous vehicle supremacy.

Ford, GM, Apple, Tesla, and Alphabet—Google’s parent company— are developing self-driving cars of their own.

Google’s self-driving startup Waymo announced this week that they are fully operating driverless cars in San Francisco.

Waymo said that their cars are just being used by employees as of now, but they hope that they will be available to the rest of us soon.

The company’s self-driving cars have been roaming the streets of San Francisco for several years now—but the cars have always had safety specialists in the driver’s seat.

Waymo announced that one of their self-driving cars even picked one of their employees up for work in the morning and took them to pick up their morning cup of Joe.

Waymo released a statement in which they said, "This morning in San Francisco, a fully autonomous all-electric Jaguar I-PACE, with no human driver behind the wheel, picked up a Waymo engineer to get their morning coffee and go to work.”

However, many of you are probably wondering if these autonomous vehicles are safe. Well, so far, the results are mixed.

According to Business Insider, “a majority of the 98 reported accidents [involving self-driving cars in San Francisco] in 2021 occurred while the vehicles were in autonomous mode, or within seconds after the autonomous mode technology had been switched off.”

“Of the 53 collisions during which the cars were operating in autonomous mode, or had been moments before impact, 11 resulted in injuries,” according to Business Insider.

One of the selling points for proponents of autonomous vehicles is that they will reduce human error and save lives. As of last year, there were a reported 40,000 human fatalities attributed to car accidents.

Fortunately, there were no reported deaths attributed to autonomous vehicles.

So far, autonomous vehicles struggle with unexpected movements like a car running a red light or a biker crossing a busy street.

However, when conditions are predictable, autonomous vehicles have proven to be effective.

Some market analysts see giant upsides in the autonomous vehicle market and are predicting that the market could total $1.4 trillion by 2025.

And some experts, including a legendary Wall Street investor, are forecasting that the autonomous vehicle market will grow by 63,000%! The best part is this legend is super pumped about one particular stock pick in the AV market…and he wants to share it with you. You can learn which AV stock he likes by clicking here.

So, in the long run, self-driving cars could have investors like you shouting: “Yabba-dabba-doo!”

It’s time for another edition of the hit stock market game that’s sweeping the nation.

It’s time to play…Split…That…Stock!

After the success split announcements from companies like Amazon and Alphabet, it seems everyone is eager to get in on this new trend.

Up next is everyone’s favorite electric vehicle maker, Tesla.

If that’s not a reason to get excited, I don’t know what is.

When he isn’t threatening to start a challenger company to Twitter or winning Times Person of the Year, Tesla CEO Elon Musk is raking in profits from his world-famous EV company…and now he’s decided that it’s time to do the splits.

Tesla filed a report with the SEC stating that the electric vehicle behemoth will seek “an increase in the number of common stock…in order to enable a stock split of the Company’s common stock in the form of a stock dividend,” according to the SEC filing.

For those inquiring minds, a stock dividend is a dividend paid to shareholders in the form of additional shares instead of cash.

A stock split, which breaks up each existing share into a predetermined number of new shares, increases the overall number while reducing the cost per share. Through this process, companies lower their share price and allow more investors to buy in.

And boy oh boy did investors love the news of Tesla’s stock split, because as of this writing, shares were up almost 9%—nearly $90—for the day, putting share prices for the company just under $1,100.

This is a fresh change of pace for the EV maker, which has been down for most of this year.

Tesla’s stock has slipped 4.4% through last Friday’s close.

However, a little bit of perspective is needed.

Shares of Tesla jumped 49.8% in 2021 and surged 743.4% in 2020! Also, the shares have risen in each of the last five years!

Not bad at all.

The last time Tesla played the stock splits, the company did a 5-for-1 split, and since that day in August of 2020, shares have more than doubled (making that just about the only good thing to happen in 2020).

Once again, not bad at all.

And on a side note, if this whole EV thing doesn’t work out and his quest to colonize Mars fails, Elon Musk can settle for starting a rival to Twitter.

That’s right, the always entertaining Twitter profile of Elon Musk was busy this past week. The Tesla CEO was thinking out loud to his 79.1 million Twitter followers when he asked if a new platform to rival Twitter was needed.

Musk tweeted, "Given that Twitter serves as the de facto public town square, failing to adhere to free speech principles fundamentally undermines democracy," Musk tweeted Saturday. "What should be done?"

[https://twitter.com/elonmusk/status/1507777261654605828] Whatever your feelings are about the dude, you must admit that Elon Musk is nothing short of entertaining.

Whether he follows through on developing a new Twitter is still to be determined.

But for now, we know that the Tesla stock split is going to create an amazing investment opportunity down the line.

And that is good enough for me.

For more quality content like this, and to learn more about the Money Moves team and the Green Zone Rating System, CLICK HERE! |

Post a Comment

Post a Comment