| I had no idea Americans had so much debt.

A Federal Reserve report shows how much we owe … and it’s a pretty lofty total.

Today, I dive into our debt crisis, the FTX/crypto debacle and share some other items that caught my attention this week.

If you have ideas on any analysis you’d like to see, drop me an email at Feedback@MoneyAndMarkets.com.

Keep scrolling to read on.

| Wealthy entrepreneur says after watching crypto the exchange go bust, U.K. pension system crisis and many stocks fall by 95%, here's what coming next… | |

We Owe How Much??? Every quarter, the Federal Reserve Bank of New York looks at just how much Americans are in debt.

After the third-quarter release this week, I can tell you … it’s a lot.

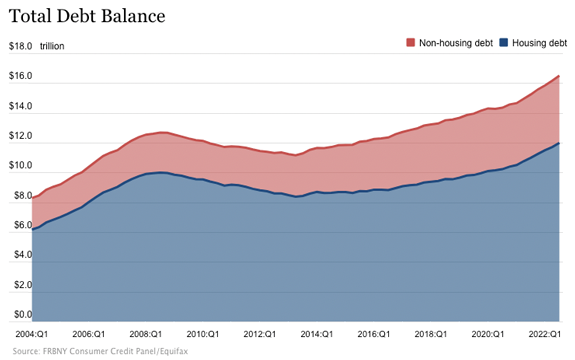

The report looks at both housing (mortgages) and nonhousing (credit cards and auto loans) debt:  (Click here to view larger image.) Total household debt jumped $351 billion, or 2.2%, from July 2022 to September 2022. - Household debt rose $282 billion.

- Nonhousehold debt climbed $69 billion.

Debt increased 15% across the board — the fastest pace in 15 years. Both mortgage balances and credit card usage exploded.

Total debt hit $16.5 trillion — up 8.3% year over year.

As I said, we owe a lot.

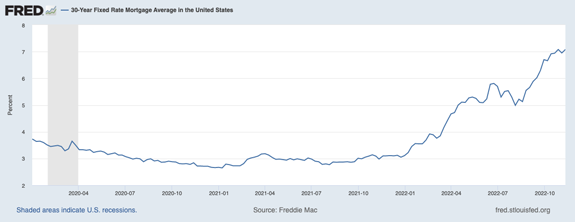

What they said: “Credit card, mortgage and auto loan balances continue to increase in the third quarter of 2022 reflecting a combination of robust consumer demand and higher prices. However, new mortgage originations have slowed to pre-pandemic levels amid rising interest rates.”

— Donghoon Lee, New York Fed economic research advisor.

Yes, but … while credit card usage is on the rise, so are delinquencies.

Researchers noted that, despite a higher number of Americans not paying their bills, the number is still low by historical standards.

Inside the numbers: - The good … student loan debt was lower at $1.57 trillion (thanks to a long forbearance period).

- The bad … auto loan balances were up to $1.52 trillion. (Cars are more expensive.)

- The ugly … interest rates on 30-year fixed mortgages are above 7%. (Last year, rates were just above 3%.)

(Click here to view larger image.) It’s not that Americans are spending frivolously … inflation and subsequent interest rate hikes are making things more expensive.

Because I can’t not mention it: Click here to read my take on the crypto and FTX debacle.

Editor’s Note: We’re switching things up a bit to focus on more ways to show you how powerful Adam O’Dell’s proprietary Stock Power Ratings is. Starting on Monday, you’ll find everything you need in our Stock Power Daily. Research Analyst Matt Clark will give you a top-rated stock each weekday, and we’ll continue to feature insights from Adam and the rest of the team. It’ll just be a more streamlined daily newsletter (and fewer emails in your inbox!). — Chad Stone, Managing Editor, Money & Markets Suggested Stories: Top 3 Energy Stocks to Buy Now

Fat 10% Yield With Major Bear Market Upside

| Take a good look at this building. This is the command center for one of the most devastating plots in American history. A plot that could make the money in your wallet worthless ... and “give federal officials FULL CONTROL over the money going into, and coming out of, every person’s account.” And that’s just the tip of the iceberg. | |

|

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment