- Big buildings need a lot of steel, concrete and glass.

- Revenue from laminated glass will grow 52.4% from 2020 to 2025.

- Today’s Power Stock is a large glass producer for the construction market. It rates a 96 on our proprietary system.

| By Matt Clark, Research Analyst Driving along Interstate 95 in Miami, tall buildings dominate the skyline.

But one in particular catches the eye:  Smack dab in the middle of that photo is the Paramount Miami Worldcenter.

It’s a 700-foot, 58-story building with condos, shops and even a soccer field.

And one thing stands out on this massive building … there’s a lot of glass.

Each condo has floor-to-ceiling laminated glass that is specially designed to hold together even when shattered … especially beneficial in hurricane-prone South Florida.

And the market for this kind of glass looks strong for the future.

Grand View Research expects the market value of laminated glass in the U.S. will increase 52.4% from 2020 to 2025.

When I see massive industry growth projections like that, I turn to our proprietary Stock Power Ratings system for unique ways to ride the trend higher.

Click here to reveal the ticker of one company to buy today.

| Chief Investment Strategist Adam O’Dell has uncovered a proven market-beating pattern for going after a new triple-digit winner every week. In fact, Adam’s average winner using this pattern is up 101% in only two days. And for a limited time, Adam is sharing his exclusive “M–W Pattern” with you.

Click here to see all the details. |

The list of indicators pointing to a recession grows longer every day.

And now, data from the shipping industry points to an economic downturn.

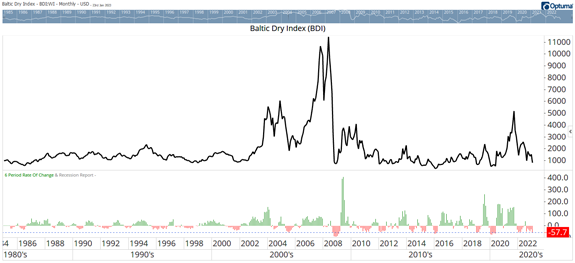

The Baltic Dry Index (BDI) measures the cost to ship dry goods around the world by sea. Dry goods can be anything that fits in a container — grains, factory equipment and even small plastic toys are just some examples.

It’s an economic indicator because the laws of supply and demand apply to the shipping market.

And the latest data looks bearish for our economic future.

| The energy crisis doesn’t look like it’s going away anytime soon. But tech expert Adam O’Dell has found a little-known company that has developed new tech to access the largest energy source on Earth … a source that could produce 5X as much power as the largest oil field … in just one year. There’s still time to get in early.

Click here for the full story. |

What Shipping Data Says About the State of Our Economy The global supply of ships is pretty much fixed because it takes time to add new ships to routes.

Since changes in supply occur slowly, demand determines prices in the short run.

When prices to send cargo by ship rise, it’s because demand for shipping services is increasing.

Lower demand is associated with lower prices in the BDI and it shows that producers are making less — an indicator that economic growth is slowing.

BDI fell more than 70% in the past year.

There have only been a few times when the index fell at least this much in a year.

Two were before the most recent recessions in 2008 and 2020. The economy avoided recession after the other signals.  (Click here to view larger image.) BDI shows a risk of a global slowdown. And a related industry confirms this trend. U.S. Trucking Industry Taps the Brakes Trucking in the U.S. confirms the nation’s economy is also slowing.

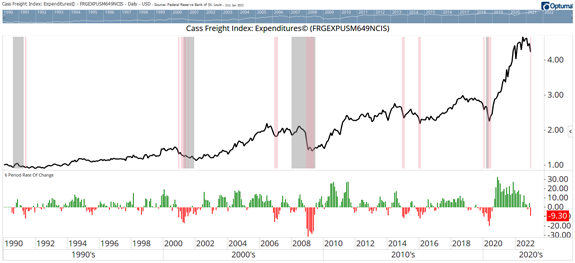

The next chart shows the Cass Freight Index.

It’s based on the amount of revenue the industry reports. Revenue for trucking companies dropped in the past few months.  (Click here to view larger image.) Previous dips shown as red shaded areas on the chart have accompanied recessions. There have also been several false signals.

Cass estimates that shipping rates fell 0.4% in the last year.

The decline is accelerating with the month-over-month decline topping 2.2%.

Bottom line: Shipping is the latest indicator pointing to a recession.

Of course, the Federal Reserve could avoid one through smart policy decisions.

But prudent investors shouldn’t bet on the Fed doing everything right.

Check Out Our Most Recent Power Stocks: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment