| Friendly reminder: Markets are closed today to observe Martin Luther King Jr. Day. But Matt still has a 100-rated Power Stock for you to consider below. Read about it so that you can add it to your portfolio when markets resume normal trading hours tomorrow!

And don’t forget! On Wednesday, at 4:00 p.m. Eastern, Matt is hosting a special Zoom call with Adam O’Dell to discuss what he sees as the biggest opportunity for 2023. Click here to add it to your calendar now. — Chad Stone, managing editor, Money & Markets

- Banks today offer customers the same traditional services: checking, savings, loans and more.

- Smart investors look deeper to find that “secret sauce” that makes a bank stock investable.

- Today's Power Stock is a Pennsylvania-based bank that’s been around since 1870. It rates a 100 on our proprietary system.

| Banks, large and small, offer the same services to customers: - Checking and savings accounts.

- Personal and business loans.

- Credit and debit cards.

Looking at the surface level, it’s hard to tell one bank from another.

You need to look deeper at a bank’s profitability and assets to determine if it’s a good investment.

One metric that captures the profitability of a bank is its net interest income.

We calculate this by subtracting interest expense (any costs related to managing loans and other interest-earning assets) from a bank’s interest income (income from anything that earns interest).

It’s like the gross profit for banks.

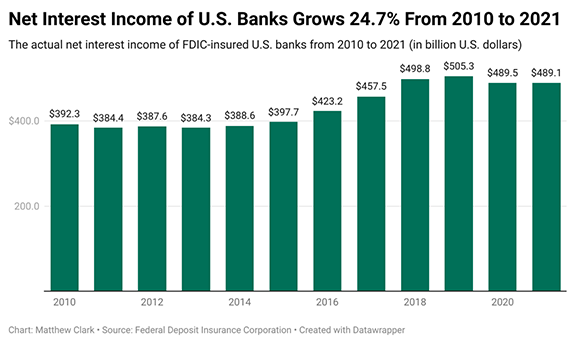

The chart below shows the net interest income of banks insured by the Federal Deposit Insurance Corporation.  (Click here to view larger image.) As you can see, banks have steadily raked in net interest income since 2010.

When I see this trend, I look to our Stock Power Ratings system to find bank stocks that stand out from the pack.

Today's Power Stock does just that.

And you can find out everything you need to buy into it now by clicking here or the button below.

| From our Partners at Banyan Hill Publishing. Goldman Sachs is saying this Next Gen Coin could overtake bitcoin. Legendary investor Cathie Wood said this same coin will surge 20X bigger.

Details here. |

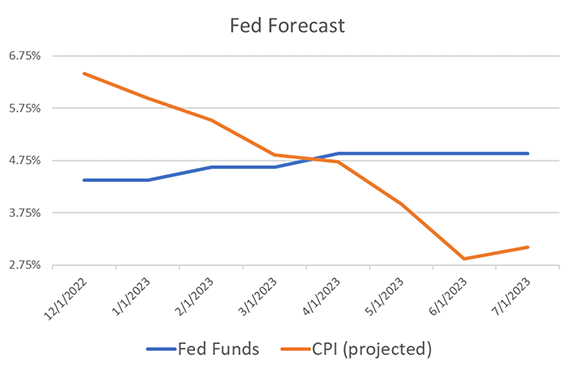

This Chart Explains Why the Fed Will Pause Soon The Federal Reserve raised interest rates seven consecutive times in 2022.

The central bank is likely to raise rates again at its first meeting in 2023 — but that hike may be smaller than previous ones.

Inflation is falling rapidly: - Over six months, inflation is less than 1%.

- Over three months, under 0.5%.

Based on the data, traders are now expecting the Fed to raise rates by 0.25% on February 1.

That's less than the 0.5% hike after the last meeting and 0.75% at previous meetings.

The reason for the slowdown?

Inflation should be below the interest rate by April. Check out its trajectory in the chart below.

That's the Fed's goal, and it's within reach.  (Click here to view larger image.)

Check Out Our Most Recent Power Stocks: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | |

Post a Comment

Post a Comment