| I’ve spilled a lot of ink parsing Warren Buffett’s comments from the Berkshire Hathaway annual meeting over the weekend — and with good reason. (Check out my take here.) The man’s track record speaks for itself. Not too many people can claim their portfolio is up 3.6 million percent. Believe it or not, as much as I respect Buffett, I don’t recommend we copy his investing moves verbatim. His reasons for buying may not align with our own. Remember: He’s running an institutional portfolio for an insurance conglomerate, not a personal IRA account! That said, Buffett’s portfolio is a nice starting point for further research. And one of his biggest buys of recent months checks off a lot of boxes for our dividend portfolio. Let’s get into it.

Suggested Stories: Warren Buffett Didn’t Mince Market Words — My Biggest Takeaways Buy Top-Rated Grocery Stock as Online Biz Boosts Revenue 20%

| The number of Nasdaq stocks down 50% or more has now hit a near record. And on May 11, it could get worse — much worse. At 4:05 p.m. EDT that day, one of America's oldest and most beloved firms will make an announcement that could send it plummeting. And take down hundreds of other stocks with it. | |

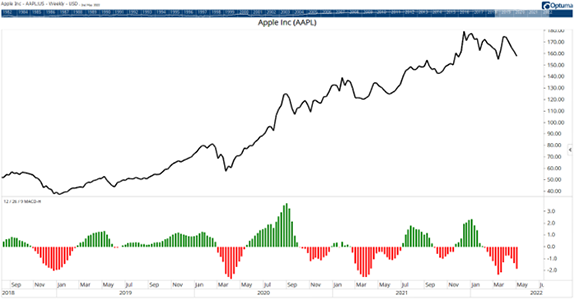

Chart of the Day After plummeting more than 13% since the beginning of the year, the S&P 500 is due for a bounce. One way to determine when that bounce is likely is with market breadth indicators. Breadth indicators are designed to measure how many stocks participate in the stock market’s broader trends. And today's chart shows a sell signal disguising a broader buy. Here's why.

Suggested Stories: German Bond Yields Force Inflation Into Spotlight for Central Banks These 7%-8% Monthly Dividends Are on Sale!

| No matter how you feel about it, you can't deny that Facebook has fundamentally changed the world we live in. Now Mark Zuckerberg is changing Facebook's name and rebranding completely — and I've discovered the key reason behind his SHOCKING decision. It's all because of a new tech breakthrough that will revolutionize how human beings live, work and interact — just like Facebook did nearly 20 years ago. Now one legendary tech researcher is giving away his No. 1 way to play it ... long before Zuckerberg's creation goes mainstream. | |

|

1959: The first annual Grammy Awards were presented to artists for their musical accomplishments from the previous year. The first winners included Ella Fitzgerald, Frank Sinatra and Count Basie. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | | |

Post a Comment

Post a Comment