| Cyberattacks are brutal. Even the word has a way of filling you with dread. But most people without a technical background have only a vague idea of what a cyberattack is. They know it involves geeky bad guys attacking a computer system. But they don’t know how these hackers gain access to our devices … or why they do it. It’s created a lucrative environment for devious individuals. But the real moneymaker will come from efforts to cut these criminals off as cybersecurity becomes a necessity. Of course, not all cybersecurity stocks are investable. And as markets sell off, it’s tough to separate the stocks with market-crushing potential from the ones that lack a runway out of this mess. That’s where my proprietary Stock Power Ratings system comes in… Suggested Stories: Change Your Bear Market Mindset: 4 Factors Create 1,000% Opportunities Gold’s Role in the Market Mess: Hedge, Speculate or Hold Forever?

| It's not a Big Oil stock… In fact, it's beating Big Oil at their own game. Get the full story on a tiny, under-the-radar company selling for less than $20. | |

Earnings Edge Last week’s Earnings Edge stocks came up well short. Walmart Inc. (NYSE: WMT) and Target Corp. (NYSE: TGT) both tumbled on earnings, signaling much deeper weakness in our economy than just pain at the pump. Let's see if that pain will carry over into the two stocks I picked this week. Suggested Stories: After IIPR’s 50% Crash, Will a Shareholder Lawsuit Finish It Off? Own the Internet With Decentralized Tech (Ask the Crypto Expert)

| Thanks to Section 40107 of the new infrastructure bill, the government is set to push $65 billion into the green tech market… According to my research, that's 22X what the government gave Tesla over its entire history… Yet one company stands out as a top candidate to receive a huge chunk of this cash… I'm talking about a tiny Silicon Valley firm that uses AI to crack open the largest untapped energy source in the world… With government backing, I believe the sky is the limit here… | |

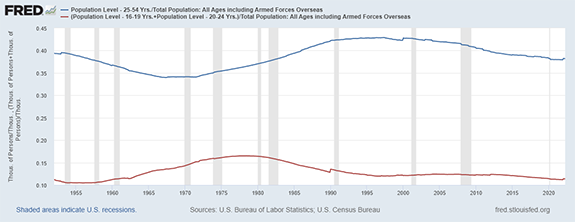

Chart of the Day Every day, investors try to make sense of new data. Some numbers change month to month, but others are updated more frequently. Price data changes every day, even every minute, while markets are open. But one of the most important data points for investors changes at a much slower pace. And it’s easy to project into the future. Take a look at today’s chart to see why my eye is on population data.  Suggested Stories: Recession Watch: It’s the ‘70s Again … or Worse When Stocks Drop, Boring Works: Low-Volatility 5G REIT to Buy

|

2002: Netflix's initial public offering (IPO) launched at $15 per share. The first day of trading left the company with a market cap of $345 million. Its market cap ballooned to more than $300 billion last November, but the tech crash sank that value to around $80 billion today. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment