Editor’s Note: U.S. markets — and Money & Markets offices — are closed today to commemorate Juneteenth. June 19, 1865, is the date that word of former President Abraham Lincoln’s Emancipation Proclamation reached African Americans in Texas. We wish each of you a terrific holiday.

- Higher mortgage interest rates are pushing millions out of buying a new home … and into more affordable multifamily dwellings.

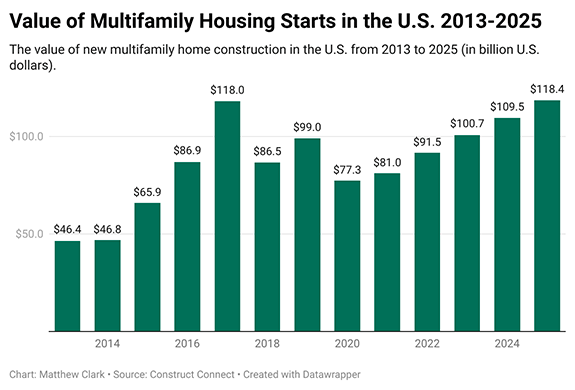

- The value of multifamily home construction in the U.S. will grow 46.2% by 2025.

- Today’s Power Stock, which helps construction companies and governments build affordable multifamily housing, rates a 94 on our proprietary system.

| When mortgage rates were at record lows, Americans flocked to buy new single-family homes.

Now that the trend has reversed, the rate hike is pricing Americans out of new homes and into apartments and duplexes.

This means an increase in multifamily housing construction across the country:  (Click here to view larger image.) The chart above shows the value of new multifamily home construction over 12 years.

The increased demand is pushing up the value of that construction.

From 2021 to 2025, the value of new multifamily construction will grow 46.2%.

This trend bodes well for today’s Power Stock, which provides financing for affordable multifamily housing in the U.S.

Click here or on the image below to find out more!

| From our Partners at Banyan Hill Publishing. Thanks to a record supply shortage and surging demand…

One asset could fly off the charts, creating a decade-long boom and potentially generating fortunes for early investors.

It’s safe to say wealthy elites like Larry Ellison of Oracle and Amancio Ortega of Zara see potential here — they already hold BILLIONS of dollars of this asset...

Learn how to take advantage of this historic opportunity here! |

Check Out Our Most Recent Power Stocks: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | |

Post a Comment

Post a Comment