The Big Lie Keeping This EV Penny Stock From Surging I’m what you may consider a “perma-bull” on EV stocks.

To me, the future is so clear that it’s inarguable. Only 10% of all new cars sold last year were electric. By 2040, every new car sold globally will be electric. This is an industry that will grow by 10X, and the highest-quality EV stocks will soar much more than that.

I think it really is that simple.

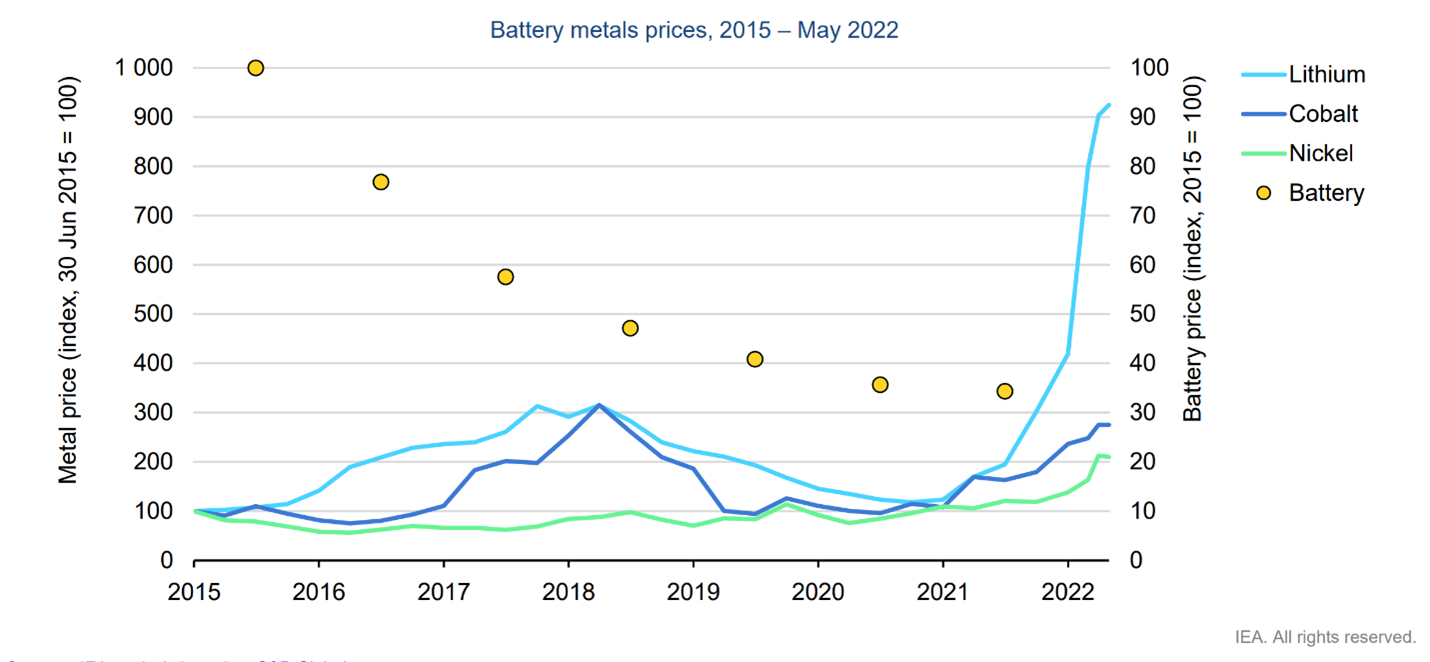

Yet, in 2022, my beliefs have been consistently challenged by one thing: Soaring metal prices.

You may have heard. The cost of everything is going up. This includes the cost of metals like lithium and cobalt, which are essential to making electric car batteries. Battery costs are the bulk of EV manufacturing costs. As they go up, the cost of an EV goes up.

Tesla. Lucid. Rivian. They’re all hiking prices on their EVs this year for this very reason.

That’s problematic, because a big part of the EV bull thesis is that EVs will not just eventually reach cost-parity with gas-powered cars, but that eventually, they’ll be much cheaper. Spiking battery metal prices throw a big wrench into that thesis.

Or do they?

My research strongly suggests that this whole idea of spiking metal prices killing EV industry momentum is a farce. Instead, the numbers bear out that even if metal prices keep rising, EV costs are going to keep plunging. No matter what, EVs will soon be significantly cheaper than gas-powered cars.

As a result, I think its time to back the truck up and start loading up on some high-quality EV stocks in 2022. They’re being pushed down on a misconception. As that misconception proves false in the coming months, these EV stocks are going to soar! Metal Prices Don’t Drive EV Prices There are two huge problems with this whole idea that spiking metal prices are going to derail the EV industry:

1. Metal prices have been going up for a decade, and EV prices plunged over that same time frame.

2. This 2022 spike in metal prices is wholly unsustainable and a one-time phenomenon.

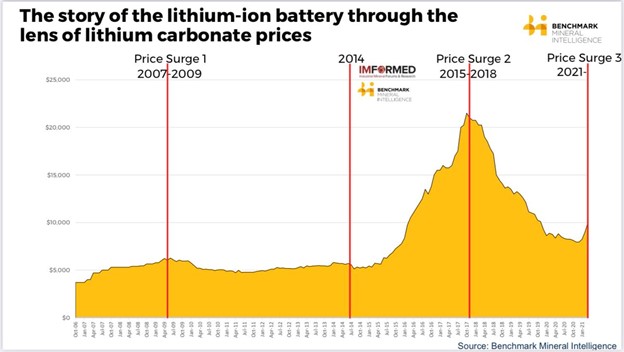

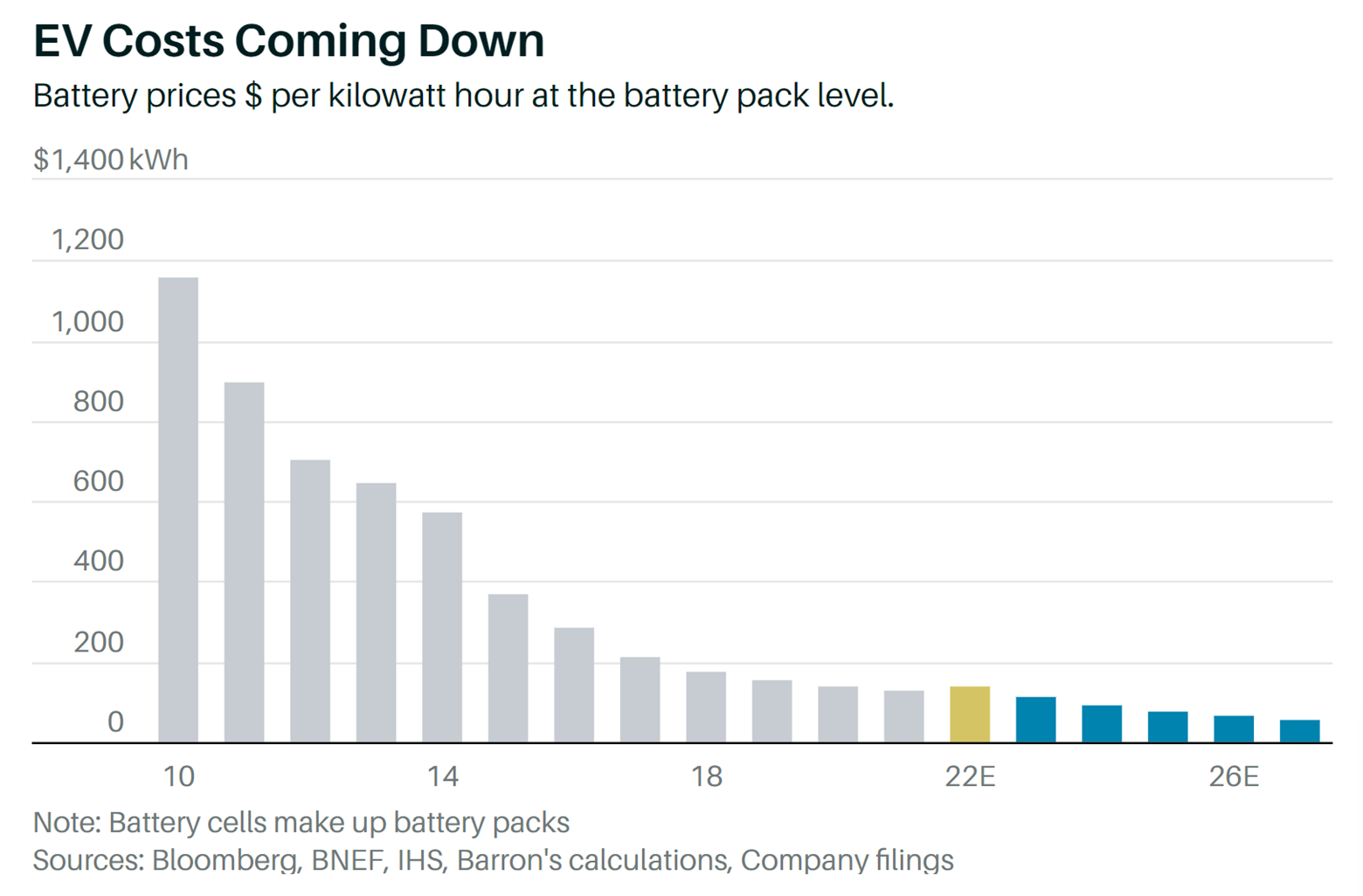

Throughout the 2010s, lithium metal prices increased, on average, by about 13% per year. Over that same time frame, lithium-ion battery costs dropped 97%.

Let me repeat that, because it bears repeating.

During the 2010s, lithium metal prices rose by 13% per year, and concurrently, lithium-ion battery costs dropped by 97%.

In other words, we have 10 years worth of data showing that battery metal prices are not a major driver of overall battery costs. Battery costs have consistently declined in the face of rising metal prices.

To be sure, lithium-ion battery prices are set to rise this year. But that’s against the backdrop of an entirely unprecedented ~800% increase in lithium metal prices since last year. And the prices hikes we’re seeing from Tesla and others are in the 5% to 10% range.

Lithium prices go up 800%. EV prices go up 7.5%. The math there isn’t that hard to calculate.

It takes an unprecedentedly large, never-going-to-happen-again spike in lithium metal prices to even nudge EV prices slightly higher.

Once lithium metal prices settle back down into a much more normal groove of rising by 10% to 15% per year, EV prices will get right back to dropping. Battery Innovation & Manufacturing Scale Are Far More Important The natural question you should be asking yourself right now is: How in the world did lithium-ion battery prices drop 97% in the 2010s while their main input costs were rising 13% per year?

As it turns out, a bunch of MIT researchers had the same question last year. They conducted a massive study to figure out what was driving lithium-ion battery prices lower at such a rapid rate.

Their conclusion? Battery innovation and manufacturing scale.

Specifically, the MIT researchers discovered that more than 50% of the cost decline of lithium-ion batteries was due to research & development in chemistry and material science In other words, over the past decade, engineers and scientists have consistently developed more innovative and cost-efficient ways to make EV batteries. That battery science innovation has been the biggest driver of falling battery costs since 2010.

The other big driver? Economies of scale. The more EV batteries the world made, the cheaper it became to make those batteries since per factory throughput was maximized.

Importantly, these are secular cost reduction drivers that will persist for the foreseeable future.

The MIT researchers found that the impact of battery innovation on battery costs has not faded over time. In fact, it remains just as strong today as back in the 1990s!

Meanwhile, EV sales are still growing rapidly, which means more manufacturing scale, and more cost reductions through economies of scale.

As EV stock investors, we can count on these two cost reduction drivers to stay in place for the next decade or even longer – and that’s a huge reason to buy EV stocks! EV Costs Set to Plunge When all is said and done, this year’s rise in EV costs is a temporary and anomalous phenomenon that will not continue.

EV battery prices are expected to rise about 5% this year. They are then forecasted to drop 17% in 2023, another 17% in 2023, another 17% in 2025, another 16% in 2026, and another 16% in 2027.

Adding it all up, EV battery prices are expected to rise 5% this year, and then drop 60% over the subsequent five years.

You know the saying “don’t make a mountain out of a mole hill”?

That’s what investors are doing right now. The 5% rise in EV prices in 2022 is a mole hill. Pundits are turning it into a mountain. Once the data proves its just a mole hill, EV stocks will soar.

And they’ll keep soaring for years, and years, and years to come. |

Post a Comment

Post a Comment