| Are we in a recession?

If you go by the technical definition many economists and analysts use, yes.

Gross domestic product (GDP) shrank in both the first and second quarters. Output contracted 1.6% in the first quarter and 0.9% in the second quarter.

Without a sharp revision (which is unusual), we are in a recession.

Good to know!

As investors, what does that mean?

Click here to see why it’s natural to fear a recession — but it shouldn’t stop you from profiting now. Suggested Stories: My Airline Debacle Reminded Me: Optimized Portfolios Aren’t Risk-Free!

Reinvestment Risk: Another Win for Dividends vs. Bonds

| Has President Biden’s new executive order…

Alongside MIT, 77 global governments, the Gates Foundation, UNICEF and the Clinton Development Initiative…

Ignited a historic $40 trillion transfer of wealth from the middle class to the rich?

One of the nation’s leading economists (Nomi Prins) has traveled to Delray Beach, Florida, to uncover exactly what’s happening and what this means for your money. | |

Marijuana Market Update By: Matt Clark, Research Analyst Cannabis earnings season just kicked off.

Some of the biggest industry names are reporting quarterly numbers soon.

How does inflation affect those profits?

Check out my latest Marijuana Market Update to find out.  Suggested Stories: Return to Office a Boon for “Strong Bullish” American Supplier

Proposed Bill Boosted Energy Storage Stocks — Get Ready for More Gains

| On September 21, 2022, Washington may make its ugliest move yet.

It could lay the groundwork for outlawing cash.

For some, it could mean tremendous prosperity. For others ... the pain could be severe. | |

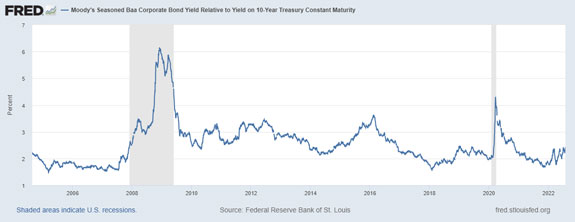

Chart of the Day Books on technical analysis define an uptrend as a series of higher highs and higher lows.

This chart pattern indicates prices are moving higher on each leg up, and selling is easing earlier in the legs down.

It’s a useful definition that you can apply to any data set.

Take a look at today’s chart to see what a certain bond spread says about a recession.  Suggested Stories: White House, Fed Clash on Recession Definition — Why This Matters

Don’t Hold and Hope — Trade Bitcoin Instead

|

1997: President Bill Clinton signed the Taxpayer Relief Act of 1997. It included Senator Bob Packwood and Senator William Roth’s provision that allowed Americans to save taxed income in a new way. You might know it better as the Roth IRA, named after its chief legislative sponsor. In 2020, 45.4 million Americans (35% of households) owned Roth IRAs. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | | |

Post a Comment

Post a Comment