| Good morning,

The $2,000 Small Account Journey probability based strategy is a fantastic way to try and grow a small account.

A probabilistic mind-set pertaining to trading consists of five fundamental truths.

Anything can happen. You don't need to know what is going to happen next in order to make money. There is a random distribution between wins and losses for any given set of variables that define an edge. An edge is nothing more than an indication of a higher probability of one thing happening over another. Every moment in the market is unique.

Pg. 121 Trading In The Zone by Mark Douglas

I'm going to cut right to the chase.

If Mark Douglas were writing up the evaluation of my Q1 trial #1 he'd point out that I violated guideline 6.

Guideline 6 Stop loss strategy: defined by sold strike into any market close.

Had I honored guideline 6, stop loss strategy, the Q1 trial #1 would still be going and I'd be doing something else with my Saturday afternoon, instead of writing this.

Thinking Like a Trader

I am a consistent winner because:

I objectively identify my edges. I predefine the risk of every trade. I completely accept the risk or I am willing to let go of the trade. I act on my edges without reservation or hesitation. I pay myself as the market makes money available to me. I continually monitor my susceptibility for making errors. I understand the absolute necessity of these principles of consistent success and, therefore, I never violate them.

Pg. 185 Trading In The Zone by Mark Douglas

I got into the NFLX trade on 2-22. NFLX closed that day at $334.88.

On 2-23 the WSJ article dropped the stock and it closed at $323.65. Clearly below my -$330 sold strike, I had all the time in the world that day to take a very small, manageable loss.

Then again on 2-27, when NFLX bounced to $330, I was basically even on the trade. Another opportunity to honor guideline 6.

In fact, from 2-23 - 3/1 I had not 2, 3, 4, BUT 5 opportunities to honor guideline 6 and get out with a small, manageable loss.

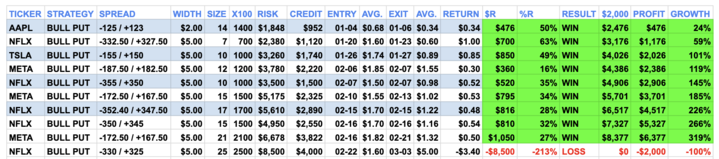

Q1 trial #1 summary:

Win streak → 9 across 2-months $ growth → $2,000 - $8,377 % growth → 319% Mistake → failed to honor stop loss End result → $0 Recommendation → reread pages 189 - 201 Trading In The Zone by Mark Douglas

Results are not typical and will vary from person to person. Nothing is guaranteed.

Remember, a good trading strategy or "edge" is nothing more than an indication of a higher probability of one thing happening over another.

This is the best strategy I know to try and grow a small account.

But it's so much more than that.

What the exercise here demonstrates with absolute certainty is how easy it is to violate guidelines and therefore render the "edge" ineffective.

A weakness of mine has been exposed. With this in mind, I'll need to continually monitor my susceptibility for making the error again.

I hope you understand the true value of this Small Account Journey isn't in just turning $2,000 into a huge number, though that is my goal.

The true value is in identifying my weaknesses, addressing them honestly, so I'm less likely to make the same mistakes with larger sums of money.

Q1 trial #2 starts Monday February 6, 2023 $2,000 Small Account Journey balance: $2,000 Status: cash

Subscribe

There are 4 Small Account Journeys in 2023. Each starting on the first day of the new quarter.

Q2 $2,000 SAJ starts April 1 Q3 $2,000 SAJ starts July 1 Q4 $2,000 SAJ starts October 1

If Q1 SAJ is still going on April 1, when Q2 starts, any new trade made will be the same for both balances so the only difference will be the amount of contracts e.g. 10 contracts allocated to Q2 balance and 30 allocated to Q1 balance. But tracked in journals separately. All Journeys are traded out of my bigger TD account.

I will run each $2,000 balance until it goes to $0 or gets too big that I'm uncomfortable risking the full amount.

$2,000 JOURNEY guidelines:

Tickers: best tech co's in world, earnings winners, strong guidance so AAPL, NFLX, TSLA, META, NVDA Order type: put credit spread (neutral to bullish i.e. good co's tend to go up) Target entry: defined by technical analysis (sell below big support to boost odds) Entry (credit) goal: 30% of the spread width i.e. $10 wide = $3, $5 wide = $1.50 etc… Exit (debit) goal: 50% of the credit Stop loss strategy: defined by sold strike into any market close Allocation: 100%, roll balance into next trade Expiry: 5-7 days from expiration (fastest rate of option decay) Hold time: 3.8 days on average Frequency: 1.13 trades / week on average

Jason Bond

|

Post a Comment

Post a Comment