| Charles argues for a dividend stalwart below, but he’ll be back tomorrow with his take on “dot-com crash 2.0” and the future of tech stocks. What do you think? Is this another 2000s bubble — or worse? Reach out to Feedback@MoneyandMarkets.com with your ideas.

— Chad Stone, Managing Editor, Money & Markets

| | | If you’re looking for a solid 6% yield and a payout that should keep up with inflation in the years ahead, look no further than telecom stalwart AT&T Inc. (NYSE: T).

AT&T is one of the oldest companies in the S&P 500, tracing its origins to Alexander Graham Bell’s invention of the telephone in 1876.

But the AT&T we know today is a product of two previous market mega trends: - A wave of consolidations in the late 1990s.

- And the birth of the mobile internet in the mid-2000s.

Despite the company’s long history, in recent years it acts more like a teenager that doesn’t know what it wants to be when it grows up.

Management fought tooth and nail to acquire Time Warner in 2018 with the goal of becoming a media content empire … only to spin off its media assets three years later.

This returned AT&T to its roots as a communications utility.

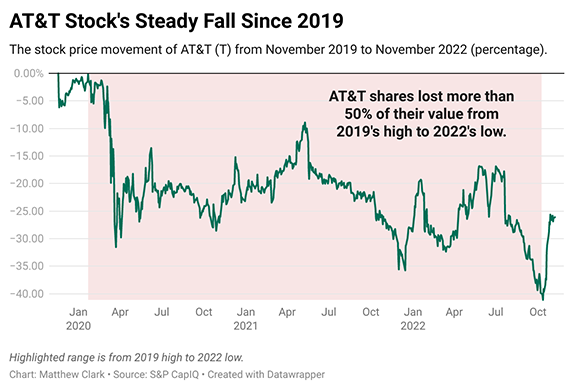

After a rocky few years (see below), it looks like T stock’s bullish turnaround is underway.

Click here to see why.

(Click here to view larger image.) Suggested Stories: Dot-Com Crash 2.0? What’s Next for Tech Stocks

No. 1 Investing Takeaway for the Midterm Elections

| It’s not a Big Oil stock… In fact, it’s beating Big Oil at their own game.

Get the full story on a tiny, under-the-radar company selling for less than $20. | |

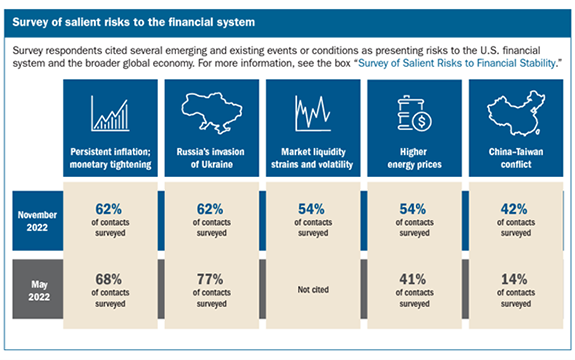

Chart of the Day Federal Reserve officials have been fighting inflation since March.

Inflation was rising for a year before the Fed acted because economists believed higher prices were transitory.

They thought supply chain issues would resolve quickly and the economy would soon return to normal.

But the Fed was wrong.

We’ll never know if earlier action could have minimized the pain of inflation. We do know inflation may continue well into next year.

Once again, the Fed has a chance to act before things get worse.

This time traders are warning the Fed that market liquidity is a concern.

(Click here to view larger image.) Suggested Stories: 11% Payout Is the Perfect Way to “Go on Offense” in ’23

Could Defense Be the Biggest Winner Post-Midterm Elections?

| It’s currently dominating Tesla in the trillion-dollar race to roll out energy storage technology…

Yet this tiny Silicon Valley company is valued at just $2 billion.

That’s almost 50X less than Tesla…

Yet, let me repeat, it’s leading Musk’s company in energy storage…

Frankly, I believe this stock is absurdly underpriced … and it won’t take the market long to realize it… | |

|

1984: Can’t sleep? That was understandable after American horror moviegoers met a new villain named Freddy Krueger. Wes Craven released A Nightmare on Elm Street in theaters, and the successful movie led to several spinoffs and sequels. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | | |

Post a Comment

Post a Comment