- Old energy has dominated headlines, but it doesn’t mean new energy is dead.

- Six regions around the world will spend a combined $785 billion on offshore wind energy between 2019 and 2040!

- Today’s Power Stock focuses on offshore wind turbines and rates a 99 on our proprietary system.

| In 2022, old energy (oil and gas) dominated the market as it ended the year in the black.

It doesn’t mean that new energy (renewables) won’t take off … because it will.

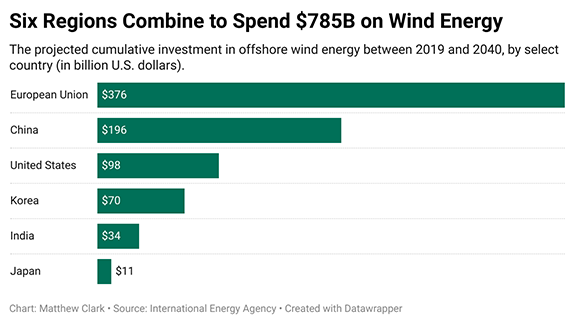

Trends suggest countries are going to pour even more money into renewable energy, such as wind, from here.  (Click here to view larger image.) This graph shows the six global regions pushing for more offshore wind energy.

According to the International Energy Agency, these six regions will spend $785 billion between 2019 and 2040 on offshore wind energy alone!

The European Union is projected to spend $376 billion, while the U.S. expects to invest $98 billion on wind power.

And today’s Power Stock is set to benefit from that growth.

Click here to reveal the ticker and start investing in this “Strong Bullish” company today!

| The energy crisis doesn’t look like it’s going away anytime soon. But tech expert Adam O’Dell has found a little-known company that has developed new tech to access the largest energy source on Earth … a source that could produce 5X as much power as the largest oil field … in just one year. There’s still time to get in early. Click here for the full story. |

CPI Sets the Market Trend On the eighth business day of every month, the Bureau of Labor Statistics releases the Consumer Price Index (CPI).

It’s a dense report that few people read. But almost everyone pays attention to the headline number.

It tells us how much the cost of living rose in the past year, but there are problems with the data.

Economists tend to rely on other measures of inflation to define trends in prices. But CPI dominates the headlines and captures the attention of traders.

In the past four months, the report kicked off a trend of massive buying or selling after the report drops. The blue bars in the chart of the S&P 500 Index below show you when each trend kicked off.

Bottom line: Traders simply needed to follow the trend to profit. This pattern may not last long but it’s worth paying attention to this month.  (Click here to view larger image.) Of course, I’m focused on a bigger trend that I call the “Silicon Shakeout.”

Tech stocks are in trouble. The Technology Select Sector SPDR Fund (NYSE: XLK) has lost 22% of its value over the last year.

But I see many short-term trading opportunities as individual companies collapse.

And I’m eyeing three big opportunities, one of which could return as much as 824% by July.

Click here to watch my brand-new presentation and find all the details you need to take advantage during the downfall. |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | |

Post a Comment

Post a Comment