| Back in January, I wrote about how value stocks were making a comeback after years of growth stock domination.

Growth and tech stocks are coming back into favor after the massive sell-off, but I think we can find plenty of potential in certain high-value plays … like the one I featured in my original write-up.

And my Stock Power Ratings system helps prove that. When I first wrote about this stock, it rated a respectable and “Bullish” 70 in my proprietary system.

Thanks to months of sustained momentum, the stock now rates a “Strong Bullish” 96! If you bought back in January, you’re up around 30% — and my system shows it isn’t done.

Click here to read more about this stock’s improved rating.

Suggested Stories: Deep-Value Gas Station Power Stock on the Road to More Gains

We Turned 2022’s Max Pessimism Into Profits (221% ... 36% ... 23% ... and More!)

| There’s a little-known way Trump could — one day — have his revenge.

It involves a federal ruling he oversaw in the final year of his presidency that could change America forever … unleash an estimated $15.1 trillion in new wealth … and create countless ways for everyday Americans to benefit.

What is this little-understood decision? And how will it impact you? | |

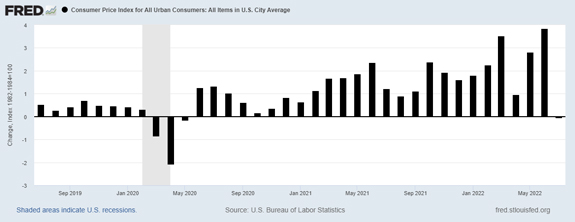

Chart of the Day Investors hailed last week’s Consumer Price Index (CPI) report as proof that the worst of inflation is behind us.

The index increased 8.5% in July from the same month a year ago, down from 9.1% in June.

Wall Street celebrated by pushing stock prices up.

I dug into the numbers. There does seem to be a reason to celebrate.

But today's chart shows we might want to hold off for now.  Suggested Stories: Cannabis REIT Targets Promising New Market

Wayfair & Big Lots’ Stocks Teach Lucrative Lesson

| Experts believe this new tech will create more wealth than all the fortunes of the last 150 years combined. That’s why the world’s richest men and even the United States Senate approved throwing hundreds of BILLIONS of dollars into this new technology… And right now, there’s a little-known stock at the center of all the action.

In fact, this small-cap stock is still trading for less than it costs to buy a tank of gas. | |

|

1971: Inflation almost reached 6%. To counter this rise, President Richard Nixon issued an executive order that froze wages, prices and rents for 90 days. It seemed promising, as the stock market soared. In the end, the freeze failed. By 1975, inflation was running at over 11% and reached 13% by 1980. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | | |

Post a Comment

Post a Comment