| One school of thought says that socially responsible investing is counterproductive because it lowers your returns. If you want to change the world: Invest profitably make the highest returns possible, and then plow your gains into the causes you support. I’m not unsympathetic to that line of reasoning. While there are a few industries I just can’t touch, my job is to help you, my readers, make money. So I can only justify socially responsible investing if it adds to the bottom line. As a trader, I try to keep my emotions in check and stick to the numbers. And for the most part, I keep politics out of my trading. As an example: When I write about the amazing opportunities I see in renewable energy, it’s because I expect we can make a boatload of money in the trade. Don’t get me wrong: I love the idea that the companies we buy provide cleaner air and reduce carbon emissions. I want to leave my son a better world than the one I grew up in, just as my parents wanted the same for me. But altruism only gets you so far. Well, there’s good news on that front. It turns out that “good” companies are often good stocks. Let’s do even better. Suggested Stories: Capitalize on NVIDIA’s Artificial Intelligence Blind Spot This Growth Dividend Stock Is STILL the Cure for a Volatile Market

| Warning: One day that shiny, new iPhone in your hand will be worthless. And that day isn't as far away as you think. Because all the 6.3 billion smartphones on the planet will be replaced by the revolutionary new device in this little black box. Investors who get in early on what Apple's CEO has called "the next big thing" will have the chance to make more money than initial iPhone investors in 2007. | |

Marijuana Market Update Matt Clark, Research Analyst In this Marijuana Market Update, I answer a viewer’s question about IM Cannabis Corp. (Nasdaq: IMCC), an international cannabis stock. I also look at the five U.S. states most likely to legalize cannabis this year. Click here for my latest cannabis market insights.  Suggested Stories: Buy Top-Tier Growth Stock as Americans Migrate South As Birth Rates Crash, AI Can Fill the Jobs Gap — That’s Just the Start!

| In July 2020, the Trump administration oversaw a RADICAL change to the tech world … one that could unleash a huge wave of disruption … prosperity … and wealth creation in the near future. Chances are you haven't heard about it until today. But according to one of America's most respected tech forecasters, it's set to create small fortunes right here in this country. He recently went on camera to explain why. | |

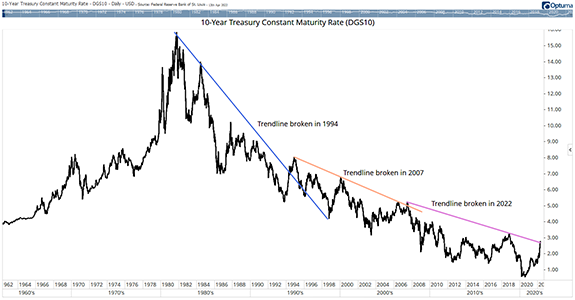

Chart of the Day Interest rates are rising. We all know that. Analysts and traders are speculating about how high rates can go. While developing my forecast, I noticed something interesting (and ominous) on the chart below. This chart shows the rate on 10-year Treasury notes. The high was 15% in September 1981. Since then, the trend has generally been down. Of course, no trend moves in one direction. There are short, countertrend moves, and these rallies in the 40-year downtrend are associated with dramatic events. The most recent break is a bad sign. Here’s why.  Suggested Stories: Great Resignation 2.0: Millennials Aren’t Special After All Full Economic Recovery Is Bad News

|

1865: President Abraham Lincoln died after being shot the previous day. The New York Stock Exchange closed after the news broke, and it didn't reopen until April 21. |

|

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment