| When it comes to dividends, 5% is a decent yield. It’s high enough to get your attention, but it doesn’t seem unsustainable.

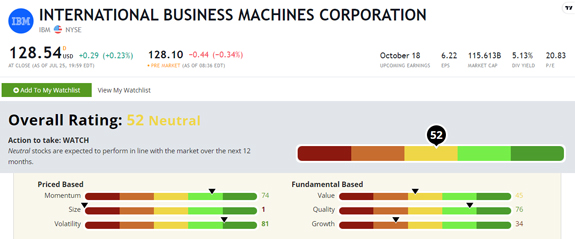

All the same, there’s one popular household name yielding 5% you should avoid: Big Blue itself, International Business Machines Corp. (NYSE: IBM).

I wrote a bearish piece on IBM a little over a year ago, and since then shares are down about 10%.

That might not sound all that bad given market conditions in 2022.

But many of the stocks that are down this year will recover and hit new highs in the future. I can't say the same for IBM.

Click here to see why.

Suggested Stories: More Investors = More Growth for One “Strong Bullish” Trading Platform

Beat the Recession AND Inflation With This “3D” Portfolio (Yields 8%)

| In this market...

There's only ONE STOCK (priced at just under $2) that could be $20 and STILL be a bargain.

It brought in more income — including equity sales — in the last 12 months than Disney, Square or Tesla.

But a key announcement in August could send this stock rocketing skyward (and you could miss your chance ... FOREVER). | |

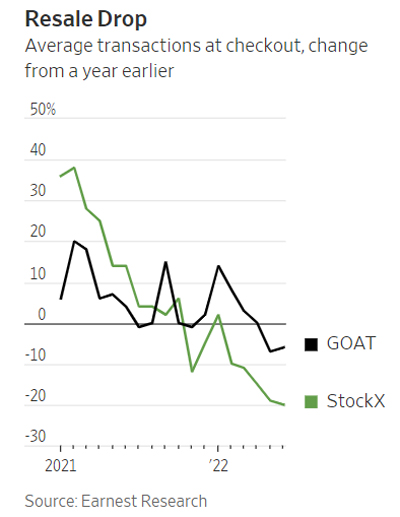

Chart of the Day Investors sometimes believe prices can only go up.

In the 1960s, this led to one-decision stocks. These were a group of about 50 stocks that were so good that the investor only needed to decide to buy.

The companies were disrupting their markets and would deliver large gains to investors.

Dubbed the “Nifty Fifty,” the companies included American Express Company (NYSE: AXP), Walmart Inc. (NYSE: WMT) and Walt Disney Co. (NYSE: DIS). The list also included Schlitz Brewing, Kresge (aka Kmart) discount stores and Revlon.

As investors learned, stocks can move down as well as up.

And they are now learning the same lesson in an unexpected market.  P.S. I developed a strategy that’s ideal for this environment. It benefits from price rallies and declines.

Back testing this strategy produced a 43,000% return over seven years!

To see the life-changing strategy I developed, sign up and tune in today at 8 p.m. Eastern.

As soon as you sign up for my free presentation, you can see the controversial asset at the center of my strategy — as well as tons of content on why NOW is the perfect time to start trading it. Suggested Stories: One Chart Explains Crypto’s Rise and Fall … and What’s Next

In Bear Markets, Buy What's Working

| Experts predict this one crypto will soar 7,200% by the end of the decade … and grow 20X bigger than bitcoin. But you must get in before its big upgrade. | |

|

1971: Merrill Lynch went public on the NYSE at $38.25 per share. At the time, it was a multinational corporation operating in over 40 countries and carried over $1.8 trillion in client assets. The company’s reputation was tumultuous before Bank of America bought it for $50 billion in 2008. It is now a branch of Bank of America rebranded as Merrill. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | | |

Post a Comment

Post a Comment