| Managing Editor’s Note: Are you wondering if the next bull market is here? We’re going to show you why this rally can’t be trusted over the next few days in Stock Power Daily. Matt kicks it off with a look back at 2022’s rout below. Read on…

— Chad Stone | $4.7 Trillion Erased in 2022: What’s Next for America’s Top Stocks Oh how the mighty have fallen.

I was crunching numbers the other day and found a statistic that blew my mind.

During last year’s market crash, the 10 largest stocks on the S&P 500 Index lost more value than the other 490 stocks … combined!

Here are the numbers…

At the start of 2022, these 10 stock giants (like AAPL, MSFT, GOOGL, etc.) were worth a combined $12.6 trillion.

By December 31, that total tanked to $7.9 trillion.

That’s 37% — or $4.7 trillion — gone in just 12 months.

The market value of all companies on the S&P 500 sank 20% in 2022 for comparison.

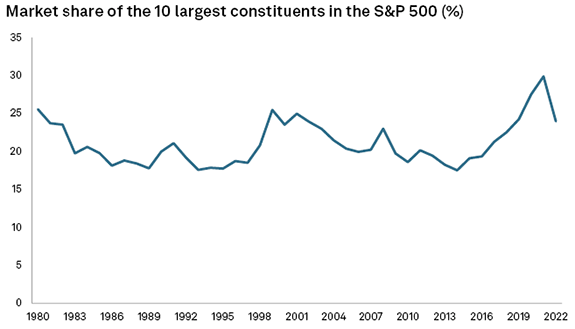

You can see how the 10 largest companies within the index (which change over time) have rallied and crashed since 1980 in the chart from S&P Dow Jones Indices below.  (Click here to view larger image.) After the 12-month downfall, these 10 companies went from making up almost 30% of the S&P 500’s total market capitalization in 2022 to only 24%.

A 6 percentage-point drop doesn’t sound so bad at first, but we’re talking about an index that was worth more than $40 trillion when 2022 kicked off.

And these are companies that have dominated the market for years.

Apple Inc. (Nasdaq: AAPL)…

Microsoft Corp. (Nasdaq: MSFT)…

Alphabet Inc. (Nasdaq: GOOGL)…

Amazon.com Inc. (Nasdaq: AMZN) … and more!

Let me break down what this means for you as an investor as we continue to look for the best opportunities after the shakeout.

| Join Adam O’Dell on Tuesday, February 14, at 1 p.m. ET. He’ll reveal the name and ticker of a company he believes is on the verge of collapse … and how you can place a special type of trade for a chance to profit.

Go here to reserve your spot now. |

The Great Value Decline Last year was the worst year for the S&P 500 since the Great Recession of 2008.

Rising inflation, soaring interest rates and fears of another recession led the index to shed 20% in 2022.

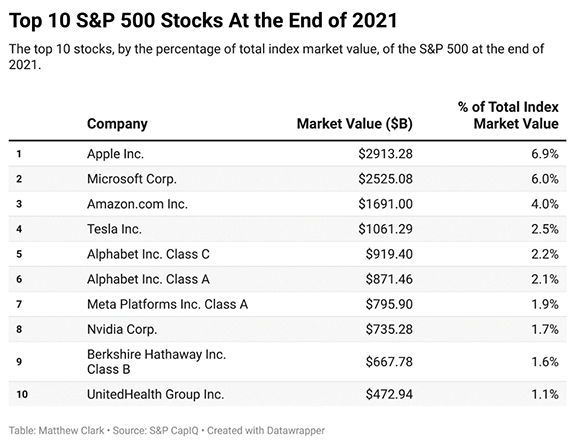

Here are the largest companies on the S&P 500 at the end of 2021:  (Click here to view larger image.) As you can see, Apple, Microsoft and Amazon were the big leaders with a combined market cap of more than $7 trillion.

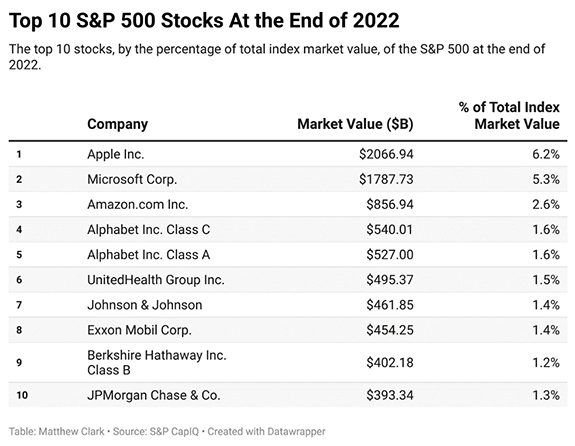

Now, let’s look at how things shook out after 2022:  (Click here to view larger image.) The top three all had massive declines. Apple lost almost $900 billion, while Microsoft lost close to $800 billion.

But I want to focus on who fell off the list.

The biggest loser was Tesla Inc. (Nasdaq: TSLA), which lost $674.6 billion, or 63.4% of its market cap in 2022.

The crash erased $620.1 billion, or 66.3%, from Meta Platforms Inc.’s (Nasdaq: META) value.

And Nvidia Corp. (Nasdaq: NVDA) lost $375.6 billion, or 51%!

To put a finer point on this, consider: - Because it’s the largest stock in the index, Apple’s negative 26.4% total return in 2022 dragged the entire S&P 500 down 2%.

- Tesla’s 65% drop tacked on another 1.8% decline for the index.

- Amazon, Microsoft and Meta each pulled the index down more than 1%.

- Those five stocks alone made up 8% of the S&P’s 20% drop last year.

Is the worst of the carnage behind us, or do we need to prepare for more pain ahead?

| A company 7X bigger than Lehman Brothers in 2008 could be on the verge of collapse. Join Adam O’Dell on Tuesday, February 14, at 1 p.m. ET. He’ll reveal the name and ticker of this company and how you can set yourself up to profit from its downfall.

Go here to reserve your spot now. |

What's Coming Next in 2023 — and

How You Can Capitalize Chief Investment Strategist Adam O’Dell and I don’t think this bear market is over.

We’re going to see more declines this year.

How low will these tickers go? It’s difficult to say, but January’s stock market rally has “fake out” written all over it. Adam and I aren’t big on market forecasting like that anyways.

But the numbers don’t add up.

And it all comes down to one word: valuations.

After years of euphoria boosting Big Tech names, these stocks are coming back down to Earth.

They simply aren’t making enough money to support their elevated stock valuations.

Just look at some of these metrics: - Apple’s price-to-book value is 42.7 compared to its industry average of 2.32.

- Tesla’s price-to-earnings ratio is 53.7 compared to the industry average of 16.9.

- Nvidia’s price-to-cash flow ratio is 71.4 … its industry average is 19.6.

And when growth is harder to achieve due to high interest rates and a mellowed-out economy, the bottom falls out.

Bottom line: These big players can make or break the broader market.

And earnings reports so far indicate a further breakdown ahead. Adam believes we’ll have a “longer and lower” bear market from here.

That doesn’t mean we have to sit on our hands and watch the value drain out of our portfolios.

Adam has developed the perfect way to capitalize on this trend with one stock, and he’s going to show you how you can turn the downfall into profits at 1 p.m. Eastern next Tuesday, February 14.

To be sure, this is a confusing time to be an investor.

Adam is a realist when it comes to investing, and that means making opportunistic trades in both bull and bear markets.

This strategy is designed to help you find profits, even when the market isn’t going up.

Click here to sign up for his free presentation before it airs next week. Stay Tuned: Why a Double on This

Stock Was a Terrible Sign Big Tech grabs all the headlines, but the 2022 sell-off hammered smaller innovative companies as well.

Tomorrow, I’ll show why one promising videogame maker is now “High-Risk” after its stock almost doubled over two weeks in November 2021.

Until then…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Check Out the Latest From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment