| Managing editor’s note: Mike Carr is just days away from showing you his newest strategy to profit during the Silicon Shakeout.

Tech stocks struggled during 2022, and Mike sees more losses on the horizon. But that’s the perfect environment for his trades that he believes have the opportunity to gain 442%, 564% and even 824% before the summer!

Click here to sign up for his free presentation on Thursday.

— Chad Stone

- Millions of Americans spend hours playing games on their phones and tablets.

- U.S. mobile game revenue will reach $58.8 billion by 2027 — a 65% increase from 2021.

- Today’s Power Stock develops and publishes games for your phone and computer. And it rates a 92 out of 100 on our proprietary system.

| When I’m done with my day at work, I have a routine.

I open my phone and play three different games: - Star Wars: Galaxy of Heroes.

- Infinite Galaxy.

- FIFA Mobile (soccer).

It’s not because I’m competitive or addicted to gaming … but more of a way to wind down from the day.

Millions do the exact same thing.

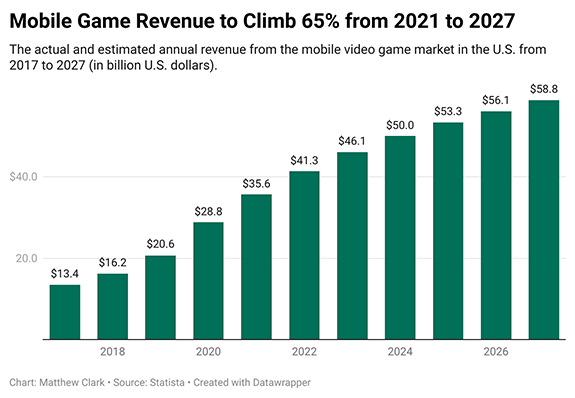

The chart below shows the revenue growth of the mobile video game market in the U.S. from 2017 to 2027:

(Click here to view larger image.) As you can see, the mobile video game market is booming.

From 2021 to 2027, revenue from the mobile video game market will grow 65%.

Today’s Power Stock develops and publishes video games for your phone, tablet and computer.

Click here or on the image below to find out why it’s set to dominate the gaming market…

| From our Partners at Banyan Hill Publishing. Wall Street legend reveals the dark truth behind a new government plan to control your savings, checking, even your retirement accounts.

(See proof.) |

Why I Plan to Trade the Worst Stocks in 2023  | I’m a contrarian by nature.

I’ve never been one to follow the herd. It’s a well-documented fact that most investors lose money. I like to be in the small minority that makes it.

This is why I’ve never been one to settle for conventional wisdom.

I mean bits of advice like: Stocks always go up in the long run.

Tell that to someone who bought Japanese stocks in the early 1990s.

They’ve never recovered.

Tell that to someone who bought tech stocks in 1999 or 2000. It took them 16 years to break even — assuming they weren’t in stocks that went totally bankrupt.

This is why many investors buy stocks on the first leg down in a bear market. They hope they’re not catching a falling knife.

But that’s exactly what happens — and they either sell at the bottom, or fail to buy at the appropriate time.

That’s why I plan to do something different.

I don’t plan to buy stocks that look “cheap.”

I plan to trade stocks that are still expensive.

In short, I want to trade the worst stocks I can find. The stocks that still have the most room to drop.

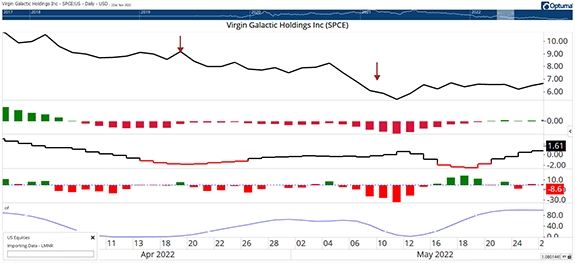

Take Virgin Galactic, for instance.

This stock was truly a hallmark of the ridiculous time we were in.

You can tell the stock was a joke by its ticker symbol — SPCE. How original.

To add insult to injury, the company went public via a special-purpose acquisition company. Once celebrated as a financial innovation that allowed companies to avoid much of the red tape of going public, investors know realize that a bit of red tape was actually a good thing, with stocks like this down 90% from its highs.

This is one of many stocks I looked at in 2022 as I was back testing my new Shakeout Profit system — which I plan to use in 2023 to profit from more deadbeat companies like this one.

This chart shows when my system would have told me to enter and exit the trade:  (Click here to view larger image.) Don’t worry about the indicators below the price chart. I’ll get to all of that a bit later — and rest assured, it’s not something you’ll need to worry about.

These indicators simply help me uncover opportunities like this one in SPCE, which would have made me a 213% gain in about three weeks. That’s a triple-your-money return while the stock was falling. Lots of Opportunities Like This I’ve seen my fair share of bear markets. The first investment I ever bought was weeks before the October 1987 crash. Fortunately, I didn’t sell, and my investment quickly returned to its initial value.

Stocks were much cheaper then — and there weren’t nearly as many investors in the market as there are today.

The last few years saw a maelstrom of easy money enter the market.

This trend, “The Rise of the Retail Investor,” distorted asset prices, sending stocks to stratospheric levels that had no business being so expensive.

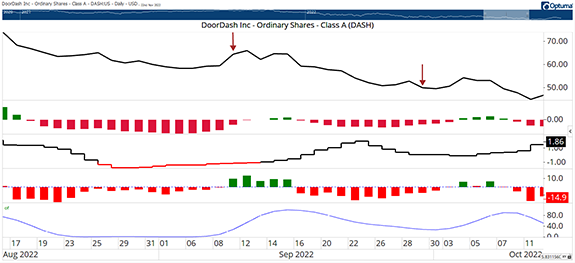

DoorDash is another great example. Ticker DASH (I wish I was joking), the stock has fallen 80% from its highs.

DoorDash is a popular app. Humans will take any excuse so they can get to be lazy. DoorDash brings them food from local restaurants without so much as needing to place a phone call.

The problem is, most of the proceeds go to the restaurants and delivery drivers. Customers don’t want to pay an additional high fee to the app. So, the “company” kept fees low.

Brilliant.

This is another trade that would have gone up 161% in less than a month according to my system’s back test. You can see the entry and exit here:  (Click here to view larger image.) I’ll share many more opportunities like these on Thursday during my Silicon Shakeout presentation — and tell you about a few I’m eyeing for potentially large profits in 2023.

Again, I want to trade the worst stocks I can find, because these are the ones that are going to drop the fastest. They’re going to move the most — and to make money my way, stocks just need to move.

Come back tomorrow and I’ll tell you more about my method for finding these opportunities — and knowing exactly when they’re most likely to drop hard.

Your guide to Shakeout Profits in 2023, Regards,

Michael Carr, CMT, CFTe

Editor, Precision Profits

Check Out Our Most Recent Power Stocks: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment