| Our publisher said it best while mulling over the downtrodden market in a meeting last week: “This stock market sucks.” Not the most graceful response, but it was accurate. It got me and the rest of the Money & Markets team thinking about market downturns and the kinds of opportunities they create down the road. So we started digging, and we found that a bear market is the perfect catalyst for certain stocks to soar higher. You just have to know where to look. Let’s look at a couple of stocks that soared 1,000% out of the 2020 crash. Note: Chief Investment Strategist Adam O’Dell isn’t turning his back on this market. Instead, he’s identified a strategy to help you find profits as these stocks come out of the downturn. He, along with the rest of the Money & Markets team, is putting the finishing touches on a strategy that identifies stocks within mega trends with 1,000% potential. We’ll have more details soon. Suggested Stories: Bonds Look Attractive Again — But Dividends Are Still the Income King The Merge, Crypto Competition and What Decentralized Really Means

| You make the trade on Monday … relax for 48 hours … and then close it on Wednesday. It couldn't be any simpler. Yet the profits using Adam O'Dell's new two-day trading strategy are out of this world. With top-performing trades like 519% in two days … 440% in two days … 440% in two days … and 400% in two days. | |

Marijuana Market Update Matt Clark, Research Analyst In this Marijuana Market Update, I focus on earnings and their relation to cannabis stocks during a market downturn. Click here to check out my latest cannabis market insights.

Suggested Stories: Dividends for a Downturn: 5.6% Payer Boasts Stability AND Growth Power Stock: Kids Love This Niche Toymaker … Investors Should Too

| No matter how you feel about it, you can't deny that Facebook has fundamentally changed the world we live in. Now Mark Zuckerberg is changing Facebook's name and rebranding completely — and I've discovered the key reason behind his SHOCKING decision. It's all because of a new tech breakthrough that will revolutionize how human beings live, work and interact — just like Facebook did nearly 20 years ago. Now one legendary tech researcher is giving away his No. 1 way to play it ... long before Zuckerberg's creation goes mainstream. | |

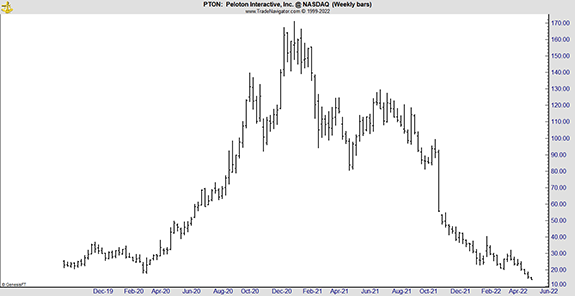

Chart of the Day As the pandemic raged, health clubs closed, and Peloton showed us the future of fitness. Millions ordered the pricey bicycles and subscription packages. Of course, those who don’t remember history are doomed to repeat it. Looking back, it was easy to see where Peloton bikes were headed. They would join Nordic Tracks and generic exercise equipment in holding laundry in millions of bedrooms around the country. But it was the pandemic. Peloton had a new technology. Customers and investors argued that this time was different. We know that’s not true. This time was exactly the same. The chart below is of Peloton Interactive Inc. (Nasdaq: PTON), but it could be of any bubble. As we enter a potential bear market, it’s an opportunity to review how bubbles end.  Suggested Stories: Stay Ahead in Fed-Spooked Market (Cash Strategy + First Stocks to Sell) Used Car Prices Signaled Inflation's Turning Point

|

1927: The Berlin stock exchange suffered a devastating "Black Friday" after the German central bank restricted margin loans a day earlier. It sank 13% as investors were forced to sell to meet the new margin requirements. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment