| Managing editor’s note: Mike Carr is just days away from showing you his newest strategy to profit during the Silicon Shakeout.

Tech stocks struggled during 2022, and Mike sees more losses on the horizon. But that’s the perfect environment for his trades that he believes have the opportunity to gain 442%, 564% and even 824% before the summer!

Click here to sign up for his free presentation on Thursday.

— Chad Stone

- U.S. companies spent 24% of their IT budgets on cybersecurity in 2022 — up from 15% in 2020.

- Our Stock Power Ratings system tells you which stocks are good investments … and which one’s aren’t.

- Today’s Stock to Avoid is a popular cybersecurity firm that rates a “High-Risk” 19 out of 100 on our proprietary system.

| Spyware … malware … bots…

These terms were hardly mainstream just 10 years ago.

Now, almost everyone with a computer and internet connection is aware of what these words mean.

U.S. businesses used just 15% of their IT budgets on cybersecurity measures in 2020.

In 2022, that percentage jumped to 24%.

People are taking cybersecurity more seriously as attacks on individuals and companies increase by the day.

But with our Stock Power Ratings system, you can see that while the cybersecurity market is growing, some cybersecurity stocks are not.

Click here or on the image below to find out why this one cybersecurity company is today’s Stock to Avoid…

| Billionaires are taking advantage of market turmoil by investing heavily into my favorite “fear-to-fortune” stock. It’s a secret used by investors like Warren Buffett, David Tepper and Sir John Templeton to become filthy rich.

How it works is simple… |

Maybe Retail Isn't Dead After All The pandemic brought unthinkable tragedies to millions around the world. It disrupted everyone's daily lives. This resulted in shifts in consumer spending as consumers stayed at home.

Sales of leisure wear soared as offices emptied. While at home, consumers bought Pelotons, had Wayfair deliver furniture, and asked DoorDash and Blue Apron to bring them food. Airports, theaters and brick-and-mortar stores were as empty as offices.

Earnest Analytics used credit card data to track these trends and they found consumer behavior is largely back to its pre-pandemic normal.

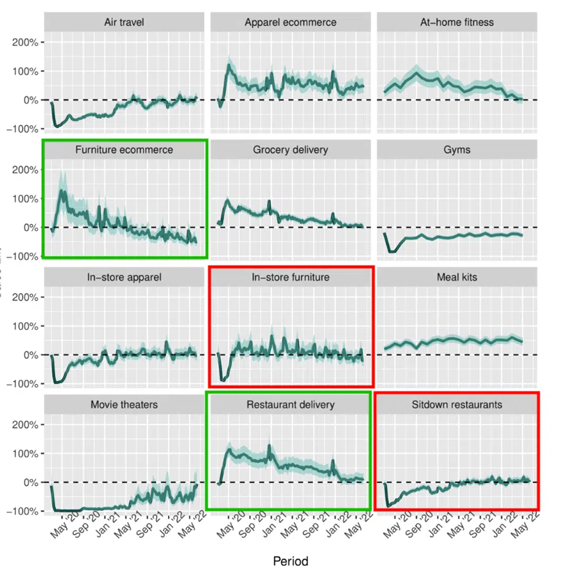

The report notes: We see, for example, that the pandemic caused sales to more than double in the short-run in the furniture e-commerce and restaurant delivery categories (green boxes).

Conversely, COVID caused declines in excess of 80% at their non-digital counterparts, in-store furniture and sit-down restaurants (red boxes). However, we also see that by June 2022, sales in most categories – including the four aforementioned categories – reverted back to their no-pandemic baselines.

Investors can't afford to ignore this data. Much of what the experts said a year ago was wrong.

It was hard to believe significant furniture buying would move online. Most of us like to sit on a couch before we spend hundreds or thousands of dollars.

We need to review our assumptions about retailers. Physical stores and shopping mall REITs may have significant upside potential. Subscription services and online specialty retailers may have downside potential.

This data confirms a shakeout lies ahead:  (Click here to view larger image.) Your guide to Shakeout Profits in 2023,

Michael Carr, CMT, CFTe

Editor, Precision Profits

Check Out Our Most Recent Power Stocks: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | |

Post a Comment

Post a Comment