Weekly Wrap:

Fun While It Lasted… Dear Loyal Reader, Can we go back to January?

In all seriousness, last week was a bit of a reality check after markets surged out of the gate to start 2023.

After Friday’s inflation-driven market bloodbath, all major indexes are trending lower once again.

That all could change, of course. It wouldn’t shock me to see massive gains again tomorrow. That’s the market we’re in. (And there are individual stocks with incredible potential. You can see some we’ve highlighted in Stock Power Daily below.)

But there are two huge things to keep in mind as 2023 continues: - Inflation is still rampant. The Federal Reserve’s preferred inflation index rose 0.6% in January, and it’s still 4.7% higher than it was a year ago (this caused the Friday market shellacking I mentioned above).

- It means the Fed isn’t done raising interest rates.

We need to be ready for more pain ahead.

I was on a call with our chief investment strategist, Adam O’Dell, and the rest of the Money & Markets team on Thursday. We were hashing out our plans for the coming weeks.

Adam is not a permabear. But he’s also not blind to what’s going on. He’s a self-proclaimed “realistic opportunist.”

Adam pointed out the relationship between bull and bear markets.

He was talking about the epic decade-long bull market that ended in 2021. Major indexes soared higher, hit a blip during the COVID crash and then soared higher once again.

Then the bottom fell out last year. We’re all aware of that.

But what struck me was Adam’s point about the transition from bull to bear (or vice versa).

He asked if the market movement since the corona crash made sense — a strong bull market turning into a weak bear market followed by a reversal and climb higher.

The short answer is: No.

The rally that followed the COVID crash was incredible, but that was when the Fed was playing fast and loose, printing money like there was no tomorrow.

Things are different now.

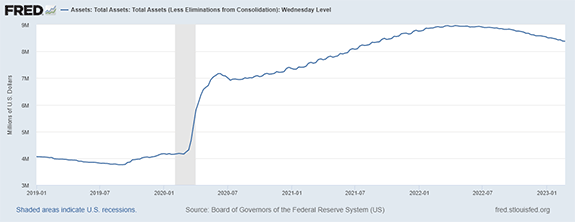

The Fed’s money tap is turned off, and it’s draining liquidity out of the market as fast as it can. Just look at its balance sheet — which has a long way to go to even hit 2020 levels:  (Click here to view larger image.) A tight Fed means growth (and stock returns) are going to be harder to come by from here.

Interest rates are also three times higher than they were just three years ago.

And company earnings are painting a picture of a weaker economy.

You’re right to be worried about what comes next.

But that Thursday call reminded me that we’re in good hands. Adam O’Dell, Matt Clark, Mike Carr, Charles Sizemore and everyone else that I work with are here to be a guiding light, show you what’s really going on and get you in position to take advantage when things actually take off again.

Keep scrolling to see how with some recent highlights from the team below.

| From our Partners at Banyan Hill Publishing. It’s not a recession, inflation or stock market crash — according to one expert: “Those are the least of our worries.”

There’s a looming event that he believes will be far worse. This event will ignite a crisis more dangerous than anything America has seen since the Great Depression. Yet no one is talking about it.

In this shocking new exposé, you will discover everything you need to know to sidestep the calamity. And perhaps even profit from it.

To watch it, free of charge, click here now. |

See what you might’ve missed in Stock Power Daily and elsewhere below: - Buy 1 Stock for Mexico’s Construction Boom: Matt noticed an incredible construction trend south of the border. This 99-rated stock is well set to benefit.

- What You Pay for What You Get: Adam’s piece in The Banyan Edge is a must-read. He goes into why the market has shifted to be value-friendly — and how you can take advantage going forward.

- The New Farming Age: Precision agriculture is bringing farms further into the 21st century. And this company is at the forefront of this movement.

That’s all for me this week.

Until next time,

Chad Stone

Managing Editor, Money & Markets

Check Out the Latest From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | |

Post a Comment

Post a Comment