| There’s always a bull market somewhere…

I know that.

I ran a specialized hedge fund for institutional clients, where I traded more than 50 futures contracts spanning the stocks, bonds, commodities and currencies asset classes … using a trend model I developed.

So I can tell you: There is always a bull market somewhere.

If investors are dumping Apple stock, they might roll the proceeds into Microsoft.

Or if they’re shedding tech stocks in general, they might scoop up financials or utilities. When it gets nasty, they might sell out of stocks altogether and buy bonds or just stay in cold hard cash.

Yes, you can have a bull market even in cash. If you think that sounds crazy, consider that the Invesco DB US Dollar Index Bullish Fund (NYSE: UUP), which tracks the U.S. dollar relative to a basket of other currencies, is up more than 10% this year.

I pondered this while reviewing my latest Leaders & Laggards Board — my high-level analysis of the 11 major sectors that make up the S&P 500. I publish this every week for my subscribers in Green Zone Fortunes.

Click here to see what the L&L board says about the energy sector — along with the other 10 sectors — now. Suggested Stories: EV Mega Trend Gives Cobalt Power Stock New Momentum

Use Trend Rules to Get Ahead as Volatility Rages On

| As the world suffers an oil shock … and gas prices rip higher…

One tiny company could have the answer to the global energy crisis. It’s using AI to crack open the largest untapped energy source on the planet … 5X larger than the biggest oil field on Earth. | |

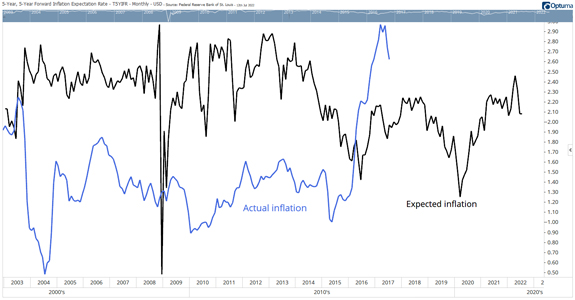

Chart of the Day It's now a joke among analysts.

As inflation rose in 2021, Federal Reserve Chair Jerome Powell insisted the price pressures were transitory.

In his defense, supply chains weren't functioning normally when the economy reopened.

With inflation now at painful levels, traders think Powell may be right.  Suggested Stories: Have Electric Vehicles Taken Over Your Garage Yet?

Gas Prices Are Down — but Not for Long

| Wired magazine is saying this small company “could be the [next] Intel”…

And it’s easy to see why.

They’re both microchip companies.

They’re both from Silicon Valley.

And in a few years’ time, they could BOTH be in the stock market Hall of Fame…

The only difference is this new company is at the start of its journey … with most of its profit potential still to be realized… Intrigued? | |

|

1968: Robert Noyce, a physicist, and Gordon Moore, a chemist known for “Moore’s law,” founded Intel with $2.5 million in capital. The two men brought their strong commitment to research and development to the company. Intel introduced the world to the microprocessor, the microchip and other innovative technologies. Today, the company is worth $159 billion! | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | | |

Post a Comment

Post a Comment