| The financial press is talking about the dreaded inverted yield curve again.

And maybe you’re wondering: What the heck is a yield curve?!

Every time it comes up, the person discussing it seems so serious.

Well, let’s talk about that.

Here’s everything you need to know about an inverted yield curve and why it matters in your investing journey.

Let’s start with the basics.

| One of the absolute best income plays right now pays an incredible 10% monthly dividend... Yet few people even know that it exists. In fact, Chief Investment Strategist Brett Owens is so excited about it that he's made it a core holding in his exclusive "7% Monthly Payer" portfolio — an easy-to-buy collection of stocks and funds that could hand you $3,000+ in dividend payouts every single month! | |

The Yield Curve It’s simple.

If you graph out the current yields on U.S. Treasury bonds of assorted maturities … you have a yield curve!

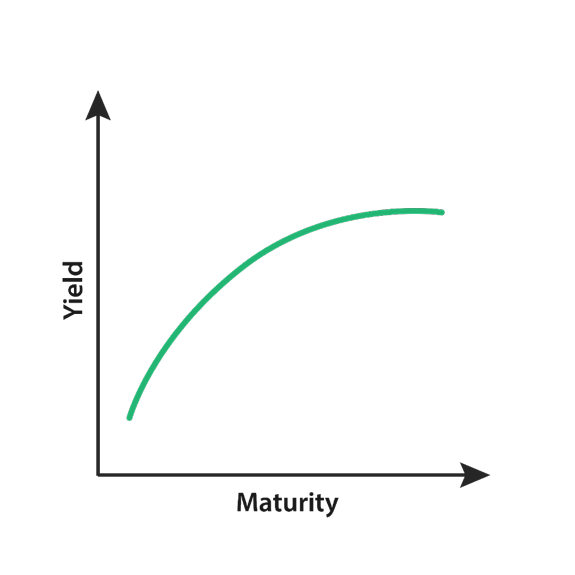

Most representations of the yield curve start at 30 days and go out to 30 years, representing the full range of bonds issued by the U.S. Treasury: A Simple Yield Curve  In a “normal” world, the curve slants upward.

Shorter-term rates are lower than longer-term rates.

You see this at your local bank: In most cases, long-term certificates of deposit (CDs) come with higher yields than their shorter-term counterparts.

And a 30-year mortgage rate is going to be higher than a 15-year mortgage rate.

The reasoning is simple: The longer the time to maturity, the less certainty there is, and that translates to more risk.

The higher interest rate is a way of compensating for that risk.

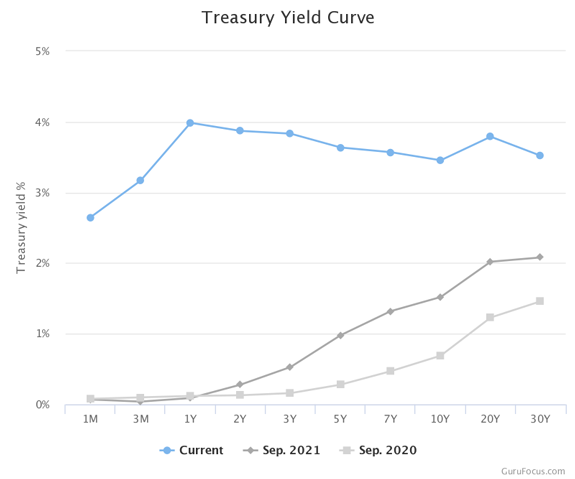

That’s not the situation we see today. Why Yield Curves Flip The yield curve is inverted, which means that shorter-term rates are now higher than longer-term rates.

It’s important to remember there’s no right or wrong way to define yield curve inversion. And analysts can pick and choose what rates they look at.

Some analysts compare the 10-year rate to the 2-year rate. Others swear by the difference between the 30-year rate and the 2-year rate or the 30-year and 5-year as better comparisons.

Either way, it’s the same story.

The market is pricing longer-term rates lower than shorter-term ones.

| In 2019, this man wrote a book called Aftermath that shocked the world by predicting that: “Something on the scale of a global pandemic will be the cause of the next financial crisis.”

And that “it will happen with 100% certainty” in the next few years.

Just four months later, we had the first reported case of the coronavirus.

Now he’s back with another bone-chilling prediction.

A prediction that’s already starting to come true.

A prediction I’m urging you to watch right away.

Because if what he says is true, within days this single event will have a profound effect on your retirement assets, your bank accounts and your entire way of life. Warning: What you’re about to see is a REAL exclusive interview with a former CIA and Pentagon insider. The content herein is NOT for the faint of heart. | |

Why Are We Seeing Inverted Yield Curves Now? There are a couple explanations.

To start, the Federal Reserve tends to focus on its short-term overnight fed funds rate.

The Fed can buy or sell longer-term bonds too. It did quite a lot of that following the 2008 meltdown and again during the pandemic.

The terms for this are “quantitative easing” or “quantitative tightening.”

But at the moment, the Fed is concentrating its tightening efforts on the short-term fed funds rate.

That’s reflected on the shorter-term end of the yield curve.

But at a fundamental level, it comes down to supply and demand.

When demand outstrips supply, prices rise and yields fall.

So when we see the 30-year bond yielding less than the 1- or 2-year note, we know investors are gobbling up every 30-year bond they can find.

That’s the situation we see today.

The 1-year Treasury’s rate is sitting at 4%, about half a percent higher than the 30-year’s.  (Click here to view larger image.) When investors push long-term yields below short-term yields, it tends to mean one thing.

They’re scared.

An inverted yield curve is a sign of market distress, and investors are pricing in slower growth and lower inflation ahead.

Over time, an inverted yield curve has been a reliable predictor of recessions.

It’s a little ambiguous as to whether the inverted curve predicts recessions or causes them.

Investor fear leads companies to cut back on spending and investing, thus created a self-fulfilling prophecy.

I’d argue the inverted yield curve is playing both sides of that debate right now.

Key takeaway: The bond market is flashing major warning signs.

This doesn’t mean you need to sell everything and run for the hills.

But it does mean that you need to think in a more defensive way, keep your position sizes modest and review your stop-losses.

It also helps to focus on mega trends.

In Green Zone Fortunes, momentum is one of the six critical factors we consider when recommending stocks.

We like to identify profitable trends that are in place and ride them higher, irrespective of what the market is doing.

Right now, the market is favoring high-yield dividend stocks. That’s where we’re seeing some of the best momentum.

In the September issue, I recommend one of my favorite income stocks. It yields 7% and has raised its payout for 24 consecutive years and counting.

And you can see how to access that ticker, along with everything you need to reinforce your income portfolio by clicking here. To safe profits,

Charles Sizemore, Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business. Suggested Stories: Not Every Future-Proof Dividend Is a Buy Now (Avoid One Tech REIT!)

Top-Rated Egg Stock Climbs Higher as Market Falls

|

1994: “The One Where the First Episode Aired”: The beloved sitcom Friends premiered on NBC. The show followed the coming-of-age of six 20-somethings and captured the hearts of American audiences. The show ran for 10 seasons, won six Emmys and produced an iconic theme song. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment