| Research Analyst Matt Clark showed you how next week’s midterm elections could shake up markets in yesterday’s Money & Markets Daily. Is he on to something? Email Feedback@MoneyandMarkets.com with your own take. And check back later this week for more insights into what’s coming for stocks after polls close next Tuesday.

— Chad Stone, Managing Editor, Money & Markets

| | | Some attribute the following quote to Albert Einstein:

”Compound interest was the eighth wonder of the world.”

No one can pinpoint the place or time he said it, and the first report of the quote came in a New York Times blurb nearly 30 years after his death.

Still, I like to imagine the world’s greatest physicist sitting at some dive bar in New York with a massive beer mug in front of him, explaining the virtues of compound interest in his thick German accent to the confused shmuck sitting next to him.

At any rate, you may already have a good idea about how compound interest works.

But click here to see how dividend compounding takes it to another level. Suggested Stories: Potential Political Gridlock: What Midterms Mean for Markets

Small-Cap Stocks Are Set to Soar in the Next Bull Market

| Ph.D. economist: “Don't bet on it.”

According to former Goldman Sachs executive Nomi Prins…

Americans who are hoping for a “return to normal” are going to be shocked when they see what happens next in America.

She says: “If you’re betting your job, savings or retirement accounts on a return to ‘normal,’ you’re about to be left behind by a brand-new crisis few see coming.” | |

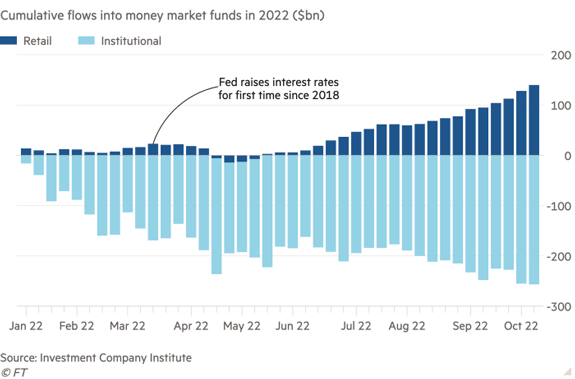

Chart of the Day Money market funds were a popular investment many (maybe not that many) years ago.

Investors held cash reserves in money market funds before interest rates fell to almost zero.

These are safe investments with a constant value of $1 per share and monthly interest payments.

Now rates are rising.

That makes money market funds more attractive.

Today’s chart shows why.  Suggested Stories: This Consumer Spending Trend Can’t Last

“Recession 2023” Game Plan (for Cheap 8.4% Dividends)

|

1976: President Jimmy Carter won the presidential election after a narrow race against Republican President Gerald R. Ford. The former governor of Georgia was the 39th president of the U.S. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | | |

Post a Comment

Post a Comment