| Managing Editor’s Note: The Money & Markets team works hard to find fantastic stocks for any market. Below you’ll find stories from Matt and Charles featuring stocks that are up big over the last month.

— Chad Stone

| | | With a station on every corner, I can afford to be picky when it comes to where I get my gas.

Because gas prices don’t fluctuate much between different stations, I look to the products sold inside to determine my patronage.

From the drinks they sell to the snacks and food they offer … it all goes into where I decide to spend my money.  (Click here to view larger image.) According to the U.S. Census Bureau, gas stations raked in $399.7 billion in 2020.

By 2024, revenue is projected to reach $483.2 billion — a 21% increase!

And this Power Stock is well set to profit off that growth. Suggested Stories: Where to Invest After Tech Stock Bust 2.0

Midterms, Big Bets and the Used Car Market Collapse

| If you thought inflation was the biggest threat to your retirement this year, think again. There is a ticking time bomb hidden within most American retirement accounts … with the power to “delete” up to 70% of your retirement savings. My new video exposes this hidden threat. | |

Dividend of the Week If you’re looking for a solid 6% yield and a payout that should keep up with inflation in the years ahead, look no further than telecom stalwart AT&T Inc. (NYSE: T).

AT&T is one of the oldest companies in the S&P 500, tracing its origins to Alexander Graham Bell’s invention of the telephone in 1876.

But the AT&T we know today is a product of two previous market mega trends: - A wave of consolidations in the late 1990s.

- And the birth of the mobile internet in the mid-2000s.

Despite the company’s long history, in recent years it acts more like a teenager that doesn’t know what it wants to be when it grows up.

Management fought tooth and nail to acquire Time Warner in 2018 with the goal of becoming a media content empire … only to spin off its media assets three years later.

This returned AT&T to its roots as a communications utility.

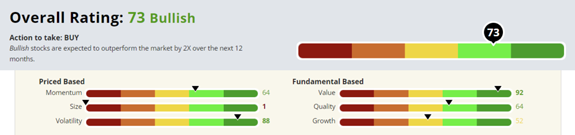

After a rocky few years, it looks like T stock’s bullish turnaround is underway.

Click here to see why.  Suggested Stories: Tales of an IPO Dropout: What the 2000s Tech Stock Crash Taught Me

Why Liquidity Is the Fed’s Latest Worry Beyond Inflation

| Take a look at this image of the Bloomberg Billionaires Index…

The four men circled here have a combined net worth of over $600 billion.

And right now, they have ONE thing in common.

They’re all throwing their weight behind a new technology I call “Imperium.”

Musk says Imperium is “amazing” … Gates says it will be “one of the most powerful technologies of the 21st century” … and Bezos and Zuckerberg are invested to the tune of billions of dollars combined.

Want to know why? | |

|

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | | |

Post a Comment

Post a Comment