| Bear markets create opportunities. With the S&P 500 and Nasdaq both well into bear market territory, I see attractive prices on certain stocks for the first time in years. I’m recommending several new positions that are poised to buck the market’s overall bearish trend. (Click here to join Green Zone Fortunes and access my latest inflation-proof stock recommendation.) But certain companies will fare better as this bear market continues, while others will continue to struggle. That’s why I developed the Stock Power Ratings system. It helps us find profitable companies within any market — up, down or sideways! Before you rush in to buy the dip in your favorite stocks, I recommend you avoid one iconic American blue chip for now. Here’s why this “Bearish” stock isn’t a buy today.

Suggested Stories: From 4.6% to 16.6%! Realty Income Shows Yield on Cost’s Power Another Bullish Workhorse for the Bear Market

| Stocks are crashing around the world, and the head of the world's biggest asset manager (BlackRock) says the next 1,000 "unicorns" (firms that get to a $1 billion valuation) will come from this sector, which you've probably never considered. | |

Marijuana Market Update Matt Clark, Research Analyst In today’s Marijuana Market Update, I respond to a viewer who asked me to analyze two popular cannabis stocks: Trulieve Cannabis Corp. (OTC: TCNNF) and Green Thumb Industries Inc. (OTC: GTBIF). Shalom sent me this email: I’m a subscriber of your YouTube channel and am a BIG FAN! It is the first time I’m emailing you at your suggestion by the end of your videos. I will MUCH MUCH appreciate it if you can do a video analyzing Trulieve (TCNNF) and Green Thumb Industries (GTBIF) and preferably even compare the two and give your take. Let’s dive into both in this week’s Marijuana Market Update.  Suggested Stories: Your Doctor’s Office Gets “Smarter” Thanks to This Tech Power Stock Kellogg Stock: Bullish Dividend Workhorse Fights the Bear Market Trend

| We're on the brink of mankind's biggest invention. This breakthrough could turn Big Tech on its ear. Bank of America says it will spur the "fastest rollout of disruptive tech in history." And the CEO of Google says this could be "bigger than fire." But the window for reaping the biggest profits in the shortest amount of time is closing soon. | |

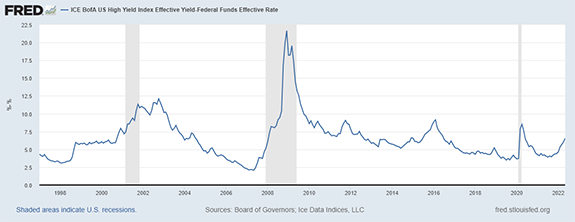

Chart of the Day Over the long run, junk bonds (i.e., high-yield bonds) tend to be poor investments for individual investors. While hedge funds and institutional investors can own a diverse portfolio of bonds, individuals are limited to index funds. They don’t have the resources to analyze the risks of the companies these bonds are for. See why junk bond yields in the chart below are a fantastic indicator for these risks.  Suggested Stories: Big Traders Ready for Futures Market Rally — Why That's a Good Sign Fed’s Latest Rate Hike = More Need for This Power Stock’s Services

|

1997: The U.S. Air Force released The Roswell Report: Case Closed. It dismissed claims that an alien spacecraft crashed in Roswell, New Mexico, in 1947. Despite the report, a majority of individuals interviewed by CNN in 1997 believed the government was hiding the truth. People still debate this conspiracy theory today. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment