| Managing Editor’s Note: It’s time to switch it up with your Money & Markets Daily. Research analyst Matt Clark is working on a new podcast driven by our Stock Power Ratings system (check out a preview here), we’re freshening up our look and we’re even considering new times to deliver our daily market insights. Is there anything you’d us to try in the Money & Markets Daily? Email Feedback@MoneyandMarkets.com now! — Chad Stone, managing editor, Money & Markets Dividend of the Week | | One down, two to go. The Nasdaq Composite is the only major U.S. index in a bear market after falling more than 20% from recent highs. The S&P 500 and Dow Jones indexes have a little further to go. But it already feels like a bear market out there. And the most remarkable aspect of this current sell-off is that there’s nowhere to hide. Stocks are getting crushed … bonds are getting crushed … and when you take inflation into consideration, even cash is getting crushed. In a market like this, income investors must find a balance between bringing in current income and protecting capital. You need something that will continue to pay the bills without tanking your portfolio. That’s where today’s diversified (and “Bullish”) real estate investment trust comes in.  Suggested Stories: Stay Ahead in Fed-Spooked Market (Cash Strategy + First Stocks to Sell) Normal Isn’t What It Used to Be — Here’s the Economic Proof

| Dave Forest discovered a unique "backdoor" play ... which can give regular folks access to potentially lucrative private deals. Readers already had a chance to see gains as high as: - 1,276%...

- 1,614%...

- 2,805%...

- Even 4,942%!

His next big recommendation could get you into a secretive deal alongside JEFF BEZOS ... and potentially hand you a 49X return ... for as little as $3. | |

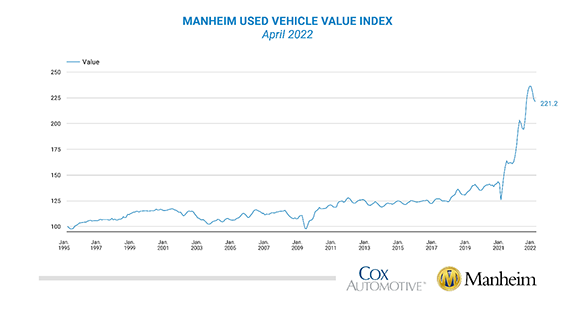

Chart of the Day Policymakers have assured us for almost two years that inflation won’t last. They argued, at first, that high inflation was due to unique factors. Most prominently, they blamed used car prices. As used car prices skyrocketed, so did the CPI. Prices jumped 89% in two years. That accounted for a gain of about 4% on the CPI. That’s more than a third of the CPI’s increase over that time. Today’s chart below shows used car prices might have finally peaked. Here’s what it means for inflation.  Suggested Stories: These 7%-12% Dividends Are in the Bargain Bin Inflation Soars, Rates Rise, American Debt Skyrockets: Stock to Benefit

| Only 2% of cars sold in the U.S. today are electric vehicles … but that's about to change — FAST. A new battery breakthrough is ready to hit the market. It could revolutionize the $2 trillion automotive industry … and could soon make gas guzzlers obsolete. This technology is predicted to cause a 1,500% surge in electric vehicle sales over the next four years. The company pioneering this new battery could be the investment of a lifetime. | |

|

1997: After winning over 30 matches against computer programs, chess grandmaster and world champion Garry Kasparov lost to IBM's Deep Blue computer program in a six-game match. It was the first time a computer defeated a world champion. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | | |

Post a Comment

Post a Comment