The 2 Words That Will Help You Thrive in 2023 Today, I’m taking a different approach to Stock Power Daily.

I want to share something that’s weighed heavily on my mind over the last few months: Making 2023 one of the most profitable years for you.

That’s not hyperbole … it’s something our entire team thinks about every day.

Now there’s no getting away from the fact that last year was well … rough … for investors.

Inflation…

Recession fears…

Stocks falling…

Bond yields … also falling.

It wasn’t pleasant, and every investor on Wall Street or Main Street experienced it. We were right along with you.

The biggest unknown here isn’t why the market fell last year … but how long will the bear market last?

I’m reminded of concepts we’ve talked about before … one in particular that I’ll get to in a minute.

| From our Partners at Banyan Hill Publishing. Tech stocks got murdered in 2022. But the financial conditions that slaughtered them aren’t going away.

The Fed has made it clear interest rates will stay higher for longer, meaning these companies won’t see the cheap debt they need to fund their operations for years.

This is one of the most obvious outcomes in the market that no one is talking about. And Mike Carr wants to tell you how to profit from the situation as these stocks head further south.

Get the full details from him here. |

Markets Don’t Move in Straight Lines My years as a financial research analyst have taught me one undeniable fact: Stocks and markets don’t move in straight lines.

There are hills and valleys.

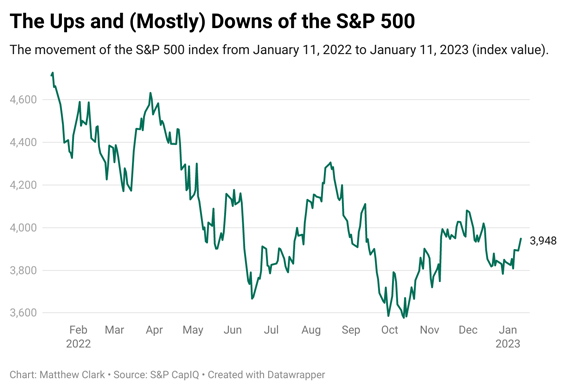

Here’s what I mean:  (Click here to view larger image.) This is a chart of the S&P 500 over the last year.

While the move from point A to point B was down, you’ll notice there are days … and even weeks … when we saw bear market rallies.

These uptrends handed some investors phenomenal gains … if they knew how to trade them.

This leads me to… Stubborn Investors Pay the Price I remember something Adam O’Dell wrote to his Green Zone Fortunes subscribers in July last year.

He was telling readers about adjusting stop-losses and introduced the concept of Adaptive Investing™: In short, it means we change our actions … as the market changes.

Stubbornness is a slippery slope: The more you dig your heels in, the worse your situation becomes if your actions don’t match reality.

Adapting is the opposite of stubbornness!

There’s a lot of truth to those words.

Take for example the 60/40 portfolio — where you invest 60% of your portfolio in stocks and the other 40% in bonds.

Vanguard says that portfolios lost 16% in 2022 … the second-worst year since 1976.

| With the market uglier than it has been in over 50 years … you should be. But with people fleeing stocks at record levels, savvy investors are finding stocks at bargain prices. For example, one stock ahead of its class is expected to surge 2,000% in the next five years.

Click here for more details. |

Things aren’t looking much better to start 2023. Inflation is still at 40-year highs, the Federal Reserve hasn’t signaled it’s ready to start cutting interest rates again and companies are taking drastic measures to stay profitable.

Does this mean you should abandon your 60/40 portfolio? That’s something you have to decide.

But if things aren’t looking any better for 2023 and you want to grow your portfolio, it‘s time to adapt.

Remember, those uptrends in the market last year gave some investors strong gains, but only if they knew how to trade them.

Well, Adam has the right formula and he’s going to share it with everyone on our special Zoom call tomorrow.

A little insider tip: This strategy is a unique way to capitalize on market volatility and give you the chance to target what’s working within the current market — because investors are making money out there.

You definitely don’t want to miss what Adam has to say.

Click here to save the date and time … tomorrow (January 18) at 4 p.m. Eastern … on your calendar now.

See you tomorrow! Stay Tuned: A Strong Bullish Stock in a Unique Industry Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

And Adaptive Investing™ is at the core of that system.

Sometimes it finds stocks within industries that you may not even know existed.

Stay tuned for the next issue, where I’ll share all the details on a company that serves as a unique play on the aerospace boom.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Check Out Our Most Recent Power Stocks: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment