| Managing Editor’s Note: We’re trying something a little different in today’s Stock Power Daily. Matt has all the details on a tech mega trend that is set to soar after the tech shakeout. (It’s already outperforming!) Let us know what you think about this format by emailing us at StockPower@MoneyandMarkets.com. You can also tell us any topics you want to know more about, and there’s a good chance Matt will hit on them in the future. Have a fantastic Friday!

— Chad Stone |  | We’ve all seen the headlines:

“Microsoft Falls After Earnings.”

“Tech Stocks Lead Market Retreat Ahead of Latest Earnings.”

“Tech Industry Sees Tough Road Ahead as Wave of Layoffs Spread.”

It spells out a lot of doom and gloom for tech stocks that were once the darlings of the market.

I’m not suggesting these headlines are wrong.

But I believe there is one mega trend in the tech sector that will not only survive this tech bust … but thrive in the aftermath.

I’ll share which one. But first, I want to tell you about the pain ahead for the tech industry.

| From our Partners at Rogue Economics. As a former Goldman Sachs managing director, I feel it’s my duty to warn you about what may be coming on January 31st.

It all starts with a new Presidential executive order, that may directly install MAJOR changes to your bank account.

Stephen Roach, former chairman at Morgan Stanley, says: “U.S. living standards are about to be squeezed as never before.”

Click here to see what’s NEXT for America… |

Earnings Paint Gloomy Picture for Tech I recently talked with my good friend and colleague Mike Carr about tech earnings.

Pro tip: You can check out Mike’s Chart of the Day here on Money & Markets.

Earnings season has just begun, but tech is already feeling some pain.

Tuesday, Microsoft Corp. (Nasdaq: MSFT) beat earnings estimates, but shares dropped 2% after the company provided lackluster guidance for the quarters ahead.

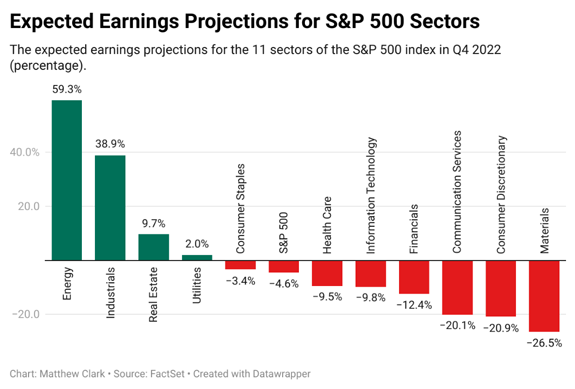

And things are not likely to get better for tech this quarter:  (Click here to view larger image.) This chart shows the expected fourth-quarter 2022 earnings for the 11 major sectors of the S&P 500.

FactSet expects earnings growth of the information technology sector to be 9.8% lower than a year ago.

Revenue growth is expected to be 0.6% lower.

For context, both of those expectations are worse than they were even a month ago.

It means tech earnings are only going lower…

And the communication services sector is in even more trouble.

Companies in that sector are expected to report an earnings decline of 20.1% compared to the same quarter a year ago. Alphabet could report a 21% drop in earnings while Meta could drop 40% … or more. We’ll find out next week.

So the idea that there is more pain in store for the tech sector isn’t wrong.

These earnings projections coupled with massive layoffs in Silicon Valley spell a rough road ahead.

And cash is harder to come by for these tech companies due to higher interest rates. That not only impacts the bottom line but the stock price.

But I think there is a silver lining … better yet … a sector within tech that will come out the other side of this even stronger than before.

Party Like It’s 2007 I remember 2007.

I was working for a daily newspaper in Southeast Kansas.

In late June of that year, Apple Inc. (Nasdaq: AAPL) transformed how we communicated with the launch of the first iPhone.

It was the tech giant’s first smartphone — complete with a touchscreen and what felt like unlimited potential.

The iPhone was a computer in your pocket.

Today, another tech innovation has grabbed our attention unlike anything we’ve seen since 2007… ChatGPT.

ChatGPT is powered by artificial intelligence (AI). The site allows users to interact with a bot to create everything from research papers to recipes.

This generative AI — a program that uses algorithms to create new content — grabbed headlines after almost passing the three medical exams that all prospective doctors are required to take. And ChatGPT didn’t have to study for years on end!

Microsoft is investing billions of dollars into the company behind this revolutionary bot: OpenAI.

ChatGPT shows that AI is capable of handling complex tasks more efficiently than humans … and there is big money in the market.

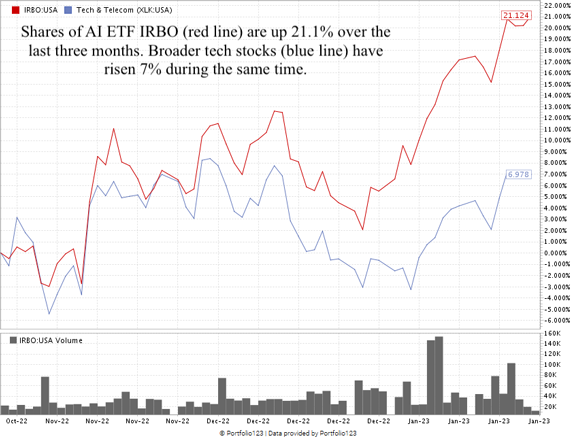

This has given some solid footing to AI-related stocks in a market where broader tech stocks continue to struggle:  (Click here to view larger image.) The chart above shows the performance of the iShares Robotics & Artificial Intelligence ETF (NYSE: IRBO). The exchange-traded fund (ETF) invests in companies operating in artificial intelligence, software research and robotics tech.

Over the last year, the ETF is down 16%, but I want to highlight how the stock has performed in the last three months.

As you can see, IRBO has climbed 21.1% while the Technology Select Sector SPDR Fund ETF (NYSE: XLK) has only risen 7%.

This tells me there is an appetite for AI stocks amid the excitement generated by ChatGPT and other innovations — all while tech stocks on the whole are getting hammered.

And IRBO is just one ETF that gives exposure to AI. Here are a few others and their performance over the last three months: - Robo Global Artificial Intelligence ETF (NYSE: THNQ): +13.2%.

- Qraft AI-Enhanced U.S. Next Value ETF (NYSE: NVQ): +5.1%.

- WisdomTree Artificial Intelligence UCITS ETF (WTAI): +12.8%.

There’s little doubt tech stocks are struggling now … and will continue for the foreseeable future.

I’ve shared a few different ways to get in on the AI mega trend, as I believe it is one that will not only survive this tech downturn, but come out on the other side stronger than before.

For reference: AAPL stock is up 3,754% since the launch of the first iPhone in 2007.

Until Monday… Stay Tuned: Capitalize as Americans Pack Up and Move Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for Monday’s issue, where I’ll share all the details on a “Strong Bullish” company that helps millions tend to all their needs during a big move.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Check Out Our Most Recent Power Stocks: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment