- While energy stocks have grabbed market headlines, steel is making a quiet run.

- The NYSE American Steel Index has jumped 46.2% off its October 2022 lows.

- Today’s Power Stock distributes steel products to various industries and rates a 99 on our proprietary system.

| Matt Clark, Senior Research Analyst, Money & Markets Energy stocks have been all the rage with investors over the year — and rightfully so.

However, another sector of the market is in the middle of a resounding rally: steel.

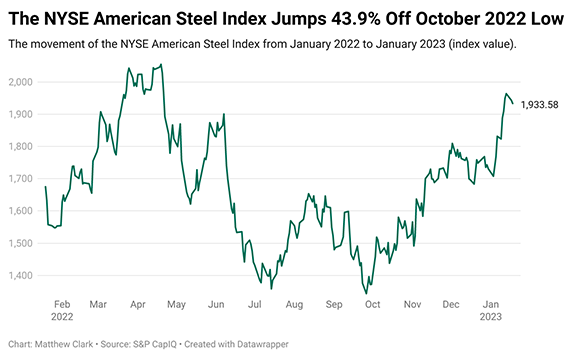

Check out this chart:  (Click here to view larger image.) The NYSE American Steel Index tracks stocks involved in steel production or the mining and processing of iron ore.

It jumped 43.9% off its October 2022 lows … and I’m confident it will move higher.

I’ve found an exceptional company that manufactures and distributes steel worldwide.

It’s one of the highest-rated companies in our Stock Power Ratings system, a tool that analyzes more than 8,000 stocks!

Click here to see why this 99-rated stock is set to rally higher from here.

| From our Partners at Trend Trader Daily. It’s not a stock, bond, crypto, option, or gold…

But this could very well be the #1 way to beat inflation.

It’s a brand new asset that the International Monetary Fund estimates should grow 24,900%.

And Pulitzer Prize nominated financial journalist Michael Robinson just found a “backdoor” for YOU to take advantage of its rise.

Click here now. |

PPI Confirms Inflation Lull — but It’s

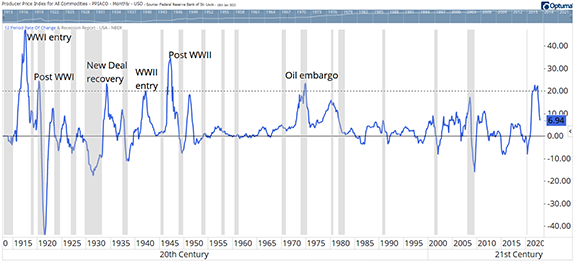

Not All Good News The Producer Price Index (PPI) is the oldest continuous data series for the U.S. government.

The PPI for All Commodities uses data stretching back to 1913.

In 2021, it reached a rare inflationary peak.

Commodity prices were rising at a rate of more than 20%: shown as the dashed line in the chart below.

Previous moves above that level were associated with important historical events: - Entering and exiting wars has been inflationary throughout history.

- The initial recovery (the New Deal recovery in the chart below) during the Great Depression was triggered by unprecedented amounts of government spending.

- And the OPEC oil embargo permanently changed that market.

This time might be similar to the New Deal recovery, when the government cut spending and the economy fell into another depression.

Bottom line: Without continued government spending, the current economy is likely to slow. Commodities show that's already happening.

(Click here to view larger image.)

Check Out Our Most Recent Power Stocks: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | |

Post a Comment

Post a Comment