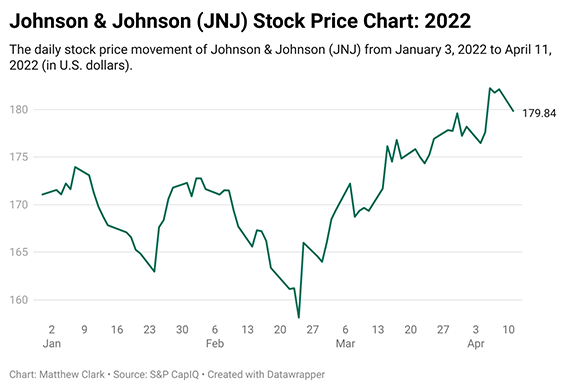

| Back in February, I wrote that blue-chip pharmaceutical and consumer products company Johnson & Johnson (NYSE: JNJ) was a fantastic “dividend Band-Aid” for a volatile market. Two months later, it’s funny how little has changed. The S&P 500 rallied hard for much of March. But now in April, the usual suspects — inflation and hawkish language from the Federal Reserve — are rattling markets again. As I write this, the S&P 500 is down about 5% for the year, and its momentum looks shaky. Yet our dividend Band-Aid from February is near its highs for the year. In fact, JNJ looks more attractive today than it did when I first recommended it. After a brief turn lower, JNJ is up 4% since I talked about it on February 2. (See its price action in the chart below.) And it’s looking even better in our Stock Power Ratings system, too! Click here to see how much it's improved and why JNJ is perfect for this market.  Suggested Stories: Buy Top-Tier Growth Stock as Americans Migrate South As Birth Rates Crash, AI Can Fill the Jobs Gap — That's Just the Start!

| "Consider V2G ... before it becomes a household name," says the rogue Wall Street reporter who's already named over 35 stocks with 1,000% gains. | |

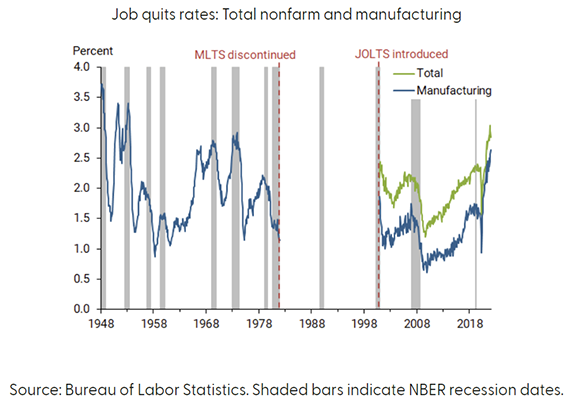

Chart of the Day Millennials are just like any other generation. That might conflict with their self-image, but every generation is more like previous generations than they are different. You may recall the “yuppies.” They believed the world would change to suit them. In the end, they changed to meet the requirements of everyday life. Now millennials seem to believe history started with their births. They (and the younger Generation Z) want to work remotely and enjoy work-life balance. If a company won’t allow that, they quit as part of the “Great Resignation.” But today’s chart shows we’ve been here before…  Suggested Stories: 4 Cheap (for now) Dividends Yielding Up to 9.8% Capitalize on NVIDIA’s Artificial Intelligence Blind Spot

| America's top stock market expert answers this governor's burning questions: "Why is NOW the best time in 50 years to invest? And what are your top three stock picks?" | |

|

1998: NationsBank announced a $62 billion merger with BankAmerica Corp. to become the financial giant Bank of America. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment