| The Consumer Price Index number for October threw us a bone on Thursday!

The annualized inflation rate dropped to “only” 7.7% last month, which is still high by the standards of the past 40 years.

But it’s an improvement… And it was enough to send virtually everything higher. Stocks, bonds, gold … all were sharply higher on the news because maybe — just maybe! — it means the Federal Reserve is a little closer to easing its inflation fight.

Tech and growth-focused stocks rallied the hardest, as these tend to be the most sensitive to changes in interest rates.

We’ll see if this rally has legs.

In the meantime, click here to see where I think a lot of potential lies within tech-based stocks. Suggested Stories: Midterms, Big Bets and the Used Car Market Collapse

Tales of an IPO Dropout: What the 2000s Tech Stock Crash Taught Me

| Today we’re fortunate enough to sit down and interview former Goldman Sachs managing director, bestselling author and Federal Reserve expert — Nomi Prins.

Today, she’s going public to reveal what’s really happening in America.

(The hidden story, beyond: inflation, rent increases, gas, groceries, political division or a pandemic.) - Revealing why President Biden is saying a “Liberal World Order” is coming.

- Or why the elites gathered in Davos to say: “You Will Own Nothing and Be Happy.”

- Or why Ray Dalio, one of the world’s richest men, says: “No Empire Lasts Forever.”

But Nomi says this all narrows down to: "An unprecedented financial SHOCK coming to America.”

The exact reason the financial elite continue to get richer grabbing more power … all while everyday folks struggle to live their daily lives. | |

Chart of the Day Sometimes, government stimulus checks are gimmicks to buy votes.

That seemed to be the case for the third COVID check that came in March 2021. Unemployment had already fallen from 14.7% to 6% and the economy was returning to normal.

The first two rounds of payments were largely spent at restaurant delivery services, online grocery stores, online marketplaces and home improvement stores like Home Depot. It’s easier to understand the need for stimulus when the money flows show consumers were staying home.

But that changed the third time around.

Consumers spent that money at department stores buying apparel and cosmetics. Earnest Research reports that restaurants and airlines also benefited from the payments. Among the biggest beneficiaries were Peloton, Dick’s, Kohl’s, Ross, TJ Maxx, Gap and Southwest.

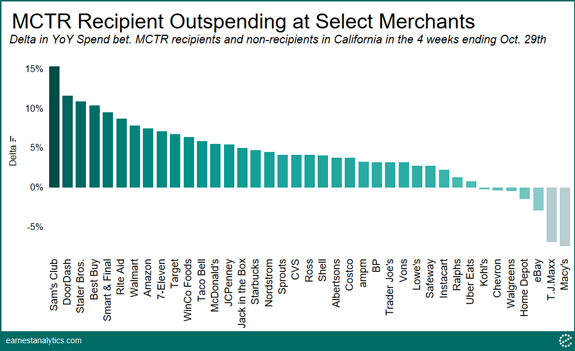

And another California inflation effort (see chart below) gave us a chance to see whether families need help again.  Suggested Stories: Tech Sell-Off Has Hammered One Music Streaming Stock (Avoid It!)

AT&T Stock: A “Bullish” Dividend Turnaround Play

| The dollar — destroyed. Inflation — run amok. Wealth — wiped out. Millions of Americans — devastated. For 10 years, Wall Street legend Ian King has been tracking a government plot that will destroy the U.S. dollar ... restrict your personal freedoms ... and send inflation soaring. | |

|

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | | |

Post a Comment

Post a Comment