| I’ve pitted bonds against dividends a lot in the past few weeks. Let’s hit on reinvestment risk as you hunt for stability while major indexes rise and fall.

I’m not the biggest fan of bonds.

Sure, they have their place. If you’re in or near retirement, it’s hard not to allocate at least a portion of your portfolio to bonds.

But for income production, bonds have major shortcomings.

Click here to see why reinvestment is one of them. Suggested Stories: Return to Office a Boon for “Strong Bullish” American Supplier

Proposed Bill Boosted Energy Storage Stocks — Get Ready for More Gains

| The next two years could be “rough for investors.”

But this top 20 living economist says 3 stocks could 10X ... thanks to Biden’s bungling. | |

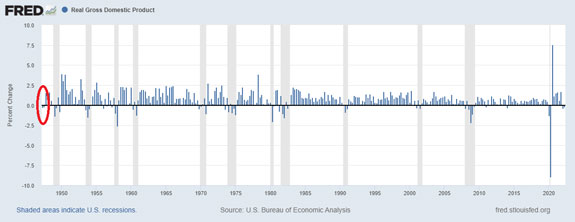

Chart of the Day It seems analysts and politicians always find something new to argue about.

This time, it's the recession definition.

The informal recession definition has always been two consecutive quarters of contraction in gross domestic product (GDP).

Now that we've had two such quarters, many analysts say we're in a recession.

Economists and policymakers in the White House disagree.

They highlight strong employment data as proof we aren't in recession.

Check out today’s chart to see why it's time to consider more data when defining a recession.  Suggested Stories: Don’t Hold and Hope — Trade Bitcoin Instead

Natural Gas Demand Won’t Cool Off — Profit With a Power Stock

| This 30-year market technician and former NSA cryptographer has a startling message for everyday Americans:

“STOP BUYING BITCOIN!”

He’s NEVER owned bitcoin … and doesn’t plan on it.

He says it’s about as useful as a “neutered stud”…

But that won’t stop him from making a BOATLOAD of money on it.

You see, this man created a bitcoin trading system that did 5 times better than buy-and-holders over a seven-year back test — while reducing the risk by 80%.

And now, thanks to a recent SEC decision, this trading system just kicked into overdrive. | |

Stock Power Ratings Managing Editor’s Note: We ran into some web issues yesterday afternoon that may have prevented you from accessing our content. You can get caught up by reading Matt’s weekly Stock Power Ratings story below. To find more analysis like this, be sure to check your inbox each weekday morning for his Stock Power Daily. — Chad Stone, Managing Editor, Money & Markets

I wouldn’t call every company boasting big gains sexy.

They don’t all tap into artificial intelligence or find the cures for diseases.

Some are just run-of-the-mill companies that have perfected their businesses over the years.

And the stock I have for you today fits that bill.

Using Chief Investment Strategist Adam O’Dell’s proprietary six-factor Stock Power Ratings system, I found a “Strong Bullish” company that manufactures business supplies like labels and envelopes: - It pays its shareholders a 4.58% dividend yield.

- The stock jumped up 32% since the middle of June.

- It’s in the top 2% of all the stocks we rate.

Check out why the business supply stock I share with you will continue its strong performance in 2022 and beyond.

|

2004: NASA launched the Messenger on a planned six-and-a-half-year journey to the planet Mercury. The Messenger had plenty to deliver by the time it crashed onto Mercury’s surface on April 30, 2015. The misguided spacecraft sent NASA over 270,000 pictures from its journey — all new research on the first planet in our solar system. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | | |

Post a Comment

Post a Comment