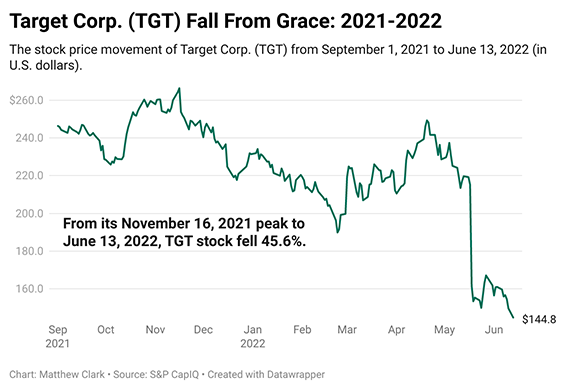

| In the midst of a market sell-off like this, I welcome any good news I can find. And Target Corp.’s (NYSE: TGT) plan for its dividend is a massive confidence boost for its investors. Here’s why… It’s been an awful year for big-box retailers like Target. The supply chain is still a mess, and inflation is driving up inventory prices while making it harder for consumers to afford the merchandise already on shelves. All of this led Target to drop a bomb on investors last week when it announced it would slash inventory. The retailer is also marking down prices in its stores to clear the glut. Investors dumped TGT on the news. It’s down almost 50% since November! (See chart below.) But Target's dividend tells a different story.

Suggested Stories: Buy Into Internet of Things’ $1 Trillion Future (Top-Rated Stock) 3 Alternative Moves for Your Cash as the Bear Roars

| No matter how you feel about it, you can't deny that Facebook has fundamentally changed the world we live in. Now Mark Zuckerberg is changing Facebook's name and rebranding completely — and I've discovered the key reason behind his SHOCKING decision. It's all because of a new tech breakthrough that will revolutionize how human beings live, work and interact — just like Facebook did nearly 20 years ago. Now one legendary tech researcher is giving away his No. 1 way to play it ... long before Zuckerberg's creation goes mainstream. | |

Chart of the Day Redbox Entertainment Inc. (Nasdaq: RDBX) stock is soaring. It looks like a takeover bid is driving the 300%-plus rally over the last month. Redbox operates self-service kiosks that rent new-release DVDs and Blu-ray discs. It went public through a special purpose acquisition company (SPAC) at $10 per share in October. RDBX reached almost $19 per share before falling below $6. Chicken Soup for the Soul Entertainment Inc. came to the rescue. And this set the trap for a wave of meme investors. (See chart below.)  Suggested Stories: College Enrollment Declines, but Employment Rises — What It Means Bear Market Success Story: Revisit PENN’s 2,900% Rally

| We're on the brink of mankind's biggest invention. This breakthrough could turn Big Tech on its ear. Bank of America says it will spur the "fastest rollout of disruptive tech in history." And the CEO of Google says this could be "bigger than fire." But the window for reaping the biggest profits in the shortest amount of time is closing soon. | |

|

1844: Charles Goodyear patented vulcanization, the process used to strengthen rubber by adding sulfur or other similar materials. Vulcanization was a rubber revolution, and it's still used today for items such as tires and shoe soles. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment