| Managing Editor’s Note: You only have one more day to sign up for Adam’s “Super Oil Bull Summit.” He’s going to reveal details on the one stock he expects to soar 100% higher in only 100 days as oil charges on. So click here to sign up before his presentation at 4 p.m. Eastern tomorrow. You’ll gain access to a stack of free resources on the future of the oil market just for signing up. We can’t wait to see you at Adam’s presentation tomorrow!

— Chad Stone

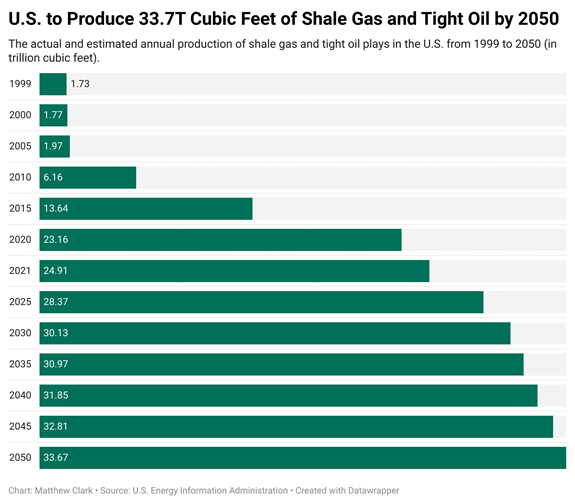

- Shale gas and tight oil are pulled from dense rock formations.

- The U.S. will produce 33.7 trillion cubic feet using this method by 2050.

- This Power Stock’s key component is used to pull oil and gas from rock formations. It rates a 93 on our proprietary system.

| The oil bull market is ramping up, and that means companies are doing whatever they can to extract oil from the ground as demand increases.

Hydraulic fracturing started in 1947 in my home state of Kansas.

The process is straightforward.

Crews shoot high-pressure liquid into rock formations to break up bedrock and reveal shale gas and tight oil in the ground.

The production of shale gas and tight oil plays in the U.S. is set to expand in a huge way over the next several decades:  (Click here to view larger image.) In 2000, the U.S. only pulled about 1.8 trillion cubic feet of oil and gas out of the ground using hydraulic fracturing.

By 2050, we will extract 33.7 trillion cubic feet this way … a 1,772.2% increase! And that’s a 35% increase from 2021’s totals.

That leads me to today’s Power Stock … a supplier of a key component used for successful hydraulic fracturing.

And I found it using Adam’s Stock Power Ratings system.

Click here to reveal the ticker now.

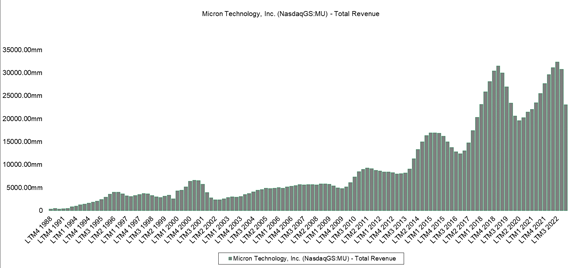

Micron's Sales Drop Forecasts Trouble Ahead Micron Technology Inc. (Nasdaq: MU) makes computer memory chips.

Its chips are in data storage systems, automobiles, consumer electronics, communications products, servers and computers. Its products are so ubiquitous, its revenue is a leading indicator of the economy.

In the quarter that ended on December 1, the company reported its revenue dropped 47% and management projected the decline would worsen to more than 50% in the next quarter. You can see the decline in the chart below. This is a steep drop, but it's not unprecedented.

Larger declines in revenue occurred when the Asian financial crisis slowed the global economy in 1997, after the tech bubble burst in 2000 and before the pandemic shut down the world in 2019. Each of those was followed by steep stock market declines.

Maybe this time is different, but it's probably not.  (Click here to view larger image.)

Check Out Our Most Recent Power Stocks: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | |

Post a Comment

Post a Comment