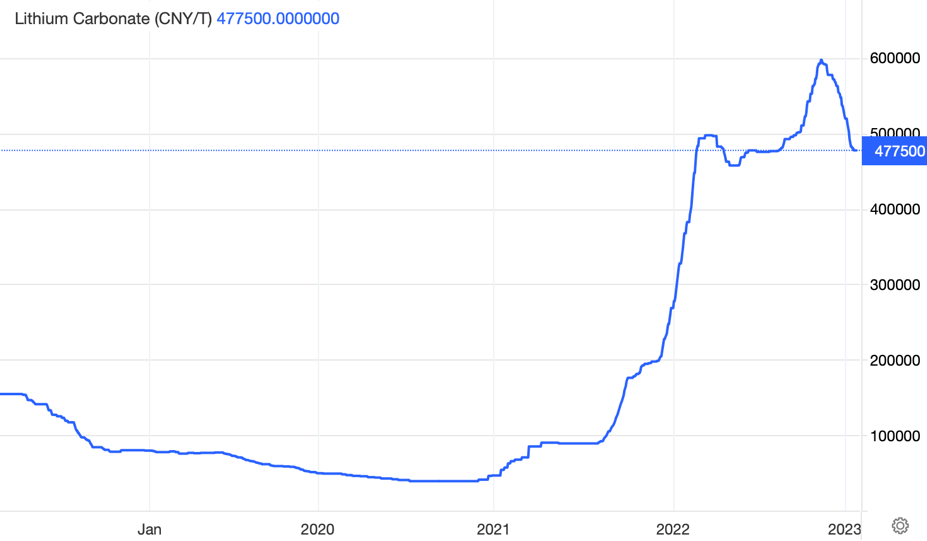

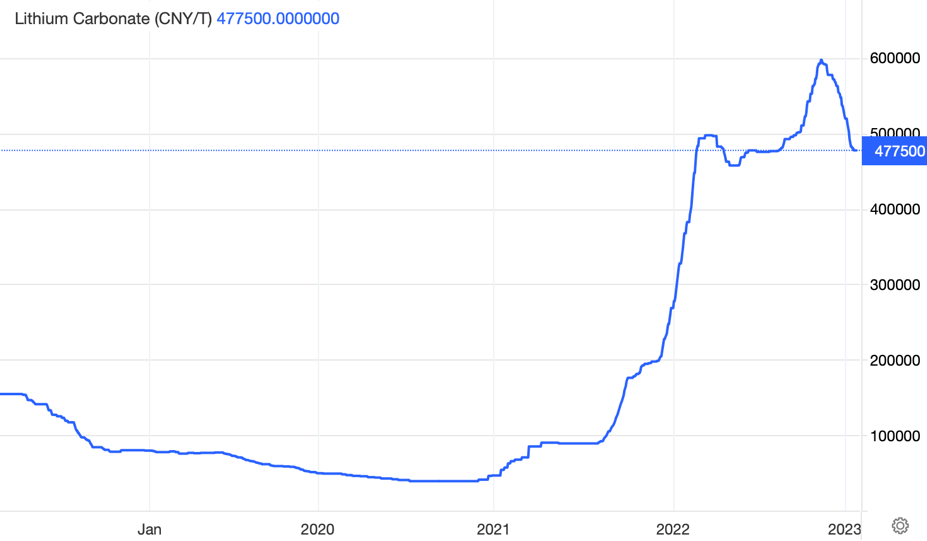

| The numbers surrounding lithium are mind-boggling. The price for a ton of lithium has more than doubled in the past year. And it’s soared nearly 1,000% since 2020. That’s why Tesla is spending $375 million on this secret project lithium project in Corpus Christi Texas.

Albemarle (NYSE: ALB) is the world’s largest lithium producer by market capitalization. And it’s no surprise that the company recently raised its earnings guidance and sales targets. The company pointed to the Inflation Reduction Act, which will boost the outlook for electric cars. Albemarle supplies many of the world's automakers, including Tesla (NASDAQ: TSLA).

Albemarle President Eric Norris explained… “We’ve increased our demand forecast once again, primarily due to higher electric vehicle production. We now expect 2030 lithium demand at 3.7 million tons, up 15% from our prior outlook”. Albemarle expects the price it receives for its lithium to jump 40% in 2023. And its longer-term outlook is also quite bullish. Albemarle expects a market deficit of 800,000 tons annually by the end of this decade because of both the growth in demand for EVs and the long multi-year time it takes to develop new lithium resources. Norris explained…

“One of the reasons that we see things being so tight is just the market is fundamentally different. In 2019, the market didn’t grow very much and it was 300,000 tons. Prior growth rates may have been 30,000-50,000 ton a year. Today, the market grows 200,000 tons a year, almost the full size of what the market was back then.” There are about 40 lithium projects under development globally, and are undergoing or have completed definitive feasibility studies. That's a 166% increase over 2019.

However, the cost of these new supplies will remain high because of lower grades under development at new projects, which should keep prices from falling too far.

There is another headache facing the industry – a lack of refining capacity in the U.S. It could be producing 362,000 ton of lithium carbonate equivalent by 2032, but have to ship 300,000 tons of it for processing overseas because of refinery shortages. That's why Tesla is among the companies eyeing new refining capacity, with plans for a possible investment of more than $375 million on a secret project along the Gulf Coast. Go here to profit from Elon Musk’s Secret Master Plan. Tony Daltorio Editor @ Wall Street Spy My Top Monthly Investment Ideas For Just $1

A small $1 investment could be the difference between success and failure in 2023. Now’s the time to jumpstart your investment portfolio - More details here. Top Investment Ideas The Truth About Tesla's New Business Elon Musk has pointed out that there is ample lithium available in the world. However, producers have been slow to pull it out of the ground. Governments – particularly in the U.S. – have been unwilling to approve new projects. And there has been little effort to build out lithium refining capacity in the U.S. And by 2024, the U.S. government requires that 40% of an EV’s battery is extracted or processed domestically. That threshold rises to 80% by 2027. So Tesla realizes that it must begin sourcing more battery components and materials in the U.S. Tesla's New $700 Million Gigafactory Expansion Morgan Stanley expects the EV battery market to hit nearly $525 billion – a 2,400% increase in two decades! Tesla will be one of the leaders – it recently applied with the Texas state department of licensing for a $700 million expansion of their Gigafactory in the state. Tesla has already built Gigafactory locations in Nevada, Texas, Shanghai, and Berlin. The next one is likely to be built in Canada. Top 5 Overnight Trades of 2023:

Discover the NAMES and TICKERS of the top overnight trades for big profits. Just $5k invested per trade could multiply to $40,950! And it’s completely possible with these fast 3-hour trades. The Adoption of EVs Just Got a Serious Boost Tesla recently made price cuts on new models in the U.S. and Europe. This is FANTASTIC news for the future of EVs. One of the hurdles before EVs can gain wider adoption was their exorbitant price. And now that changed overnight. These new price cuts could seriously turbocharge the adoption of EVs, while winnowing out some of Tesla's competitors. This Hasn’t Happened in 25 Years Tesla has become the TOP luxury brand in the U.S. automotive market – the first time an American automaker does so in almost 25 years. In doing so, Tesla has upset the apple cart since the top luxury auto brands have traditionally been the German automakers like Mercedes, BMW and Audi. But no longer. |

Post a Comment

Post a Comment