- The travel industry took a massive hit at the height of the COVID pandemic in 2020.

- A deep dive into our Stock Power Ratings system uncovers certain profit-draining stocks.

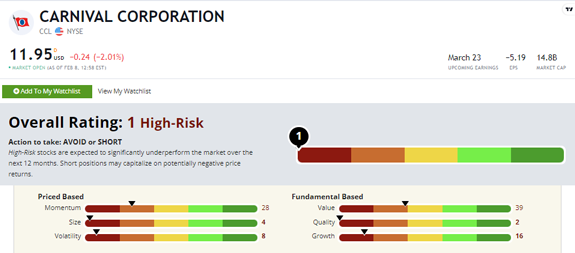

- Today’s Stock to Avoid is a $14.7 billion global cruise line operator and rates a “High-Risk” 1 out of 100 on our proprietary system.

| In 2020, the travel industry took a massive hit to its bottom line.

The COVID pandemic shut almost everything down, forcing travel to grind to an abrupt halt.

Cruise Hive estimated that the cruise line industry lost nearly $20 billion in 2020 as hundreds of ships were kept in port for months without any passengers.

Over the last two years, the industry has tried to rebound. But it’s going to take a long time for cruise lines to reach the profitability they had before the global shutdowns.

Even into 2023, cruise line stocks continue to struggle.

This is especially the case with Carnival Corp. (NYSE: CCL)…

| The energy crisis doesn’t look like it’s going away anytime soon. But tech expert Adam O’Dell has found a little-known company that has developed new tech to access the largest energy source on Earth … a source that could produce 5X as much power as the largest oil field … in just one year. There’s still time to get in early.

Click here for the full story. |

CCL Struggling to Claw Back Carnival operates in North America, Australia, Europe and Asia.

In addition to its signature cruise ships, the company also operates these popular lines: - Cunard (remember the Titanic…).

- Holland America.

- Costa (based in Italy).

- Princess (the line that’s featured in The Love Boat).

Even with these popular lines under the company’s control, CCL stock continues to struggle and is not worth investing in right now. (And yes, that's even with its recent rally — more on that below.)

CCL stock scores a “High-Risk” 1 out of 100 on our Stock Power Ratings system. We expect it to underperform the broader market over the next 12 months.  (Click here to view larger image.)

| From our Partners at Banyan Hill Publishing. A rogue economist from Florida just issued a dire warning that every parent and grandparent should pay close attention to ... about a shocking financial event that could obliterate the economy and wreak havoc for generations to come.

Full details on the event — that no one else seems to be talking about — are revealed in his shocking new exposé called ... “The Coming Middle-Class Massacre.”

You can watch it here, free of charge. |

CCL Stock: Weak Growth + High Volatility Looking at Carnival’s financials shows us that the company continues to struggle from the monumental hit it took during the COVID pandemic: - The company's latest quarterly update shows an adjusted net loss of $1.1 billion!

- Its occupancy (number of people on ships) was 19 percentage points below its pre-pandemic levels for the quarter.

This shows why CCL scores a 16 on our growth factor.

It also slumps on quality (2).

Its return on equity is a horrendous negative 63.4% … and its net margin is negative 50%.

These are both well below its industry peer average.

So, CCL continues to struggle on the financial side, with fewer passengers and the inability to climb above the red.

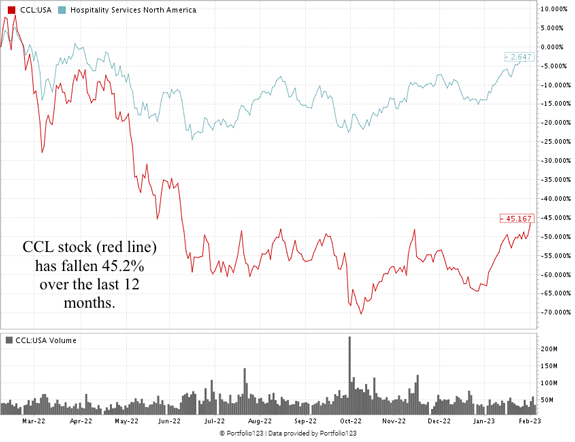

Another telltale sign to avoid the stock is its momentum (or lack thereof) … Carnival Corp. is down 45.2% over the last 12 months as I write. You can see its underperformance in the chart below.  (Click here to view larger image.) For context, its hospitality services peers (blue line in the chart above) are only averaging a 2.6% decline over the same time.

And while Carnival stock has rallied higher in 2023, our system shows that the underlying numbers can't sustain it.

CCL stock scores a dreadful 1 overall on our proprietary Stock Power Ratings system.

That means we consider it “High-Risk” and expect it to underperform the broader market.

Bottom line: The cruise industry continues to claw its way back from dismal pandemic losses.

However, CCL shows that the broader industry has a long way to go.

A lack of profitability and negative margins tell us to steer clear of pouring money into Carnival stock.

Before I go: Carnival stock is another one that is participating in the current “fake out” rally. It’s up almost 50% in 2023!

But my colleague Adam O’Dell thinks this rally is about to leave a lot of smaller investors holding the bag.

Carnival and Roblox aren’t alone.

Next week, Adam is going to tell you about what he’s calling “The Next Big Short,” and how you can take advantage as one of the biggest stocks falls again.

Click here to sign up for his free presentation now. It airs on Tuesday, February 14 at 1 p.m. Eastern. Stay Tuned: How Short Selling Works Our managing editor, Chad Stone, will have your Weekly Wrap in Sunday’s issue of the Stock Power Daily. Make sure to check that out.

And then I’ll be back on Monday with a guide on how short selling works — but there’s another way to play stocks as they sink lower.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets P.S. I’d love to hear what you thought about my “Stock to Avoid” article today. Was it valuable? Would you like us to continue sharing high-risk stocks on occasion, so you know what to stay away from?

Would you prefer that we only share “Bullish” and “Strong Bullish” stocks?

Write in and let us know!

Check Out the Latest From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Post a Comment

Post a Comment