| Matt Clark, Research Analyst Every day, I’m amazed at what my smartwatch can accomplish. It tracks all kinds of information: stock market conditions, workouts, weather… It's all on this tiny device on my wrist. That’s a far cry from the must-have watch of my childhood: the Casio calculator watch.

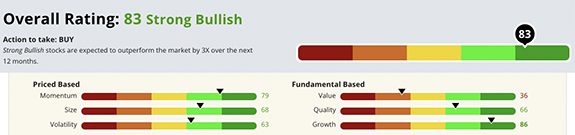

Remember this relic of the past? My smartwatch works within the Internet of Things (IoT). It sends and receives thousands of data points because it’s connected to the internet 24/7 … either through Wi-Fi or a cellular data connection. I found a “Strong Bullish” stock that provides IoT products and services around the world: - It just reported record quarterly revenue of $95 million.

- The stock hit a 52-week high at the beginning of June.

- We expect it to beat the market by 3X over the next 12 to 24 months.

Check out why this IoT stock will continue its strong performance well into the future.

Suggested Stories: Bear Market Success Story: Revisit PENN’s 2,900% Rally Watch for Ominous Signs in 2 Earnings Reports (ORCL & KR Analysis)

| Expert predicts a meeting scheduled for June 15, 2022, could have many Americans unloading their investments and running to the bank. With just one move, the most popular asset in America could suddenly be on its way to being illegal. | |

It was nice while it lasted… After a brief respite in the second half of May, the bear market is back. The S&P 500 and Nasdaq 100 have now been down in nine of the last 10 weeks, and the Dow‘s in similar shape. Perhaps the worst aspect of all is that there’s nowhere to hide. Stocks are down, but so are bonds, gold and cryptocurrencies. Considering inflation is clocking its highest readings in four decades, cash itself is looking suspect. We understand the “why.” If a rising tide lifts all boats, a falling tide will have the opposite effect. Understanding what is happening is the easy part. Navigating it is trickier. But with a little discipline, it’s doable. Take a look at three rules that will keep you on target. Suggested Stories: College Enrollment Declines, but Employment Rises — What It Means 99-Rated HVAC Power Stock Beats Summer Market Heat

| Over $100 billion has been invested into this "future tech." Companies such as Toyota, Honda, Ford, even Apple and Amazon have all invested big. What are these auto and tech companies up to? It's this. A tech that could trigger a $7 trillion market by 2050. It's set to grow 63,000% ... this decade alone. | |

|

2002: 2002 MN, a 73-meter Apollo asteroid, narrowly missed Earth. The asteroid flew within 74,000 miles of our planet (roughly one-third the distance to the moon). | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment