| Well, that was nasty.

In case you missed it, Bed Bath & Beyond Inc. (Nasdaq: BBBY) had a rough time last week. The stock lost almost 20% of its value on Thursday … and then proceeded to drop another 44% in after-hours trading.

By Friday’s close, BBBY was 60% lower than its Tuesday peak.

Neither a bad earnings release nor negative guidance tanked the stock. The retailer’s woes have been common knowledge for years.

No, it was news that activist investor and GameStop Chair Ryan Cohen had liquidated his large position in the company after purchasing more than 7 million shares earlier this year.

BBBY is the latest meme stock to face a reckoning, but it won’t be the last.

Click here for my take on meme stocks and two tips if you do want to trade them. Suggested Stories: Massive Texas Migration a Boon for High-Value Rental REIT

Poll: How Much Do You Invest in Real Estate?

| Hedge funds, venture capitalists, billionaires and Wall Street love this one crypto. It’s not bitcoin — it’s a coin that experts say will be 20X bigger. | |

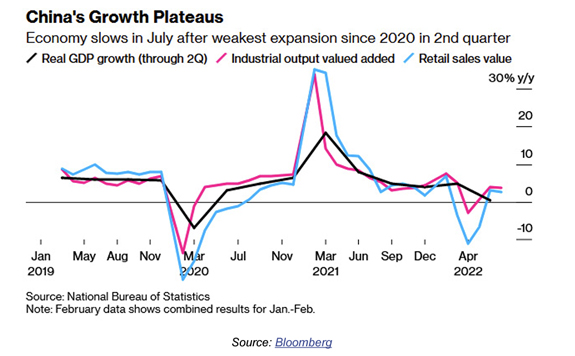

Chart of the Day China’s economy is slowing.

Its gross domestic product (GDP) grew 2.5% in the first half of 2022.

That’s well below the government’s target of 5.5%.

It appears that economic growth might be even lower, according to recent data.

See what question the chart below raises, and why it's a good sign for U.S. stocks.  Suggested Stories: The Fed’s Economic Indicator Spots Room for Growth

How Midterms Will Change the Cannabis Market + 3 Stocks to Watch

| Has President Biden’s new executive order…

Alongside MIT, 77 global governments, the Gates Foundation, UNICEF and the Clinton Development Initiative…

Ignited a historic $40 trillion transfer of wealth from the middle class to the rich?

One of the nation’s leading economists (Nomi Prins) has traveled to Delray Beach, Florida, to uncover exactly what’s happening and what this means for your money. | |

|

1902: After Henry Ford and investors couldn’t find common ground on where to take the Henry Ford Company’s next model, the latter formed the Cadillac Motor Company. This explains why the first model of the Cadillac looked so similar to Ford's Model A. Cadillac was already considered a luxury brand when auto giant General Motors (NYSE: GM) purchased the company seven years later. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | | |

Post a Comment

Post a Comment