| By Matthew Clark, Research Analyst Energy stocks are head and shoulders above the rest of the market.

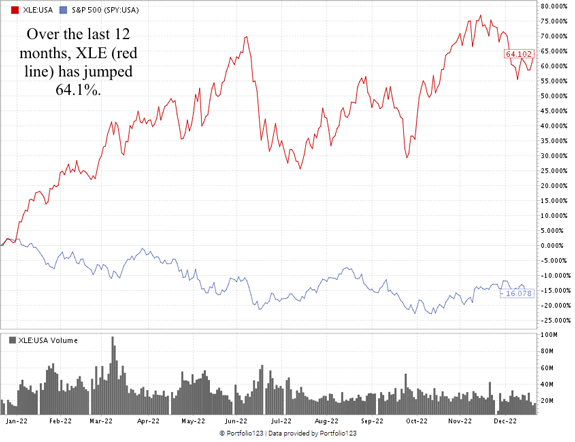

The energy sector has blown away the broader S&P 500. Just look at the chart below:  (Click here to view larger image.) The Energy Select SPDR Fund (NYSE: XLE), a fund that tracks the overall sector, is up more than 64% over the last 12 months.

The broader S&P 500 (blue line in the chart above), on the other hand, is down 16.1% over the same time.

Using Adam O’Dell’s proprietary Stock Power Ratings system, I’ve identified the five energy stocks to watch now.

1. ExxonMobil (NYSE: XOM) ExxonMobil is one of the world's largest publicly traded oil and gas companies.

The company operates in more than 70 countries and has a market capitalization of over $433 billion.

ExxonMobil is a diversified energy company, with operations in upstream, downstream and chemical businesses.

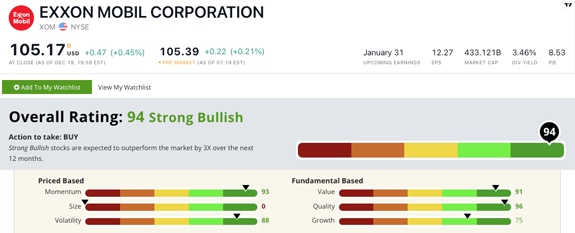

And ExxonMobil stock looks like a strong candidate for your investing in 2023.  (Click here to view larger image.) XOM scores a “Strong Bullish” 94 out of 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

It scores the highest on our quality factor.

XOM’s returns on assets, equity and investment are all higher than the integrated oil and gas industry average.

The stock is also a strong value with price-to ratios right in line with its industry peers. 2. Chevron (NYSE: CVX) Another big oil mega-cap stock is Chevron.

It operates in more than 80 countries and has a market capitalization of over $328 billion.

Chevron is also a diversified energy company, with operations in upstream, downstream and chemical businesses.

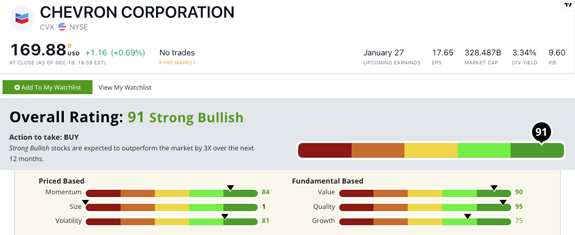

And Chevron stock mirrors XOM on many factor ratings.  (Click here to view larger image.) CVX scores a “Strong Bullish” 91 out of 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

Like XOM, Chevron earns its highest factor rating on quality.

CVX also has returns and margins right at, or slightly higher than, the industry average.

| Warren Buffett, Ray Dalio and Goldman Sachs all agree. Now’s the time to bet BIG on oil. And on December 28, Adam O’Dell will reveal the details on his No. 1 oil stock for 2023. An oil company he believes could hit 100% gains in the next 100 days. And beat the gains of Exxon, Marathon and Occidental.

Click here to save your spot now. |

3. ConocoPhillips (NYSE: COP) I’m spotting a trend here…

ConocoPhillips operates its oil and gas empire in more than 30 countries.

It’s slightly smaller, with a market capitalization over $137 billion.

ConocoPhillips focuses on exploration and production activities in both the upstream and downstream segments of the oil and gas industry.

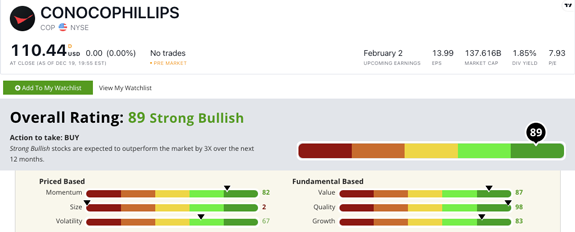

And COP stock is also “Strong Bullish.”  (Click here to view larger image.) COP scores an 89 out of 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

While scoring the highest on our quality factor, COP’s returns on assets, equity and investment are all higher than the industry average.

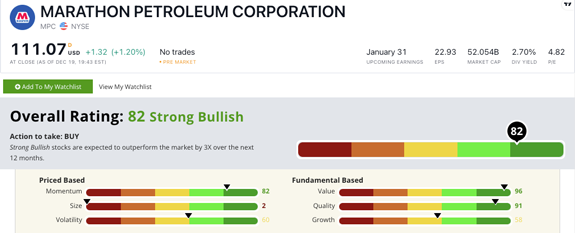

What’s more, its net and operating margins are also stronger than its industry peers. 4. Marathon Petroleum (NYSE: MPC) Keeping with the big oil trend, Marathon Petroleum is a publicly traded oil refining and marketing company with operations in the United States, Canada and the Caribbean.

The company has a market capitalization of over $51 billion.

Marathon Petroleum is one of the largest refiners in the U.S., with the capacity to process more than 2 million barrels per day.  (Click here to view larger image.) MPC scores a “Strong Bullish” 82 out of 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

Unlike the previous stocks on our list, MPC earns its highest rating on our value factor.

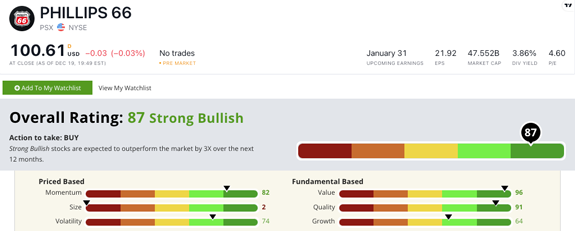

Its price-to-earnings are less than half its peer average. Its price-to-sales, book and cash flow are all lower than its downstream energy competitors. 5. Phillips 66 (NYSE: PSX) Phillips 66, with a market cap of more than $47 billion, refines oil and markets its products in the U.S., Europe, Asia and Australia.

Phillips 66 competes with Marathon on the refining front, but its capacity is at 1 million barrels per day.  (Click here to view larger image.) PSX scores a “Strong Bullish” 87 out of 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

Like MPX, Phillips 66 earns its highest factor rating on value.

PSX’s price-to-earnings, price-to-sales and price-to-book value stand well below the downstream energy industry average.

The bottom line: Energy is having a tremendous run … especially oil stocks.

All of these stocks rate well on our Stock Power Ratings system.

That’s what makes them the five energy stocks to watch now.

Of course, my colleague Adam O’Dell has something even better for you in the energy sector.

He’s targeting a super bull in oil with one stock.

And he sees it gaining 100% in 100 days once things get underway in earnest.

If you want to know why, click here to sign up for his upcoming presentation.

This is one of your last chances to sign up before he tells all on Wednesday.

So click here to add your name to his guest list now.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Check Out Our Most Recent Power Stocks: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment