| So you’re sitting at your computer looking for the next big stock to trade, hoping you make enough to get a new car, take another vacation or finally buy your boat.

A headline flashes across your screen that company XYZ Inc. just reported horrible earnings and you think … this stock is going to crater.

And you wonder … what’s a great way I can profit from this company’s inevitable nosedive?

You may even recall an article you read about an investment firm making millions by short selling XYZ Inc. just when it was starting to tank.

Light bulb moment, right?

Wrong.

While the idea of short selling to make fast profits may sound attractive to some, it’s way more risk than any one person should be willing to take on.

Today, I’m going to dive deeper into short selling and give you the pros and cons before sharing a better way to profit from stocks moving down.

| Join Adam O’Dell on Tuesday, February 14, at 1 p.m. ET. He’ll reveal the name and ticker of a company he believes is on the verge of collapse … and how you can place a special type of trade for a chance to profit.

Go here to reserve your spot now. |

The Speculation of Short Selling At the end of the day, short selling a stock is speculating it will drop in price.

Some investors use short selling as a hedge against potential downside risk in a long position.

That’s not the complicated part.

Short selling starts by borrowing shares of a stock you think will go down in value. You don’t actually own the shares.

You sell these borrowed shares to anyone willing to pay the market price.

Remember … these are borrowed shares, and the borrower has to return them at some point.

Before doing so, they bet the share price drops from when they originally sold them. If that happens, they can buy back the borrowed shares at a lower cost. The difference is pure profit for the person who borrowed the shares.

Here’s a visual from CFA Journal that outlines this process:  (Click here to view larger image.) Not everyone can go out and short sell stocks. To open a short position, you have to have a margin account — an account where a broker-dealer lends you cash to buy stocks.

It’s typically that broker-dealer who will help find the shares to borrow to open the short position. Why You Don’t Want to Sell Short I know I said I’ll go over the pros and the cons, but the only benefit to short selling is the potential gain.

Remember XYZ Inc.? Let’s say the stock price is currently $50 a share and you think its horrible earnings report will push the price down.

You want to sell short, so you borrow 100 shares and sell them to another investor at $50 per share. You are “short” 100 shares because you just sold something you don’t own.

By the next week, the share price of XYZ Inc. is down to $35 … exactly what you wanted to happen.

You then buy 100 shares at $35 and return the borrowed shares. Your profit is $15 per share (the original price of $50 minus the current price of $35), or $1,500 — not counting the fees and commissions you pay on the margin account.

Sounds good, right?

Well, here are the cons.

Take the same scenario — XYZ Inc. is at $50 a share and you think the price is on the way down.

You borrow 100 shares and sell them for $50 each.

But the market rallies and investors seem to forget about the dumpster fire quarterly report you were betting would tank the stock.

XYZ Inc.’s stock price goes up to $70 with no prospect of going down. You have to get out to mitigate your loss, so you buy the 100 shares at $70 each and return them. You have now taken a loss of $2,000 (original price of $50 minus the current price of $70 multiplied by the 100 shares).

Let’s not forget about one of the biggest drawbacks to selling short … short squeezes.

This is a little complicated to explain, but it boils down to this:

Investors see a massive short position on ABC Inc. — meaning there are a lot of short selling positions (people betting the stock drops) — so they decide to bid the price up, forcing those short sellers to sell out of already losing positions.

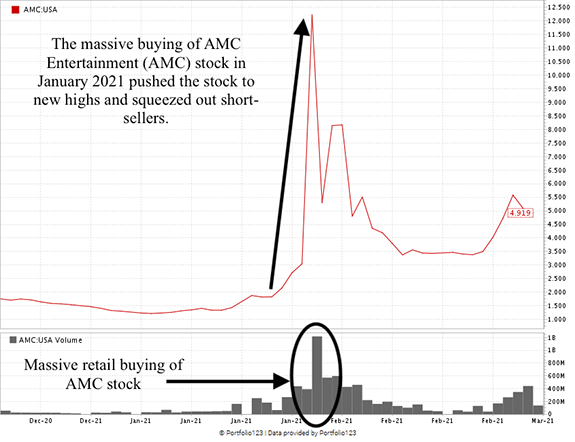

This happened in January 2021 when some investors noticed massive (millions of dollars) short positions in AMC Entertainment (NYSE: AMC).

As you can see in the chart below, retail investors drove the price up. This ended up costing institutional investors and hedge funds millions when they had to buy back borrowed shares for 3,722% more than they sold them for.  (Click here to view larger image.) Bottom line: The risks of short selling well outweigh the potential rewards. However, there’s a better (and less risky) way to profit from stock declines… A New Strategy That Banks on Declines My good friend and chief investment strategist, Adam O’Dell, is putting the final touches on a strategy that helps you profit from companies as their stock prices fall.

The best part: It’s not nearly as risky as short selling.

I hope you join him at 1 p.m. Eastern tomorrow, when he unveils this phenomenal strategy that can help you find gains, even when the market is circling the drain.

Make sure to click here and reserve your spot for this can’t-miss presentation.

Until tomorrow… Stay Tuned: An EV Manufacturer

That Can’t Compete Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Tomorrow, I’ll give you the ticker of an electric vehicle company that is struggling with competition in a super tight market overseas.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Check Out the Latest From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment