| By this time next week, we should know what the next phase of the U.S. government will look like after Tuesday’s midterm elections.

My colleagues Matt Clark and Charles Sizemore each took their turn handicapping the potential winners… Market winners, that is.

Matt explained that the stock market as a whole tends to perform well under gridlock.

When a Democratic president is in the White House and Republicans control at least one half of Congress, the S&P 500 has returned a healthy 13%. Investors are comfortable with a middle-of-the-road, divided government that can’t push too far in either direction.

Charles discussed the outlook for the bond market.

The last time we had a Democratic president and Republican Congress was during Barack Obama’s presidency. And that was about the most dysfunctional our government has ever been, with perpetual fights over the debt ceiling and government shutdowns.

But one benefit of that chaos was that it kept a lid of sorts on government spending and helped to shrink the budget deficit. If we get a repeat of that going forward, it should be good for bonds.

Today, I want to dig deeper into a specific sector that may benefit from Tuesday’s outcome.

Click here to see my Stock Power Ratings x-ray of 10 stocks in the sector.

Is there a sector you think will end up winning big after Tuesday’s outcome? Email us at Feedback@MoneyandMarkets.com to let us know what you think! Suggested Stories: Midterm Prep Part 2: One Asset Thrives Amid Political Gridlock

Duo the Unhinged (and Unprofitable) Mascot: DUOL Stock Analysis

| In this market...

There's only ONE STOCK (priced at just under $2) that could be $20 and STILL be a bargain.

It brought in more income — including equity sales — in the last 12 months than Disney, Square or Tesla.

But a key announcement in December could send this stock rocketing skyward (and you could miss your chance ... FOREVER). | |

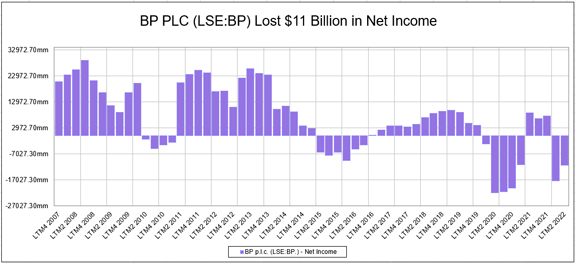

Chart of the Day The headline was attention-grabbing:

“BP rakes in quarterly profit of $8.2 billion as oil majors post another round of bumper earnings.”

CNBC was reporting on BP PLC’s (NYSE: BP) third-quarter earnings.

A profit of more than $8 billion in just three months sounds like a lot of money.

In the quarter, BP wasn’t the oil company to make money: - Shell posted a quarterly profit of $9.5 billion.

- Chevron earned $11.2 billion.

- Exxon reported a profit of $19.7 billion.

The eye-popping numbers caught the attention of investors and politicians.

Here’s why.  Suggested Stories: Investors Flee Into Money Market Funds — What That Means for Stocks

Dividend Compounding: The Eighth Wonder of the World

| You need to watch this video as soon as you can…

Because in the first 30 seconds, you’ll discover a little-known technology that’s set to drive the greatest investing mega trend in history.

I call the technology “Imperium.”

It’s something that only nerds and science geeks know about right now…

Yet according to experts, Imperium is set to go from 1 million users … to having 2 BILLION in the next four years … launching a stock market “gravy train” that almost nobody sees coming… | |

|

2008: Yes, we can! Democrat Barack Obama made history by winning the U.S. presidential election. He was the first African American to lead the country, and his presidency lasted two terms. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | | |

Post a Comment

Post a Comment